The Tax Tug-of-War

In the high-stakes arena of American politics, few issues hit closer to home than taxes. As we hurtle towards the 2024 presidential election, the battle lines are drawn, with former President Trump and Vice President Harris offering starkly different visions for the future of our tax system. But what does this mean for you, the average American taxpayer?

“In this world, nothing is certain except death and taxes.” – Benjamin Franklin

Franklin’s words ring truer than ever, but the amount of taxes we pay is far from certain. Let’s dive into the nitty-gritty of these competing tax plans and uncover how they could reshape your financial future.

The Current Tax Landscape: A Nation Divided

Before we explore the candidates’ proposals, let’s take a snapshot of where we stand:

- A staggering 56% of Americans believe they pay too much in federal income tax

- Only 22% feel they receive valuable services from their tax dollars

- The Tax Cuts and Jobs Act (TCJA) of 2017 is set to expire after 2025

- If the TCJA expires, a whopping 62% of taxpayers could see their tax bills increase

These statistics paint a picture of a nation at a crossroads, with the 2024 election poised to determine the direction of tax policy for years to come.

Trump’s Tax Vision: Doubling Down on Cuts

The TCJA Legacy

The cornerstone of Trump’s tax philosophy is the extension and expansion of the 2017 Tax Cuts and Jobs Act. Let’s break down the key components:

- Standard Deduction Doubled: This simplification measure reduced the number of Americans itemizing deductions to a record low of 9%.

- Across-the-Board Tax Cuts: The TCJA provided tax relief for the vast majority of taxpayers.

New Proposals on the Horizon

Trump isn’t content to rest on his laurels. His campaign has floated several new ideas:

- Exempting Tip Income: A potential boon for service industry workers

- Tax-Free Social Security Benefits: A move that could appeal to seniors but may have unintended consequences

“Everything we have to do should be oriented towards one thing: increasing the rate of economic growth of our country.” – Trump campaign statement

The Economic Impact: Growth vs. Deficits

Trump’s approach is rooted in the belief that tax cuts stimulate economic growth. However, this strategy comes with trade-offs:

| Pros | Cons |

|---|---|

| Potential for increased investment | Increased budget deficits |

| Short-term economic stimulus | Long-term debt concerns |

| Popular with voters | Uncertain long-term growth effects |

What It Means for You

If Trump’s plan becomes reality:

- Most Americans would see their current tax situation remain largely unchanged

- Service industry workers could see a significant boost in take-home pay

- Seniors might enjoy tax-free Social Security benefits, but at what cost to the program’s solvency?

Harris’s Tax Agenda: Reshaping the System

Building on Biden’s Blueprint

Vice President Harris’s tax vision aligns closely with the current administration’s policies:

- Maintaining TCJA Benefits for Most: Continuing tax cuts for those earning under $400,000 annually

- Expanding the Child Tax Credit: Potentially making it fully refundable

- New Tax Credits: Including a $6,000 credit for households with newborns and up to $25,000 for first-time homebuyers

Revenue Raisers: Targeting the Wealthy and Corporations

To fund these initiatives, Harris proposes:

- Increasing the corporate tax rate to 28% (up from 21%)

- Implementing a 25% minimum tax on individuals with over $100 million in wealth

- Raising the long-term capital gains tax to 28% for households earning $1 million or more annually

“We’re asking the wealthiest Americans and large corporations to pay their fair share.” – Harris campaign statement

The Economic Philosophy: Redistribution and Social Investment

Harris views the tax code as a tool for economic and social change:

| Policy Goal | Proposed Method |

|---|---|

| Boost care economy | Provide living stipends and housing assistance |

| Increase homeownership | Offer tax credits for first-time buyers |

| Support families | Expand child tax credits |

What It Means for You

Under Harris’s plan:

- If you earn less than $400,000, your tax rates would likely remain stable

- Lower-income Americans could benefit from expanded refundable tax credits

- First-time homebuyers and new parents might see significant tax advantages

- High-income earners and corporations would face increased tax burdens

The Great Tax Debate: Comparing the Plans

As we contrast these two approaches, several key differences emerge:

- Economic Philosophy

- Trump: Trickle-down economics, focusing on growth through tax cuts

- Harris: Redistributive policies, using tax code for social investment

- Corporate Taxes

- Trump: Maintain or potentially lower the current 21% rate

- Harris: Increase to 28%

- Individual Taxes

- Trump: Extend cuts across the board

- Harris: Maintain cuts for most, increase for high earners

- Tax Credits

- Trump: Focus on simplification

- Harris: Expand and create new credits for specific groups

- Long-Term Vision

- Trump: Emphasis on economic growth and simplification

- Harris: Focus on social programs and wealth redistribution

The Broader Economic Context

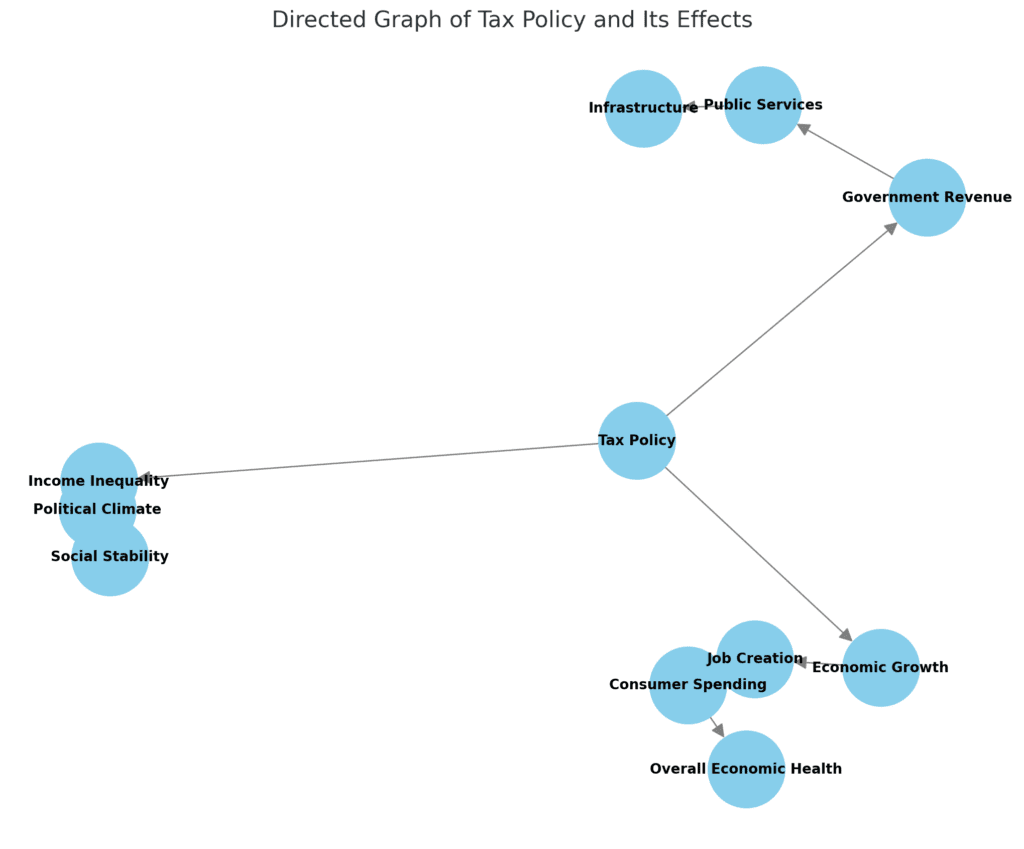

It’s crucial to consider these tax plans within the larger economic landscape:

This diagram illustrates the complex interplay between tax policy and various economic factors. Both candidates’ plans will have far-reaching effects beyond just your individual tax bill.

How Will This Affect Your Wallet?

As we’ve seen, the impact of these tax plans on your personal finances depends largely on your income level and life circumstances. Here’s a quick breakdown:

| Income Level | Trump’s Plan | Harris’s Plan |

|---|---|---|

| Under $400k | Likely unchanged | Potential for new credits |

| $400k – $1M | Tax cuts extended | Possible slight increase |

| Over $1M | Tax cuts extended | Significant increase likely |

Your Vote, Your Taxes

As we approach the 2024 election, the choice between Trump’s and Harris’s tax visions represents more than just numbers on a balance sheet. It’s a referendum on the role of government, the nature of economic growth, and the very fabric of American society.

Whether you prioritize lower tax rates across the board or targeted relief for specific groups, your vote will play a crucial role in shaping the future of the American tax system. As you head to the polls, consider not just how these plans will affect your wallet today, but how they’ll shape the economic landscape for generations to come.

Remember, in the world of taxes, the only constant is change. Stay informed, engage in the debate, and make your voice heard. After all, it’s your money – and your future – at stake.

Further Reading:

For more in-depth analysis on tax policy and its economic impacts, check out these resources:

- Tax Policy Center: Nonpartisan analysis of tax issues

- Congressional Budget Office: Official budgetary impact assessments

- National Taxpayers Union Foundation: Taxpayer advocacy and policy research

More content from Van’s Log:

- The Savvy Investor’s Guide to Navigating Tax and Capital Gains in 2024

- The Taxing Truth: Navigating the Complex 2024 Tax Landscape

Disclaimer: This blog post is based on current policy proposals and expert analysis. Tax laws and candidate positions may change. Always consult with a qualified tax professional for advice on your specific situation.