My Journey to Becoming My Own Financial Advisor

I’ve always been passionate about money management. My interest started when I was young. My father was extremely diligent and skilled at managing his finances. He emphasized the importance of saving and not spending frivolously. By living below his means and investing prudently, he was able to accumulate over $1 million in savings over his lifetime.

Watching my dad sparked my interest in personal finance at an early age. I started developing a “saver’s mentality” and enjoyed watching my modest childhood savings grow. By starting the money management habit early, I learned how rewarding it was to watch accounts grow through the power of compounding.

When I went to college at Baruch, I decided to major in finance and investing. This gave me a robust education on the wide range of strategies for earning beyond just saving – bonds, stocks, mutual funds, CDs, annuities, calculating rates of return, etc. I also learned core principles like dollar cost averaging, the 70/30 asset allocation rule, how to value companies for investing, and most importantly, managing risk.

After leaving Baruch, I made some early mistakes and lost some money in investments. But over time, through continual reading and learning, I’ve developed strategies that work for me. My two favorite sites for ongoing financial education are Investopedia and Financial Samurai. Sam Dogen at FS doesn’t know me personally, but I’ve learned immensely from reading his investing perspectives.

Why I Chose the DIY Path

With this background, I decided to manage my finances myself rather than paying an advisor. Here are some key reasons why:

- I enjoy being in control of my own financial decisions and destiny. Relying on an advisor seemed like giving up some of that self-determination.

- I already had a strong base of financial knowledge to build on from my finance education and early reading.

- I had my dad’s example of financial prudence and self-management to follow.

- I appreciated having the final say on how my investment portfolio was structured. I didn’t have to compromise to an advisor’s approach.

- I wanted to avoid paying thousands in annual advisory fees and keep more of my hard-earned money.

- I realized few advisors would ever care as much about my money as I do. The accountability is all on me.

Challenges I’ve Faced (And Tips To Overcome Them)

That said, being your own financial advisor is far from easy. I’ve confronted roadblocks like:

- Lacking guidance at key financial milestones – I’ve addressed this by reading books and blogs to educate myself on big decisions like buying a home, assessing insurance needs, and setting up my first retirement account. I also consult fee-only advisors for one-time guidance when needed rather than full-time management.

- Letting emotion drive investment decisions – I’ve combatted this tendency by setting rules and parameters in advance. For example, I rebalance my portfolio on a fixed schedule rather than reacting in the moment.

- Lacking discipline around budgeting and planning – Setting financial calendar reminders and money dates has been crucial for staying on track each month and quarter.

- Getting overwhelmed by the time required – As much as possible, I’ve automated contributions to streamline my system. I also give myself grace, realizing I don’t need to optimize or perfectly understand everything immediately. Slow and steady learning works.

The DIY path has had hurdles but overall been deeply rewarding. I take pride in developing financial mastery and the independence that comes with being my own advisor. While it’s not for everyone, if you have the motivation, the sense of accomplishment from taking control of your financial life makes the effort well worth it. In the next section, we will delve into the pros and cons of the DIY approach.

The Pros and Cons of Being Your Own Financial Advisor

Personal finance can be daunting. With so many financial products, strategies, and decisions to make, it’s tempting to hand over the reins to a financial advisor. They’re the experts, right? Why not just pay them to take care of everything?

Well, not so fast. Being your own financial advisor has some distinct advantages. But it also requires diligence, discipline, and a commitment to continual learning.

The Benefits of Managing Your Own Finances

You Maintain Complete Control Over Financial Decisions

When you’re in the driver’s seat as your own advisor, all financial decisions are yours alone. You get to decide exactly how to save, invest, budget, manage debt, and reach your financial goals according to your personal priorities. An outside advisor always has some degree of influence over your decisions, even if they have your best interests in mind. They’ll never care quite as much about your money and financial success as you do. Staying hands-on as your own advisor means your short- and long-term finances unfold precisely according to your personal vision and values.

You Save Thousands in Advisory Fees

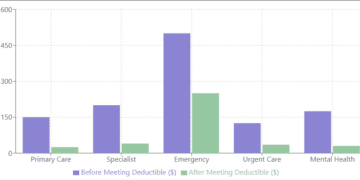

Financial advisors are helpful, but they certainly aren’t free. Most advisors earn a fee based on the total assets they manage for you. This annual fee often ranges from 0.5% to over 1% of total assets. For example, if an advisor managed a $500,000 investment portfolio for you, you’d likely pay between $2,500 to $5,000 per year for their guidance and expertise. The larger your portfolio, the higher the fees. Portfolios over $1 million can easily incur $10,000 or more per year in advisory fees. Avoiding these sizable recurring costs by managing your own finances saves you a tremendous amount of money over your lifetime.

You Build Substantial Financial Literacy and Confidence

“Risk comes from not knowing what you’re doing.” – Warren Buffett

Managing every aspect of your own finances requires continual learning and research. But with knowledge comes power. Regularly studying and expanding your understanding of personal finance topics like investing, retirement planning, taxes, insurance, budgeting, saving strategies, and leveraging debt in beneficial ways makes you a much more financially savvy steward of your money. The DIY approach leads to tremendous growth in your financial literacy and ultimately your confidence in making smart money decisions.

You Eliminate Potential Conflicts of Interest

Even ethical financial advisors have potential incentives and arrangements that could cause them to make recommendations not fully aligned with a client’s best interests. Advisors who earn commissions for selling certain financial products and services may be inadvertently swayed. Others have bonus structures based on getting clients to purchase in-house investment products. But being your own advisor eliminates any possibility of these conflicts of interest influencing decisions. You’ll always have your own best interests at heart.

The Challenges of DIY Financial Management

While complete financial independence clearly has advantages, handling everything yourself also comes with some potential downsides to carefully consider:

It’s More Time Consuming Than Delegating

Learning about personal finance topics, researching financial products and options, staying on top of managing accounts and investments, budgeting properly – being your own financial advisor eats up a lot more time compared to delegating to an outside expert. To do it right, you’ll need to carve out multiple hours every month for financial “homework” like reading, number crunching, planning, and implementation. Are you willing to spend 5-10 hours monthly on managing your money?

You Lose an Objective Second Opinion

Getting personalized financial advice from a competent advisor provides helpful perspective. They can challenge your assumptions, provide an objective tie-breaking opinion, and stop you from making overly emotional decisions. Going solo means relying exclusively on your own analysis and intuition when making big money choices. It’s easy to fall prey to confirmation bias without an outside view. Periodically consulting fee-only advisors on an hourly basis can help provide a second set of eyes.

Staying Disciplined is More Difficult Without Oversight

With no professional financial advisor reviewing your decisions and progress, it’s easy to procrastinate, neglect important tasks, or stray from your smart financial habits. A dedicated advisor provides accountability. Can you stick to budgets, reach savings goals, follow prudent investing strategies, and stay on track with debt repayment without that external oversight? Maintaining self-discipline around your finances becomes much more challenging but crucially important.

Gaining Confidence Takes Time and Will Involve Some Early Stumbles

Becoming an expert on personal finance doesn’t happen overnight. It takes most people years of continual education and experience to gain real confidence in making big financial decisions independently. Embarking on the DIY path inevitably means some early mistakes and stumbles as you work your way up the learning curve. Be patient with yourself, commit for the long haul, and know that sticking with the self-education process does pay off enormously over time.

Mistakes and Missteps Fall Squarely On Your Shoulders

When you delegate financial processes to an advisor, they shoulder responsibility if anything goes wrong. But if you take over managing every aspect of your finances, any costly errors or oversights fall squarely on you. Doing it all yourself requires developing diligent processes, double and triple checking your work, and maintaining meticulous financial records so nothing gets overlooked.

Tips for Succeeding as Your Own Financial Advisor

“Study, Study, Study!” – Van Phillips

If you can work around the drawbacks and challenges, managing your own money often aligns very well with an independent DIY ethos. It provides greater control over your financial life and fosters money mastery. Here are some tips for succeeding as your solo financial advisor:

- Set a Routine: Block out specific time each week or month for financial reviews. Add monthly money date nights to the calendar for couples.

- Create Checklists: Follow consistent processes for recurring money tasks like budget reviews. Checklists reduce errors and oversights.

- Automate Savings and Investments: Set up automatic transfers into investment accounts. Dollar cost average into index funds monthly without thinking.

- Read Books and Blogs: Study educational resources to gain insights from experienced financial professionals. Never stop learning.

- Use Technology Wisely: Take advantage of budgeting and investment apps and tools. Let tech streamline tedious money management tasks.

- Join Online DIY Communities: Connect with forums and groups of like-minded independent financial managers to discuss ideas.

- Consult Specialists for One-off Advice: Work with fee-only advisors for guidance around major life events like home buying, college planning, etc. Pay only for advice you need.

- Obsess Over Organization: Maintain meticulous physical and digital financial records so nothing gets misplaced or overlooked.

- Review the Big Picture: Step back quarterly and annually to assess overall financial health and progress toward goals. Course correct as needed.

Utilize Tax-Efficient Strategies

“It’s not how much money you make, but how much money you keep.” – Robert Kiyosaki

Tax planning is a crucial aspect of wealth accumulation. Explore tax-advantaged accounts like IRAs and 401(k)s, and consider tax-efficient investment strategies to minimize your tax liabilities.

For a comprehensive guide on tax planning, refer to the Internal Revenue Service (IRS) website. It provides detailed information on tax codes, deductions, and credits that can significantly impact your financial bottom line.

For an in-depth guide on retirement planning, check out Seizing Your Worth: Mastering the Art of Salary Negotiation and The Ins and Outs of 401k Retirement Plans: A Comprehensive Guide for 2023.

Achieving Financial Success on Your Own Terms

Self-guided financial management aligns with the priorities of many self-starters. While the path has challenges, the payoff of understanding your money deeply, avoiding fees, and maintaining total control over your financial life is huge. If you’re up for the challenge, being your own financial advisor can be one of the most rewarding and empowering money moves you’ll make.

For comprehensive insights into personal finance, including answers to credit and debt-related questions, refer to The Complete Guide to Personal Finance: In-Depth Answers to Your Credit and Debt Questions.

Remember, with the right knowledge and determination, you have the power to shape your financial destiny. Seize it.

Disclaimer: The information provided in this blog post is for educational purposes only and should not be construed as financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Van Phillips