Trade with news is a key strategy employed by traders in the Futures and Forex markets. In these fast-paced and dynamic financial arenas, staying informed about relevant news events is crucial for making informed trading decisions. News has the power to significantly impact market movements, creating opportunities for traders to capitalize on price fluctuations and maximize their profits.

News events, ranging from economic indicators and central bank announcements to geopolitical developments and corporate earnings reports, can trigger substantial volatility in the Futures and Forex markets. These events have the potential to influence currency exchange rates, commodity prices, and interest rates, among other key factors that drive these markets.

By understanding how news events can impact market movements, traders can effectively position themselves to take advantage of these shifts. Reacting promptly and accurately to news allows traders to seize opportunities, manage risks, and optimize their trading strategies. In the following sections, we will explore the strategies, tools, and considerations involved in successfully trading using news in the Futures and Forex markets.

How Traders Use the News

News plays a crucial role in guiding trading decisions and strategies in the Futures and Forex markets. Traders rely on news as a fundamental source of information to assess market sentiment, evaluate economic conditions, and anticipate potential price movements. By staying informed about relevant news events, traders gain valuable insights that can influence their trading decisions.

Staying updated with news events is essential for traders, as it helps them identify opportunities and manage risks effectively. News can provide valuable context and background information on the factors influencing market trends. By understanding the impact of news events on market sentiment, traders can anticipate potential price fluctuations and adjust their strategies accordingly.

News analysis is a vital tool in the arsenal of traders who aim to capitalize on market opportunities. Through comprehensive analysis, traders evaluate the potential impact of news events on specific markets, assess the market’s reaction to past events, and identify patterns or trends. This analysis can help traders uncover potential trading opportunities, such as identifying breakout points, trend reversals, or significant support and resistance levels.

By combining news analysis with technical and fundamental analysis, traders can develop a well-rounded trading strategy that incorporates both short-term market movements and broader market trends. The integration of news analysis allows traders to make more informed decisions, enhancing their chances of success in the Futures and Forex markets.

In the next sections, we will explore specific strategies, tools, and platforms that traders can utilize to effectively trade using news in the Futures and Forex markets.

Trading Stocks with News vs. Futures and Forex

When it comes to trading with news, there are notable differences between trading stocks and trading in the Futures and Forex markets. Understanding these differences is essential for traders to tailor their approach and strategies accordingly.

- Market Scope and Accessibility:

Trading stocks involves buying and selling shares of individual companies listed on stock exchanges. While news events can impact stock prices, the scope is relatively limited to specific companies. In contrast, the Futures and Forex markets encompass a broader scope, including various currency pairs, commodities, indices, and interest rate products. News events can have a more widespread impact across these markets.

- Timing and Liquidity:

Stocks typically react to news events during regular trading hours, with pre-market and after-market trading having limited liquidity. Futures markets, on the other hand, operate nearly 24 hours a day, allowing for trading opportunities during different sessions. The Forex market is also open 24 hours, providing traders with continuous access to news-driven opportunities across various time zones.

- Volatility and Risk:

Trading stocks with news can result in significant price movements, but the impact might be more pronounced in smaller-cap stocks or during earnings seasons. In the Futures and Forex markets, news events can trigger substantial volatility across various instruments. Traders need to carefully manage risk and account for potentially heightened price fluctuations.

- Leverage and Margin:

Trading in the Futures and Forex markets often involves higher leverage and margin requirements compared to stock trading. This can amplify both profits and losses. Traders should exercise caution and have a solid risk management plan in place when trading Futures and Forex based on news events.

- Global Factors and Interconnectedness:

The Futures and Forex markets are highly influenced by global factors such as economic indicators, central bank policies, geopolitical events, and commodity prices. News events can have a cascading effect, impacting multiple markets simultaneously. Traders need to consider these interconnected factors when trading Futures and Forex based on news analysis.

In summary, while both stock trading and trading in the Futures and Forex markets can be influenced by news events, the scope, timing, liquidity, volatility, risk, and global factors differ between these markets. Traders must adapt their strategies and risk management techniques accordingly to capitalize on news-driven opportunities effectively.

When to Trade After News

Timing is crucial when trading after news announcements in the Futures and Forex markets. Traders must consider the market’s initial reaction to the news and wait for price stability before entering trades. Here are some key considerations:

- Market Reaction:

Immediately after a news release, markets often experience heightened volatility and erratic price movements. This initial reaction can lead to whipsaws and false signals. It’s essential for traders to allow the market to digest the news and determine the true direction before committing to a trade.

- Price Stability:

Waiting for price stability is crucial to avoid entering trades during periods of extreme volatility. Traders should look for a period when the market has settled and a clearer trend or direction has emerged. This stability provides a more reliable basis for making trading decisions.

- Technical Confirmation:

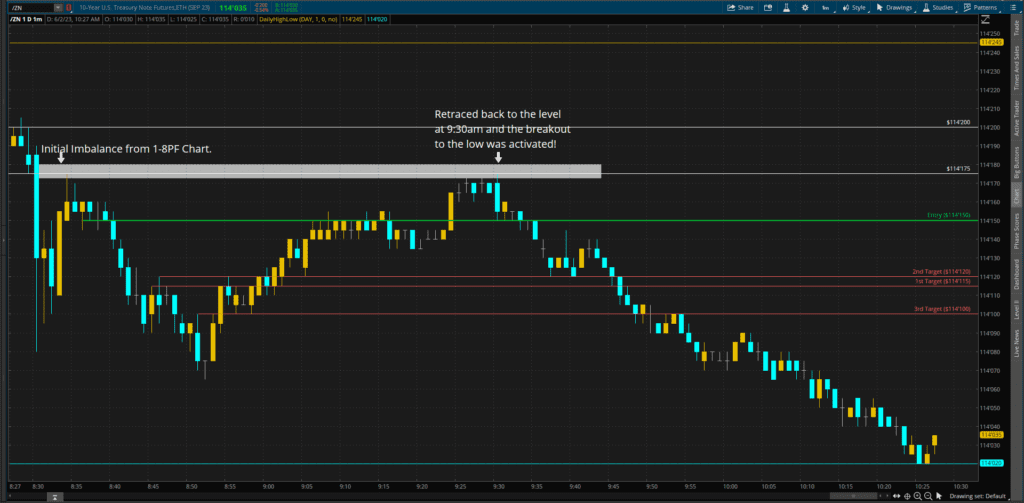

Combining news analysis with technical indicators can provide additional confirmation before entering a trade. Traders may look for signals such as support and resistance levels, trend lines, or chart patterns aligning with the anticipated market direction following the news release. Technical analysis can help validate the potential trade setup and enhance the probability of a successful trade.

- Timeframes:

The timeframe in which traders operate can influence their approach to trading after news events. Short-term traders may focus on immediate market reactions and intraday price patterns, while longer-term traders may wait for more significant trends to develop over several days or weeks. Each timeframe requires careful consideration of the market’s reaction and the desired trading strategy.

- Economic Calendar:

Monitoring an economic calendar is crucial for staying aware of upcoming news releases and their potential impact. Traders can plan their trades by identifying key events, understanding their relevance to the market, and evaluating the historical market response. This allows for more informed decision-making and the ability to trade strategically after important news releases.

By exercising patience and waiting for price stability, traders can minimize the risks associated with trading immediately after news announcements. This approach allows for a more informed and calculated entry into trades, increasing the likelihood of successful outcomes. Remember, trading after news requires careful analysis and consideration to balance the potential opportunities with risk management principles.

Getting News Fast: Tools and Platforms

To effectively trade using news, traders rely on various news sources and platforms to access timely information. Here are some popular platforms and brands that traders utilize:

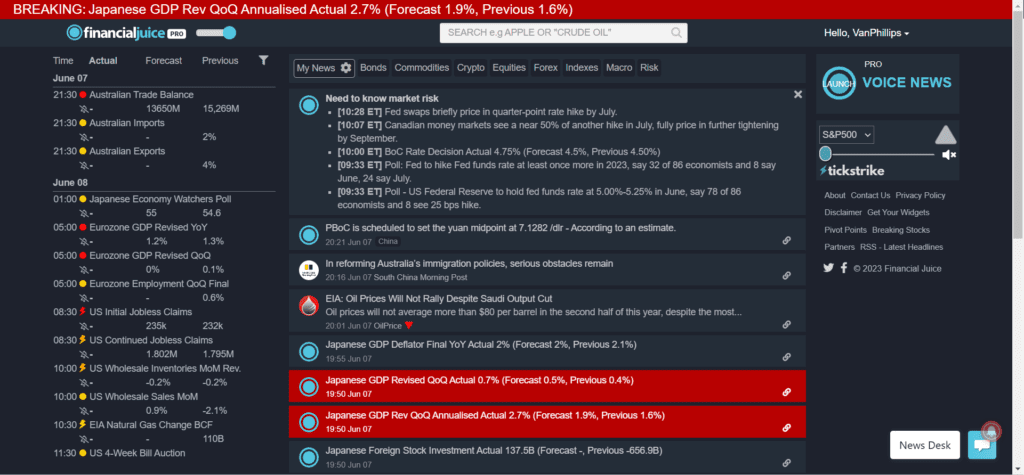

FinancialJuice is a real-time news platform designed specifically for traders. It offers comprehensive coverage of economic indicators, central bank announcements, geopolitical events, and market news. Traders can customize their news feed and receive instant alerts for important events.

Investing.com provides a wide range of financial news, including market analysis, economic calendars, and real-time updates. Traders can access news related to stocks, futures, Forex, and other financial instruments. The platform also offers charts, technical analysis tools, and a vibrant community of traders.

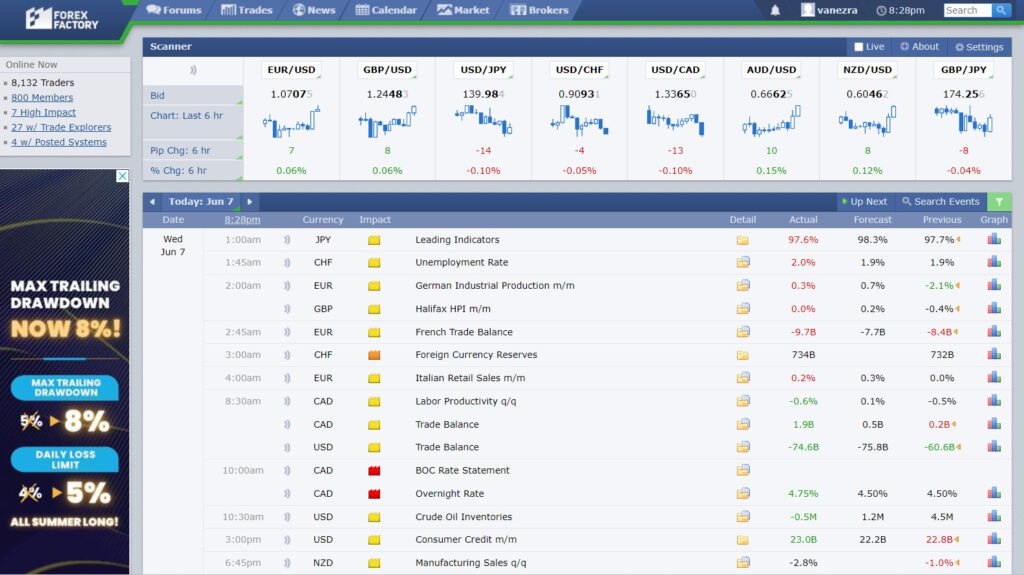

Forex Factory is a popular website among Forex traders that offers a calendar of upcoming news events, along with real-time news updates. It provides valuable insights into the impact of news releases on currency pairs and helps traders plan their trades accordingly.

Reuters is a renowned global news agency that covers a wide range of topics, including finance, business, politics, and economics. Traders can access real-time news updates and analysis, which can significantly impact market sentiment and trading decisions.

Bloomberg is a comprehensive financial information platform that provides news, data, and analytics. Traders can access real-time news, market insights, and research reports. The Bloomberg Terminal is widely used in professional trading environments, offering advanced tools for market analysis.

Dow Jones Newswires is a leading provider of real-time news and analysis. It covers a broad spectrum of financial topics, including stocks, commodities, currencies, and global market trends. Traders can receive concise and actionable news updates tailored to their specific interests.

Twitter has become a valuable source of breaking news and market updates. Traders follow relevant accounts, including financial news outlets, market analysts, and industry experts, to stay informed in real-time. Hashtags and lists can help filter news related to specific topics or instruments.

Google News aggregates news articles from various sources, providing a personalized news feed based on the user’s preferences. Traders can customize their feed to include specific financial topics, markets, or brands, ensuring they receive relevant news updates.

Feedly is a content aggregator that allows traders to gather and organize news from multiple sources in one place. Traders can create customized feeds and receive updates from platforms like FinancialJuice, Investing.com, Reuters, and more. This streamlines the process of staying informed and saves time.

Each platform mentioned above has its unique advantages and features. Traders should explore these platforms to determine which ones best suit their trading style, preferences, and information needs. Combining multiple platforms can provide a comprehensive and well-rounded news experience, ensuring traders have access to timely information that can drive their trading decisions.

The Impact of News on Day Trading

News events have a significant impact on day trading strategies in the Futures and Forex markets. Understanding how news can affect trading and adapting strategies accordingly is crucial for day traders. Here are key points to consider:

- Increased Volatility and Liquidity:

News releases often lead to increased volatility and liquidity in the markets. Traders can experience sharp price movements and wider spreads during these periods. Day traders may capitalize on these volatile market conditions by executing quick trades to take advantage of price fluctuations.

- Trading Opportunities:

News events can create trading opportunities for day traders. Positive news can drive prices higher, presenting potential buying opportunities. Conversely, negative news can lead to price declines, offering short-selling opportunities. Day traders should analyze the news, assess its potential impact on market sentiment, and develop trading strategies to align with the anticipated price movements.

- Speed and Timing:

Day traders need to react quickly to news events due to the time-sensitive nature of their trades. Rapid decision-making and execution are essential. Utilizing real-time news feeds and platforms that deliver immediate updates can help day traders stay informed and act promptly.

- Risk Management:

Effective risk management is vital in day trading, especially during news releases. Volatility can lead to larger price swings, increasing the potential for both profits and losses. Day traders should set appropriate stop-loss orders and position sizes, limiting their exposure to adverse market moves. They should also be prepared for unexpected news outcomes and have contingency plans in place.

- Fundamental and Technical Analysis:

Day traders may use a combination of fundamental and technical analysis to assess the impact of news events. Fundamental analysis involves evaluating the potential consequences of news on market sentiment and specific instruments. Technical analysis can help identify key support and resistance levels, chart patterns, and other technical indicators that may validate entry and exit points.

- News Trading Strategies:

Day traders may employ various news trading strategies, such as breakout trading or momentum trading. Breakout traders aim to take advantage of significant price movements triggered by news events. Momentum traders look for sustained price trends following news releases. These strategies require careful planning, risk management, and the ability to react swiftly to changing market conditions.

Day trading during news releases offers both opportunities and risks. Traders should be prepared to adapt their strategies based on market conditions and news outcomes. Staying informed about relevant news events, managing risk effectively, and utilizing appropriate technical and fundamental analysis can help day traders navigate the dynamic nature of trading in response to news in the Futures and Forex markets.

Market Reaction Speed to News

Markets exhibit varying speeds of reaction to news events in the Futures and Forex markets. Understanding the dynamics of market reaction is essential for traders seeking to capitalize on news-driven opportunities. Here’s what you need to know:

- Immediate Price Movements:

Markets often experience rapid and substantial price movements immediately after the release of significant news events. The speed of these movements can be influenced by the magnitude and unexpectedness of the news. Traders who act quickly during this initial phase can benefit from capturing early price fluctuations.

- Volatility Expansion:

News events frequently lead to an expansion of volatility in the markets. Increased volatility indicates larger price swings and potentially more significant trading opportunities. Traders can take advantage of these expanded ranges by implementing strategies that are designed to profit from price volatility, such as breakout trading or range trading.

- Subsequent Price Adjustments:

After the initial spike in volatility, markets may enter a phase of price adjustment as traders digest the news and reassess their positions. During this period, price movements may become more stable and directional trends may emerge. Traders can leverage this phase by identifying key support and resistance levels, chart patterns, or trendlines to plan their entries and exits.

- Market Sentiment Shifts:

News events have the power to influence market sentiment, which can lead to sustained price movements. Positive news can generate optimism and bullish sentiment, while negative news can evoke pessimism and bearish sentiment. Traders can monitor changes in market sentiment following news releases to align their trading strategies with the prevailing market mood.

- News Reaction Strategies:

Traders can employ various strategies to leverage market reactions to news events. For instance, some traders may adopt a “fade the news” approach, which involves taking positions against the initial market reaction. They anticipate a reversal or correction in the immediate price movement. Others may opt for “follow the trend” strategies, aiming to capitalize on the continuation of the initial price movement.

- Risk Management:

As markets react swiftly to news events, traders should be mindful of the heightened risks associated with increased volatility. Proper risk management techniques, including setting stop-loss orders, using appropriate position sizing, and having a clear trading plan, are crucial to protect against adverse price movements and mitigate potential losses.

Traders who understand the speed at which markets react to news events can strategically position themselves to seize opportunities. By combining technical analysis, fundamental analysis, and a deep understanding of market dynamics, traders can effectively interpret and respond to market reactions following news releases. It is important to stay updated with news sources and platforms, assess the impact on market sentiment, and adjust trading strategies accordingly to optimize trading outcomes.

Best Strategies to Trade News

When it comes to trading news in the Futures and Forex markets, employing effective strategies is crucial for success. Here are some proven approaches that traders can consider:

- Breakout Trading:

Breakout trading involves capitalizing on significant price movements that occur after the release of news events. Traders identify key support and resistance levels and enter trades when the price breaks out of these levels. This strategy aims to take advantage of the increased volatility and momentum generated by the news release.

- Trend Following:

Trend following strategies involve identifying and riding the trend that emerges after a news event. Traders analyze the impact of the news on market sentiment and look for sustained price movements in the direction of the trend. This strategy aims to capture profits by staying in trades as long as the trend remains intact.

- News-Based Swing Trading:

News-based swing trading combines elements of fundamental analysis and technical analysis to identify potential swing trading opportunities. Traders analyze the news event’s impact on market sentiment and look for price swings that align with the prevailing trend. This strategy aims to capture shorter-term price movements within a larger trend.

- Utilizing Trading Platforms:

Trading platforms play a crucial role in executing news trading strategies effectively. Platforms like MetaTrader, thinkorswim, and Bloomberg Terminal offer advanced charting capabilities, real-time news feeds, and a wide range of technical indicators. These platforms enable traders to analyze market data, monitor news events, and execute trades efficiently.

- MetaTrader: MetaTrader is a widely used trading platform known for its user-friendly interface and comprehensive features. It offers real-time market data, customizable charts, and the ability to implement automated trading strategies.

- thinkorswim: thinkorswim is a popular trading platform known for its advanced tools and analytical capabilities. Traders can access real-time data, advanced charting, backtesting features, and a wide range of technical indicators. It also provides a paper trading feature for practicing strategies without risking real capital.

- Bloomberg Terminal: Bloomberg Terminal is a professional-grade platform that caters to institutional traders and sophisticated individual traders. It offers real-time market data, news updates, economic indicators, and powerful analytics tools. Bloomberg Terminal provides comprehensive coverage of financial markets, making it a valuable resource for news-based trading strategies.

Implementing these strategies requires a combination of technical analysis, fundamental analysis, and quick decision-making. Traders should adapt their strategies based on the specific market conditions, news events, and their risk tolerance. It’s essential to practice and refine these strategies using demo accounts or paper trading to gain experience before executing them with real capital.

Remember, trading news involves inherent risks, and proper risk management techniques should always be employed. Traders should also stay updated with relevant news sources, economic calendars, and financial platforms to ensure they have the necessary information to make informed trading decisions.

Bottom Line

In conclusion, trading using news in the Futures and Forex markets can be a powerful strategy for traders looking to capitalize on market movements. Throughout this article, we have explored various aspects of news trading and provided valuable insights. Here are the key takeaways:

- Importance of News Analysis:

News analysis is crucial for traders as it provides valuable information about economic indicators, geopolitical events, and market sentiment. Incorporating news analysis into trading strategies allows traders to identify potential trading opportunities and make informed decisions.

- Timing Considerations:

Timing plays a vital role in news-based trading. Traders should carefully consider when to enter trades after news releases, allowing for price stability and assessing the immediate market reaction. Being patient and waiting for suitable trading conditions can enhance the probability of success.

- Tools and Platforms:

Traders have access to a variety of tools and platforms to get timely news updates. Platforms such as FinancialJuice, Investing.com, Forex Factory, Reuters, Bloomberg, Dow Jones Newswires, Twitter, Google News, and Feedly offer real-time news feeds, economic calendars, and customizable features to suit individual preferences.

- Market Reaction and Strategies:

Markets react at different speeds to news events, presenting both immediate and subsequent price movements. Traders can leverage this market reaction to their advantage by employing strategies such as breakout trading, trend following, and news-based swing trading.

- Risk Management and Adaptability:

Successful news-based trading requires effective risk management techniques and adaptability. Traders should set appropriate stop-loss orders, manage position sizes, and have contingency plans in place to mitigate risks. Staying informed, continuously learning, and adapting trading strategies to changing market conditions are essential for long-term success.

In the fast-paced world of trading, staying informed about relevant news events and adapting trading strategies accordingly can make a significant difference. By incorporating news analysis into their trading approach, traders can enhance their decision-making process and potentially increase their trading profits.

Remember, news trading carries inherent risks, and it is essential to thoroughly understand the markets, news sources, and the impact of news events on specific instruments. Continuously expanding your knowledge, honing your skills, and practicing with virtual accounts can help you refine your news-based trading strategies.

Stay informed, stay adaptable, and embrace the opportunities that news trading offers in the exciting world of Futures and Forex markets.

It’s clear that you are passionate about making a positive impact and your blog is a testament to that Thank you for all that you do