Interest is a fundamental concept in the world of finance, playing a crucial role in determining the growth and value of your investments. Whether you’re saving for a rainy day, planning for retirement, or looking to build wealth, understanding how interest works is essential. In this blog post, we’ll dive deep into the world of interest, exploring its various forms and how it impacts different bank products.

Understanding the Basics of Interest

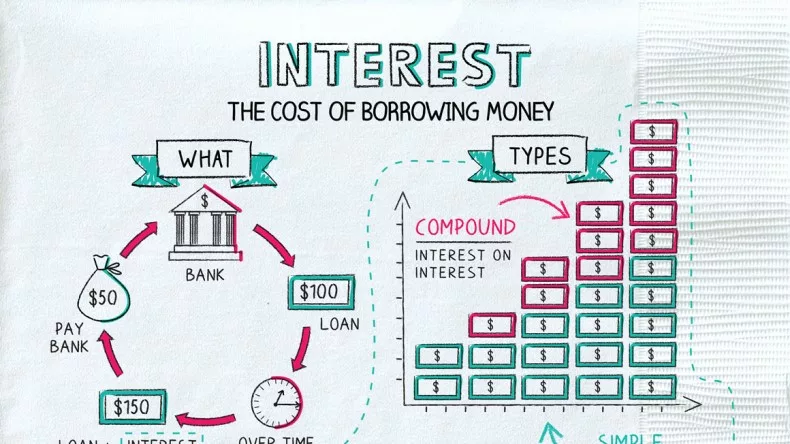

At its core, interest is the cost of borrowing money or the reward for lending it. When you deposit money in a bank account, you’re essentially lending money to the bank, and in return, the bank pays you interest. On the flip side, when you borrow money from a bank, you pay interest to the bank for the privilege of using their funds.

The amount of interest you earn or pay depends on several factors, including:

- The principal amount (the initial sum of money)

- The interest rate (expressed as a percentage)

- The compounding frequency (how often interest is calculated and added to the principal)

- The length of time the money is invested or borrowed

Types of Interest: Simple vs. Compound

There are two main types of interest: simple interest and compound interest. Understanding the difference between the two is crucial when evaluating bank products and making financial decisions.

Simple Interest

Simple interest is calculated based solely on the principal amount. It doesn’t take into account any interest earned over time. The formula for simple interest is:

Simple Interest = Principal × Interest Rate × Time SimpleFor example, if you invest $1,000 at a 5% annual simple interest rate for three years, you would earn:

$1,000 × 0.05 × 3 = $150At the end of the three years, you would have a total of $1,150.

Compound Interest

Compound interest, on the other hand, is calculated based on the principal amount plus any interest earned over time. In other words, you earn interest on your interest. The formula for compound interest is:

Compound Interest = Principal × (1 + Interest Rate)^Time – PrincipalUsing the same example as before, if you invest $1,000 at a 5% annual compound interest rate for three years, you would earn:

$1,000 × (1 + 0.05)^3 – $1,000 = $157.63At the end of the three years, you would have a total of $1,157.63.

While the difference between simple and compound interest may seem small in this example, the power of compound interest becomes more apparent over longer periods and with larger principal amounts.

| Investment Term | Simple Interest | Compound Interest |

|---|---|---|

| 10 Years | $500 | $628.89 |

| 20 Years | $1,000 | $1,653.30 |

| 30 Years | $1,500 | $3,321.94 |

Assumes a $1,000 initial investment at a 5% annual interest rate.

As you can see, compound interest significantly outpaces simple interest over time, making it a powerful tool for growing your wealth.

Interest Rates: APY vs. APR

When comparing bank products, you’ll often come across two types of interest rates: Annual Percentage Yield (APY) and Annual Percentage Rate (APR). While they may seem similar, there are important differences to understand.

Annual Percentage Yield (APY)

APY is the actual rate of return you earn on your investment, taking into account the effect of compound interest. It represents the total amount of interest you’ll earn over one year, assuming you don’t make any additional deposits or withdrawals.

For example, if you invest $1,000 in a savings account with a 1.5% APY, you would earn $15 in interest after one year, assuming monthly compounding.

Annual Percentage Rate (APR)

APR, on the other hand, is the annual rate of interest charged on a loan or credit card. It includes not only the interest rate but also any additional fees or charges associated with the loan, such as origination fees or closing costs.

For example, if you take out a $10,000 loan with a 5% APR and $500 in fees, your total cost of borrowing would be $1,000 ($500 in interest plus $500 in fees) over one year.

When comparing bank products, it’s essential to look at the APY for savings accounts and investments, and the APR for loans and credit cards. A higher APY means you’ll earn more interest on your money, while a lower APR means you’ll pay less in interest and fees.

Bank Products and Interest

Now that we’ve covered the basics of interest let’s explore how it applies to various bank products.

Savings Accounts

Savings accounts are designed to help you set aside money for short-term goals or emergencies. They typically offer lower interest rates compared to other investment options, but they also provide easy access to your funds when you need them.

When choosing a savings account, look for one with a competitive APY. Some of the best high-yield savings accounts currently offer APYs around 0.50%, which is significantly higher than the national average of 0.06%.

Keep in mind that some savings accounts may require a minimum balance or charge fees if you don’t maintain a certain balance or make a certain number of transactions per month.

Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are savings accounts that offer a fixed interest rate for a specific term, typically ranging from a few months to several years. In exchange for a higher interest rate, you agree to leave your money in the account until the term expires.

CDs can be a good option if you have a lump sum of money that you don’t need immediate access to and want to earn a guaranteed return. However, keep in mind that if you withdraw your money before the term ends, you may face early withdrawal penalties.

When comparing CDs, look for one with a competitive APY and a term that aligns with your financial goals. Bankrate’s CD rates tool can help you compare rates from multiple banks and credit unions.

Money Market Accounts

Money market accounts combine features of both savings and checking accounts. They typically offer higher interest rates than traditional savings accounts, but also provide check-writing and debit card access.

Money market accounts can be a good option if you want to earn a higher return on your savings while still maintaining some flexibility and liquidity. However, they often require a higher minimum balance than savings accounts and may charge fees if you don’t maintain that balance or exceed a certain number of transactions per month.

When choosing a money market account, look for one with a competitive APY and low fees. Some of the best money market accounts currently offer APYs around 0.50% with minimum balances of $1,000 or less.

Bonds

Bonds are debt securities issued by corporations, municipalities, or governments to raise capital. When you buy a bond, you’re essentially lending money to the issuer in exchange for regular interest payments and the return of your principal when the bond matures.

Bonds can be a good option for investors looking for a predictable stream of income and lower risk compared to stocks. However, keep in mind that bonds are subject to interest rate risk, meaning their value can fluctuate as interest rates change.

When investing in bonds, consider factors such as the issuer’s creditworthiness, the bond’s maturity date, and the coupon rate (the annual interest rate paid by the bond). Treasury Direct is a good resource for learning more about government bonds and how to invest in them.

Maximizing Your Interest Earnings

Now that you understand how interest works and how it applies to various bank products, let’s explore some strategies for maximizing your interest earnings.

Shop Around for the Best Rates

Don’t settle for the first bank product you come across. Take the time to shop around and compare rates from multiple banks and credit unions. Online banks and neobanks often offer higher rates than traditional brick-and-mortar banks, so be sure to include them in your search.

Consider Longer Terms for Higher Rates

Generally, the longer you’re willing to commit your money, the higher the interest rate you can earn. For example, a 5-year CD will typically offer a higher APY than a 1-year CD. If you have money that you don’t need immediate access to, consider investing in longer-term products to maximize your earnings.

Ladder Your Investments

If you’re investing in CDs or bonds, consider using a laddering strategy to balance your need for liquidity with your desire for higher returns. Laddering involves investing in multiple products with staggered maturity dates so that you have some money coming due on a regular basis.

For example, instead of investing $10,000 in a single 5-year CD, you could invest:

- $2,000 in a 1-year CD

- $2,000 in a 2-year CD

- $2,000 in a 3-year CD

- $2,000 in a 4-year CD

- $2,000 in a 5-year CD

As each CD matures, you can either reinvest the money in a new 5-year CD or use it for other purposes, depending on your financial needs.

Reinvest Your Interest

To take full advantage of compound interest, consider reinvesting your interest earnings rather than withdrawing them. By leaving your interest in the account, you’ll earn interest on your interest, accelerating your growth over time.

Many bank products offer the option to automatically reinvest your interest, so be sure to take advantage of this feature if it’s available.

The Bottom Line

Interest is a powerful tool for growing your wealth over time, but it’s important to understand how it works and how it applies to different bank products. By shopping around for the best rates, considering longer terms, laddering your investments, and reinvesting your interest, you can maximize your earnings and reach your financial goals faster.

Remember, even small differences in interest rates can add up to significant amounts over time, so don’t underestimate the importance of seeking out the best deals and making smart investment choices.

This content is for informational purposes only and should not be considered investment, tax, or legal advice. Please consult with a qualified professional before making any financial decisions.

For more content, check out The Complete Guide to Personal Finance: In-Depth Answers to Your Credit and Debt Questions.