Understanding Your Healthcare Coverage: A Comprehensive Analysis of In-Network Deductibles

Healthcare coverage can be complex, but understanding your in-network deductibles is crucial for managing your medical expenses effectively. This comprehensive guide will walk you through everything you need to know about in-network services and how deductibles affect your out-of-pocket costs.

What Are In-Network Deductibles?

Before diving into specific services, it’s essential to understand what an in-network deductible means. An in-network deductible is the amount you must pay for covered healthcare services before your insurance begins to pay. Working with in-network providers ensures you receive negotiated rates and maximum coverage benefits.

“Understanding your healthcare deductible is the first step toward taking control of your medical expenses and making informed decisions about your care.” – American Medical Association

Primary Care and Specialist Visits

When it comes to office visits, your coverage typically includes:

Primary Care Office Visits

Primary care visits are the foundation of preventive healthcare. These visits usually have lower copayments than specialist visits, even before meeting your deductible. Many insurance plans offer primary care visits with copayments that aren’t subject to the deductible.

Specialist Office Visits

Specialist visits typically involve higher copayments and may be subject to your deductible. However, some plans offer specialist visits with set copayments before meeting the deductible for certain conditions.

| Visit Type | Before Deductible | After Deductible | Typical Wait Time |

|---|---|---|---|

| Primary Care | $125-175 | $20-35 | 1-2 weeks |

| Specialist | $175-225 | $40-60 | 2-4 weeks |

| Mental Health | $150-200 | $25-45 | 1-3 weeks |

Diagnostic Testing and Imaging Services

Complex Imaging Authorization

Most insurance plans require prior authorization for complex imaging services such as:

- MRI scans

- CT scans

- PET scans

Working with in-network facilities for these services can save you significantly on out-of-pocket costs.

Outpatient Testing

Laboratory work and diagnostic testing costs vary widely. National Institutes of Health research shows that in-network labs typically charge 60-70% less than out-of-network facilities.

Preventive and Routine Services

One of the most valuable aspects of health insurance is coverage for preventive services. Under the Affordable Care Act, many preventive services are covered at 100% when received in-network:

Routine Physical Exams and Immunizations

Annual physicals and recommended vaccinations are typically covered without cost-sharing when performed by in-network providers.

Women’s Health Services

- Routine mammograms

- Well-woman exams

- Preventive prenatal care

- Lactation consultant services

- Breast pump and supplies

Men’s Health Services

Prostate cancer screening (PSA test) is typically covered as a preventive service for men over 50 or those at higher risk.

Hospital Services and Surgical Procedures

Overnight Hospital Stays

Hospital stays involve two main cost components:

- Facility fees

- Physician/surgeon fees

Working with in-network hospitals can reduce your out-of-pocket costs by 40-60% compared to out-of-network facilities.

Same Day Surgery

Outpatient surgical procedures often have lower copayments and coinsurance rates than inpatient procedures. Healthcare Cost Institute data shows that same-day surgeries at in-network facilities can save patients an average of 30-50% compared to overnight stays.

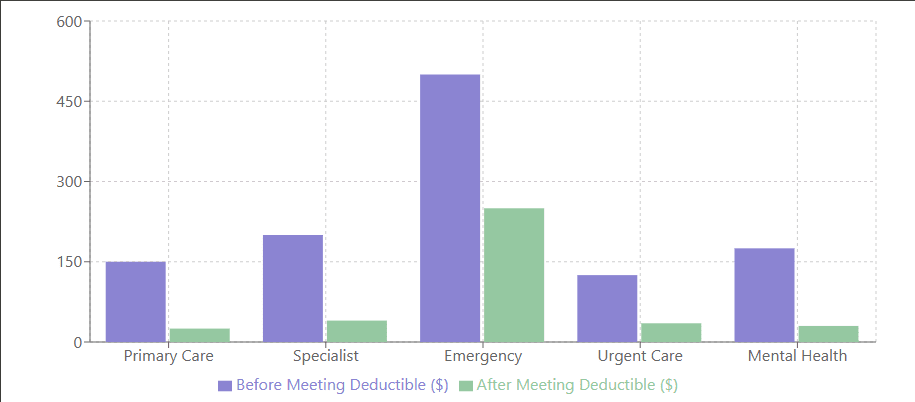

Emergency and Urgent Care Services

Emergency Room vs. Urgent Care

Understanding when to use each service can significantly impact your costs:

| Service Type | Average Cost | Typical Wait Time | Best For |

|---|---|---|---|

| Emergency Room | $1,500-$3,000 | 3-4 hours | Life-threatening conditions |

| Urgent Care | $150-$200 | 30-60 minutes | Non-emergency conditions |

| Walk-in Clinic | $75-$125 | 15-30 minutes | Minor illnesses |

Specialized Treatment Services

Mental Health & Substance Abuse

Mental health parity laws require insurance companies to provide comparable coverage for mental health services:

- Inpatient mental health treatment

- Outpatient counseling therapy

- Substance abuse services

Cancer Treatment Services

Chemotherapy coverage includes:

- Facility fees

- Infusion therapy

- Home health care

- Specialist visits

- Physician/surgeon fees

Work closely with your insurance provider to understand pre-authorization requirements and coverage limits for cancer treatments.

Rehabilitation Services

Physical Therapy

Most plans cover physical therapy with specific visit limits:

- Evaluation visits

- Treatment sessions

- Progress assessments

Occupational and Speech Therapy

Coverage typically includes:

- Initial evaluations

- Treatment sessions

- Home exercise programs

- Progress monitoring

Alternative Medicine Coverage

Many insurance plans now offer coverage for alternative treatments:

Acupuncture

Coverage often includes:

- Initial consultation

- Treatment sessions

- Follow-up care

Chiropractic Care

Typical coverage includes:

- Spinal manipulation

- X-rays

- Treatment plans

Maximizing Your Healthcare Benefits

Tips for Managing Your Deductible

- Schedule routine services early in your plan year

- Utilize preventive services that aren’t subject to the deductible

- Consider timing for elective procedures

- Take advantage of health savings accounts (HSAs) or flexible spending accounts (FSAs)

Understanding Your Rights

The Patient Advocate Foundation recommends:

- Reviewing your Explanation of Benefits (EOB) carefully

- Appealing incorrect claims

- Understanding your rights under your state’s insurance laws

Conclusion

Understanding your in-network deductibles and healthcare coverage is crucial for managing your medical expenses effectively. By staying informed about your coverage options and working with in-network providers, you can maximize your benefits while minimizing out-of-pocket costs.

For more information about specific coverage details, always consult your insurance provider or benefits administrator. Healthcare coverage can vary significantly between plans and providers, so it’s essential to verify your specific benefits and requirements.

Disclaimer: The information provided in this blog post is for general informational and educational purposes only. This content is not intended to be a substitute for professional medical, insurance, or financial advice. While we strive to maintain accurate and up-to-date information, healthcare policies, insurance coverage, and medical costs can vary significantly based on location, provider, insurance plan, and other factors.

Please note:

- All costs, deductibles, and coverage details mentioned in this article are approximate and for illustrative purposes only. Actual costs and coverage may vary significantly.

- Healthcare regulations and insurance policies change frequently. The information presented was current at the time of publication but may not reflect the most recent changes in healthcare laws or insurance requirements.

- Before making any decisions about healthcare services or insurance coverage, please:

- Consult your insurance provider directly

- Review your specific plan documents

- Contact your healthcare provider

- Seek professional advice when necessary

- The external links provided in this article are for reference only. We are not responsible for the content, accuracy, or reliability of external websites.

- Coverage for specific services, especially alternative medicine and certain treatments, may vary significantly between insurance plans and providers.

For specific information about your healthcare coverage, please contact your insurance provider or benefits administrator directly.