As a professional trader and investor, I’ve spent countless hours pondering the intricate relationship between time and money. It’s a topic that has been on my mind for years, and I’ve come to a powerful realization: In order to have more time and freedom, you have to make money. But making money can also take away your time and freedom. This epiphany has led me to ask the question: How do we balance both?

The Value of Time vs. Money

Before we dive into the strategies for managing time and money, it’s essential to understand the value of each. Time is a finite resource that we can never get back once it’s gone. It’s the most precious commodity we have, and it’s the one thing that money can’t buy. On the other hand, money is a tool that allows us to purchase goods and services, invest in our future, and ultimately, buy back some of our time.

As Naval Ravikant, the renowned entrepreneur and investor, once said:

“Money is a tool for moving value across time. It’s a tool for capturing time, for capturing your time, and for deploying your time.”

In other words, money is a means to an end, not the end itself. The ultimate goal is to use money to create more time and freedom in our lives.

The Time-Money Paradox

The paradox of time and money is that we often have to sacrifice one to gain the other. To make more money, we may have to work longer hours, take on additional responsibilities, or invest our time in learning new skills. This can leave us feeling like we have less time for the things that truly matter to us, such as spending time with loved ones, pursuing hobbies, or simply relaxing.

On the flip side, if we prioritize time over money, we may find ourselves struggling to make ends meet or unable to achieve our financial goals. It’s a delicate balance that requires careful consideration and planning.

Strategies for Balancing Time and Money

So, how do we find the perfect balance between time and money? Here are some strategies that I’ve found to be effective:

1. Set Clear Financial Goals

The first step in balancing time and money is to set clear financial goals. What do you want to achieve financially, and by when? Do you want to save for retirement, pay off debt, or build an emergency fund? Once you have a clear understanding of your goals, you can create a plan to achieve them.

2. Create a Budget

Creating a budget is essential for managing your money effectively. It allows you to see where your money is going and identify areas where you can cut back or save. By tracking your expenses and income, you can make informed decisions about how to allocate your resources.

Here’s an example of a simple budget:

| Income | Amount |

|---|---|

| Salary | $5,000 |

| Investments | $1,000 |

| Total Income | $6,000 |

| Expenses | Amount |

|---|---|

| Rent/Mortgage | $1,500 |

| Utilities | $300 |

| Groceries | $500 |

| Transportation | $200 |

| Entertainment | $300 |

| Savings/Investments | $2,000 |

| Total Expenses | $4,800 |

3. Invest in Passive Income Streams

One of the best ways to balance time and money is to invest in passive income streams. Passive income is money that you earn without actively working for it, such as rental income, dividends from stocks, or royalties from a book or product. By building passive income streams, you can create more financial freedom and flexibility in your life.

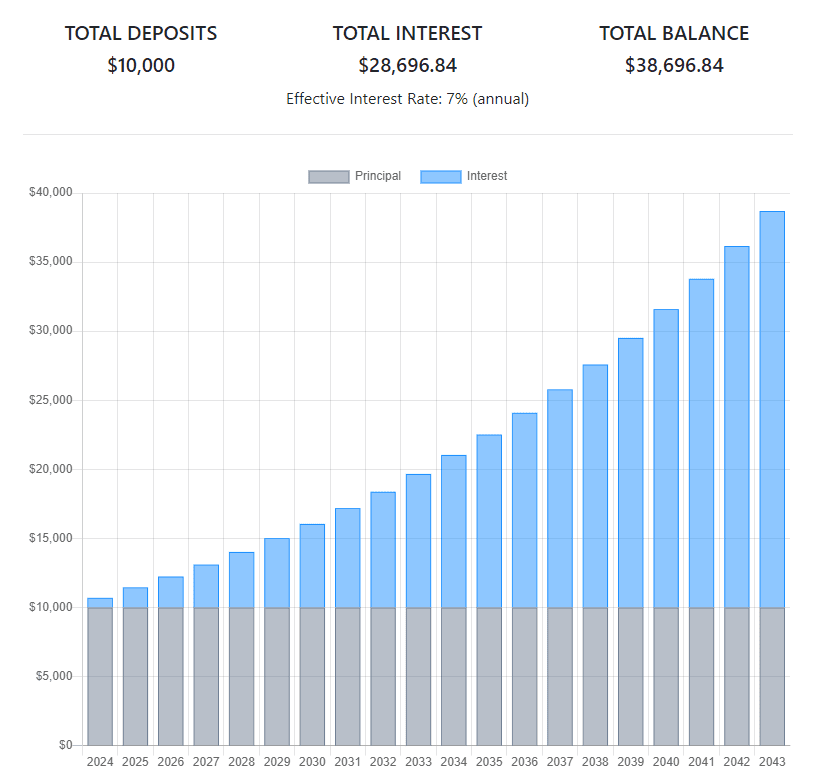

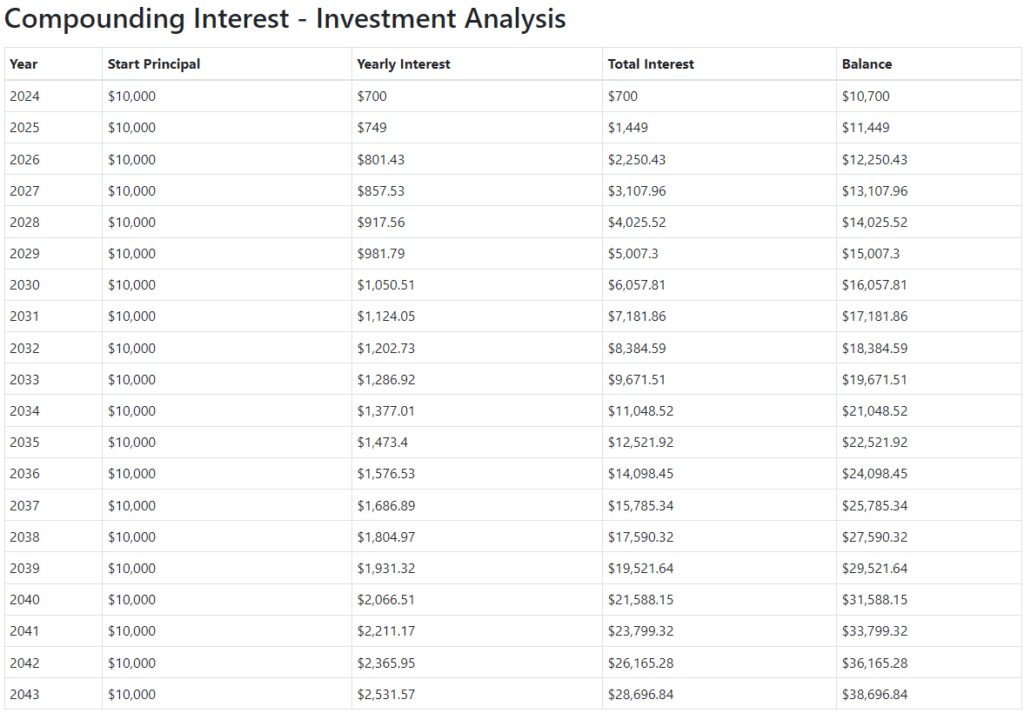

Here’s a chart showing the potential growth of a $10,000 investment over 20 years, assuming an average annual return of 7%:

As you can see, the power of compounding can turn a relatively small initial investment into a significant sum over time.

4. Outsource and Automate

Another way to balance time and money is to outsource and automate tasks that are time-consuming or tedious. For example, you could hire a virtual assistant to handle administrative tasks or use software to automate your social media posting. By freeing up your time, you can focus on the activities that generate the most value for you.

5. Prioritize Self-Care

Finally, it’s essential to prioritize self-care when balancing time and money. Taking care of your physical, mental, and emotional health is crucial for maintaining a sense of well-being and avoiding burnout. Make time for activities that recharge you, such as exercise, meditation, or spending time in nature.

As Elizabeth Grace Saunders, the author of “How to Invest Your Time Like Money,” writes in Harvard Business Review:

“When you feel in control of your time, you feel less stressed, more creative, and more effective. You’re able to focus on what matters most to you.”

The Bottom Line

Balancing time and money is a challenge that we all face, but it’s one that can be overcome with the right strategies and mindset. By setting clear financial goals, creating a budget, investing in passive income streams, outsourcing and automating tasks, and prioritizing self-care, we can create more time and freedom in our lives while still achieving our financial objectives.

Remember, money is a tool, not an end in itself. As Seneca once said:

“Time is the most valuable thing a man can spend.”

Use your money wisely to create more time and freedom in your life, and you’ll find that the rewards are well worth the effort.

Click this here to read another article about time and money!

Note: This blog post is written by a professional trader and investor based on personal experiences and opinions. It is not intended as financial advice. Always conduct your own research and consult a financial advisor before making any financial decisions.