In the realm of entrepreneurship, the decision to establish a Limited Liability Company (LLC) can be a pivotal moment, laden with both excitement and trepidation. As an entrepreneur who embarked on this journey myself, I found that the LLC structure offered a beacon of hope, promising tax advantages and a framework tailored to my specific needs. In this odyssey, I navigated through the labyrinth of legalities, tax intricacies, and the dynamic landscape of business ownership. Join me as I unveil the nuances, challenges, and triumphs encountered along the path to LLC establishment.

Embracing the LLC Paradigm: A Strategic Choice

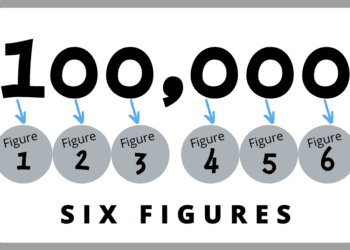

Choosing the right business entity lays the cornerstone for a successful entrepreneurial venture. For me, the allure of an LLC stemmed from its inherent flexibility, liability protection, and favorable tax treatment. Unlike sole proprietorships or C corporations, the LLC structure struck a harmonious balance, offering limited liability protection while allowing for pass-through taxation.

The Birth of My LLC: A Tale of Two Ventures

Establishing a Landholding Company in Kentucky

My journey commenced with the establishment of a Landholding Company nestled in the picturesque landscapes of Kentucky. The startup costs were modest, and the process, albeit bureaucratic, was relatively smooth-sailing. Leveraging the benefits of an LLC shielded me from personal liability while nurturing the growth of my land-based enterprise.

Setting Sail with a Holding Company in New York

Venturing into the bustling metropolis of New York, I embarked on a grander endeavor – the inception of a Holding Company. The startup costs proved to be more substantial, reflective of the state’s regulatory landscape. Nonetheless, armed with determination and foresight, I embraced the challenge, cognizant of the potential rewards that lay ahead.

Navigating the Legal Labyrinth: Trademarks and Beyond

Trademarking: A Legal Odyssey

Trademarking the company name emerged as a pivotal juncture in the LLC establishment process. The intricacies inherent in securing intellectual property rights necessitated legal counsel, underscoring the importance of meticulous attention to detail. Partnering with a seasoned attorney proved instrumental in navigating the labyrinthine terrain of trademark law, ensuring the safeguarding of my brand identity.

Taxation: Unraveling the Complexities

A Prelude to Tax Obligations

As the fiscal year unfolds, the specter of tax obligations looms large on the horizon. While my Landholding Company in Kentucky has borne modest tax burdens thus far, the inaugural tax season for the Holding Company in New York beckons with uncertainty. Acknowledging the complexity of tax compliance, I contemplate the prospect of enlisting the expertise of a seasoned tax professional, poised to navigate the intricacies of state and federal tax codes.

Reflections and Revelations: A Journey Unveiled

Embracing the Learn-As-You-Go Ethos

In retrospect, the journey of LLC establishment epitomizes a paradigm of perpetual learning and growth. Each obstacle surmounted, each challenge confronted, serves as a testament to the resilience of the entrepreneurial spirit. As the Holding Company blossoms into fruition, and the Landholding Company thrives amidst the verdant expanse of Kentucky, I stand emboldened by the transformative power of entrepreneurship.

Insights and Recommendations: Navigating the LLC Terrain

Words of Wisdom for Aspiring Entrepreneurs

For those embarking on the voyage of LLC establishment, I impart the following insights gleaned from firsthand experience:

- Conduct Comprehensive Research: Delve into the intricacies of LLC formation, acquainting yourself with the legal, financial, and operational considerations that underpin the process.

- Exercise Due Diligence: Approach LLC establishment with meticulous attention to detail, ensuring compliance with regulatory requirements and safeguarding against potential pitfalls.

- Seek Professional Guidance: Consult with financial advisors, legal experts, and tax professionals to navigate the complex terrain of LLC establishment, leveraging their expertise to chart a course towards entrepreneurial success.

In conclusion, the journey of LLC establishment epitomizes a testament to resilience, foresight, and unwavering determination. As I traverse the labyrinth of entrepreneurship, guided by the beacon of LLC structure, I am emboldened by the boundless possibilities that await on the horizon.

As the proverbial sage posits, “Fortune favors the bold” – may the journey of LLC establishment be a testament to the indomitable spirit of entrepreneurial endeavor.

Disclaimer: The information provided in this blog post is for informational purposes only and should not be construed as legal, financial, or tax advice. Readers are encouraged to consult with qualified professionals regarding their specific business needs and circumstances.

Further Reading:

- Understanding LLCs: A Comprehensive Guide

- Navigating Trademark Law: Key Considerations for Entrepreneurs

- Tax Implications of LLC Formation: Insights from Financial Experts

Check out the business guide on the US Small Business Administration website.

Check out these internal links:

- Cut Your 2024 Tax Bill Down to Size: The Top 10 Business Write-Offs

- The Heavy Weight of Taxes: How Different Tax Burdens Impact Americans Across State Lines

As the journey of entrepreneurship unfolds, may the LLC serve as a steadfast companion, empowering aspiring visionaries to chart a course towards entrepreneurial fulfillment and prosperity.