Wealth. The very word evokes a spectrum of emotions—desire, fear, admiration, and even resentment. But what if I told you that wealth is more than just a number in your bank account? It’s a mindset, a choice, and a lifestyle. In this blog post, we’ll dive deep into the concept of wealth, exploring not only how to accumulate it but also how to sustain and grow it through a powerful combination of mindset, choice, and action. We’ll draw inspiration from The Wealth Choice by Dennis Kimbro and explore practical strategies to help you unleash your full wealth potential.

The Wealth Mindset: A Choice, Not a Chance

Wealth Begins in the Mind

As Kimbro’s book emphasizes, wealth is not an accident—it’s a deliberate choice. This idea is epitomized in the story of Ken Brown, a McDonald’s owner-operator whose mother’s wisdom laid the foundation for his success. Her words—”Success occurs by choice, not chance”—resonate deeply with anyone who has ever wondered why some people seem to attract wealth while others struggle.

This notion isn’t just motivational talk; it’s backed by research and psychology. A wealth mindset is about believing in abundance, not scarcity. It’s about understanding that financial success starts with the decisions we make every day.

“Be an optimist. Seize the moment. Live today to the fullest. Whatever good you desire is yours, but you must stretch forth your hand and take it.” – Ken Brown’s mother, The Wealth Choice

The Scarcity vs. Abundance Mindset

One of the most critical shifts in achieving wealth is moving from a scarcity mindset to an abundance mindset. Those with a scarcity mindset focus on what they lack, whether it’s money, opportunities, or resources. This mentality breeds fear and hesitation, leading to missed opportunities and stagnation.

In contrast, an abundance mindset sees possibilities everywhere. It’s about believing that there’s enough wealth to go around and that you can create more wealth by tapping into your unique strengths and opportunities. This mindset fosters confidence, action, and resilience—key ingredients in building wealth.

Table 1: Scarcity vs. Abundance Mindset

| Scarcity Mindset | Abundance Mindset |

|---|---|

| Focuses on what is lacking | Focuses on what is available |

| Driven by fear and doubt | Driven by confidence and optimism |

| Sees opportunities as limited | Sees opportunities as limitless |

| Hoards resources | Shares and invests resources |

| Avoids risks to prevent loss | Takes calculated risks to gain more |

Building Wealth Through Intentional Choices

The Power of Financial Discipline

One of the most potent tools in wealth building is financial discipline. This involves making intentional decisions about how you earn, save, invest, and spend your money. The wealthiest people aren’t always those who earn the most; they’re often the ones who manage their money the best.

Ken Brown’s journey to owning a McDonald’s franchise didn’t start with luck. It started with deliberate choices and financial discipline. He chose to live below his means, save aggressively, and invest wisely. These choices, compounded over time, led to substantial wealth.

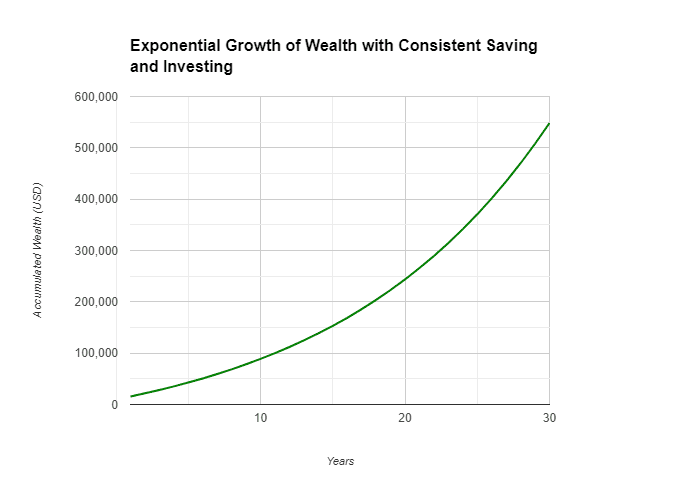

Chart 1: The Impact of Saving and Investing Over Time

Investing in Yourself: The Ultimate Wealth Strategy

Investing in yourself is one of the most important decisions you can make on your journey to wealth. This means continuously acquiring knowledge, developing skills, and expanding your network. Education and personal development are not expenses; they are investments with potentially unlimited returns.

In The Wealth Choice, Kimbro highlights how many successful African American millionaires invested heavily in their personal growth. Whether through formal education, mentorship, or self-directed learning, these individuals understood that their greatest asset was themselves.

“Manhood can never be given, only earned. Your greatest strength is the power of your example.” – Ken Brown’s mother, The Wealth Choice

The Role of Entrepreneurship in Wealth Creation

Entrepreneurship is often seen as a key pathway to wealth, and for a good reason. Owning a business gives you the potential to earn far more than a traditional job might offer. It also allows you to build an asset that can grow exponentially in value over time.

However, entrepreneurship is not without its challenges. It requires a strong work ethic, resilience, and the ability to navigate uncertainty. But for those willing to take the leap, the rewards can be significant.

Table 2: Traditional Employment vs. Entrepreneurship

| Traditional Employment | Entrepreneurship |

|---|---|

| Fixed salary or wages | Unlimited income potential |

| Stability and predictability | Risk and uncertainty |

| Limited by company hierarchy | Self-directed career path |

| Dependent on employer | Independent and self-reliant |

| Retirement benefits often provided | Must plan and manage your own retirement |

Overcoming the Barriers to Wealth

The Poverty Mentality: A Self-Imposed Barrier

One of the most significant barriers to wealth is the poverty mentality. This mindset is characterized by a belief that wealth is unattainable, that life is a zero-sum game, and that financial success is reserved for others. This mentality keeps individuals trapped in a cycle of scarcity, preventing them from taking the necessary steps to improve their financial situation.

Ken Brown’s mother speaks to this directly in The Wealth Choice, urging us to rid ourselves of the poverty mentality. She challenges us to reject the worship of poverty and scarcity and instead embrace a mindset of abundance and possibility.

“Haven’t we worshipped the God of poverty and scarcity long enough? You must decide that you will not be poor.” – Ken Brown’s mother, The Wealth Choice

Taking Responsibility for Your Financial Future

Another key aspect of building wealth is taking full responsibility for your financial future. This means acknowledging that your financial situation is a result of the choices you have made up to this point. It also means recognizing that you have the power to change your financial trajectory through new choices and actions.

This concept is empowering because it shifts the focus from external circumstances to internal control. While you can’t control the economy, the job market, or other external factors, you can control how you respond to them. You can choose to educate yourself, take risks, and seize opportunities.

The Importance of Financial Education

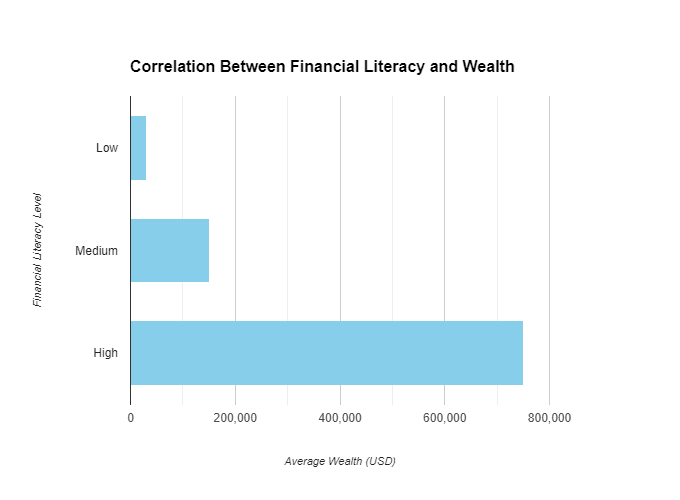

Financial education is a critical component of wealth building. Without a solid understanding of money management, investing, and financial planning, it’s easy to make mistakes that can derail your wealth journey. Unfortunately, many people lack this education, either because it wasn’t taught in school or because they never sought it out on their own.

In The Wealth Choice, Kimbro emphasizes the importance of financial literacy among successful African American millionaires. These individuals took the time to educate themselves about money, investing, and business, and this knowledge became a cornerstone of their wealth.

Chart 2: The Correlation Between Financial Literacy and Wealth

Wealth and Legacy: Building Wealth That Lasts

The Power of Generational Wealth

One of the ultimate goals of wealth building is to create a legacy that extends beyond your lifetime. This means accumulating enough wealth to not only support your own needs and desires but also to pass on to future generations.

Generational wealth is about more than just money; it’s about values, education, and opportunities. It’s about giving your children and grandchildren a strong financial foundation so they can build on your success. It’s also about instilling in them the mindset and habits that will help them maintain and grow that wealth.

Strategies for Preserving Wealth

Building wealth is one thing; preserving it is another. Many families lose their wealth within a few generations due to poor financial management, lack of education, or failure to plan for the future. To avoid this fate, it’s essential to implement strategies for preserving and growing your wealth over time.

Some of these strategies include estate planning, setting up trusts, diversifying your investments, and educating your heirs about financial management. By taking these steps, you can help ensure that your wealth continues to benefit your family for generations to come.

Table 3: Wealth Preservation Strategies

| Strategy | Description |

|---|---|

| Estate Planning | Creating a will, trusts, and other tools to manage your assets after death. |

| Diversification | Spreading investments across different asset classes to reduce risk. |

| Trusts | Setting up legal entities to manage assets and protect wealth for future generations. |

| Financial Education for Heirs | Teaching your children and grandchildren about money management and investing. |

| Charitable Giving | Donating to causes you care about, which can also have tax benefits. |

The Role of Philanthropy in Wealth Building

Philanthropy is often seen as the final stage of wealth building, but it can also be an integral part of your journey to wealth. Giving back to your community not only creates a positive impact but can also open doors to new opportunities, relationships, and experiences.

In The Wealth Choice, many successful individuals highlight the importance of philanthropy in their lives. They understand that wealth is not just about accumulation but also about using it to make a difference in the world.

“Abundance is your destiny. Rid yourself of the poverty mentality. Money goes wherever it is welcomed.” – Ken Brown’s mother, The Wealth Choice

Wealth is Within Your Reach

Wealth is not an elusive dream reserved for a select few; it is a tangible reality that can be achieved by anyone willing to make the right choices, adopt the right mindset, and take consistent action. The journey to wealth is deeply personal, shaped by your beliefs, values, and the decisions you make every day.

As we’ve explored in this blog post, the foundation of wealth lies in the power of your mindset. By shifting from a scarcity mentality to one of abundance, you open yourself up to a world of possibilities. This transformation begins in your mind and is reinforced by your actions—whether it’s practicing financial discipline, investing in your personal growth, or embracing the entrepreneurial spirit.

But mindset alone isn’t enough. Building wealth also requires practical strategies and a commitment to continuous learning. From managing your finances wisely to making informed investment decisions, the choices you make today will determine your financial future. As we’ve seen in the story of Ken Brown, success is a choice, not a chance. His journey from humble beginnings to becoming a successful entrepreneur is a testament to the power of intentional living and financial discipline.

Moreover, wealth isn’t just about the money you accumulate; it’s about the legacy you leave behind. Generational wealth is the culmination of a lifetime of hard work, smart decisions, and a desire to provide for future generations. By implementing strategies to preserve and grow your wealth, you can ensure that your legacy endures.

Finally, never underestimate the role of philanthropy in your wealth journey. Giving back not only enriches the lives of others but also adds meaning and purpose to your own life. As Ken Brown’s mother wisely said, “Abundance is your destiny.” When you embrace this truth and commit to welcoming wealth into your life, you not only improve your financial situation but also create a ripple effect that can positively impact those around you.

Action Steps to Begin Your Wealth Journey

To help you start or continue your wealth-building journey, here are some actionable steps you can take today:

- Assess Your Mindset: Reflect on your current beliefs about money and wealth. Are they rooted in scarcity or abundance? If you find yourself leaning towards scarcity, begin challenging those beliefs and replace them with thoughts of abundance.

- Set Clear Financial Goals: Define what wealth means to you. Whether it’s financial independence, the ability to travel, or leaving a legacy, having clear goals will give you direction and motivation.

- Create a Budget and Stick to It: Financial discipline begins with knowing where your money is going. Create a budget that aligns with your goals and stick to it. This will help you save more and spend wisely.

- Invest in Yourself: Commit to continuous learning and personal development. Whether through formal education, reading books like The Wealth Choice, or attending workshops, the more you know, the better equipped you’ll be to make smart financial decisions.

- Explore Entrepreneurship: If you have a passion or a business idea, consider taking the leap into entrepreneurship. The potential rewards can be life-changing, but be prepared to work hard and stay resilient.

- Educate Yourself About Investing: Start learning about different investment options and how to diversify your portfolio. The sooner you start investing, the more time your money has to grow.

- Plan for the Future: Think about the legacy you want to leave behind. Consider estate planning, setting up trusts, and educating your heirs about financial management.

- Give Back: Incorporate philanthropy into your wealth-building strategy. Whether through donations, volunteering, or mentoring, giving back can enrich your life and create opportunities for growth.

Recommended Reading and Resources

To further enhance your understanding of wealth building, here are some recommended books and resources:

- The Wealth Choice: Success Secrets of Black Millionaires by Dennis Kimbro

- Think and Grow Rich by Napoleon Hill

- Rich Dad Poor Dad by Robert Kiyosaki

- The Millionaire Next Door by Thomas J. Stanley and William D. Danko

- Your Money or Your Life by Vicki Robin and Joe Dominguez

Additionally, consider following financial blogs, podcasts, and YouTube channels that focus on wealth building and personal finance. Some resources include:

- Financial Samurai (www.financialsamurai.com)

- BiggerPockets Money Podcast

- The Dave Ramsey Show

Final Thoughts

Wealth is a journey, not a destination. It’s a continuous process of learning, growing, and making choices that align with your values and goals. Remember, wealth isn’t just about having money; it’s about living a life of abundance, purpose, and fulfillment. By adopting the right mindset, making informed decisions, and taking consistent action, you can unlock your wealth potential and create a legacy that lasts for generations.

So, are you ready to take control of your financial future and begin your journey to wealth? The choice is yours.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always consult with a financial advisor before making any investment decisions.

Related Articles:

- How to Develop a Wealth Mindset

- Unleashing the Power of Strategic Investing: The Key to Financial Freedom

- The Shocking Truth About Money That Can Transform Your Life

External Links:

- Financial Samurai: For insights on financial independence and wealth building.

- Investopedia: A great resource for learning about investing and financial literacy.

- BiggerPockets: For real estate investing strategies and advice.

This blog post is designed to provide comprehensive insights into wealth building by combining mindset, strategy, and action. With a strong focus on practical advice and inspiration from The Wealth Choice, it aims to empower readers to take control of their financial destiny.