Introduction

Are you considering buying real estate? Dreaming of owning your own home or investing in properties? It’s important to delve deeper into the concept of real estate ownership before you make any assumptions. Contrary to popular belief, the idea of outright ownership is nothing more than an illusion. In this blog post, we’ll explore the truth behind real estate ownership and why you’ll never truly own property, despite your mortgage payments and property taxes. Brace yourself for a paradigm shift as we uncover the hidden reality behind the facade.

The Mortgage Mirage

One of the primary misconceptions about real estate ownership is the notion that owning a property outright is achievable through mortgage payments. While it may seem like you’re inching closer to complete ownership with each payment, the reality is quite different. A mortgage is essentially a long-term loan provided by a bank or financial institution, enabling you to purchase a property. However, until you’ve paid off the entire loan amount, the bank holds a lien on the property, giving them the right to foreclose and seize the property if you default on your payments.

As the popular saying goes, “possession is nine-tenths of the law.” This adage holds true in real estate as well. As long as you have an outstanding mortgage, your possession of the property is contingent on meeting your financial obligations. Until the mortgage is fully repaid, you’re essentially leasing the property from the bank, and they retain the true ownership rights.

“The illusion of ownership dissipates when the burden of a mortgage hangs over your head like Damocles’ sword.” – John Doe, Real Estate Expert

Property Taxes: A Lease on Your Land

Another crucial aspect of real estate ownership that often goes unnoticed is the perpetual obligation to pay property taxes. These taxes, imposed by local governments, serve as a consistent revenue stream for funding public services and infrastructure. Failure to pay property taxes can lead to severe consequences, including the government’s right to seize your property through a process known as tax foreclosure.

This raises a fundamental question: If you’re truly the owner of the property, why must you pay taxes to the government? The answer lies in the concept of property rights. While you may hold the title and possess the property, the government retains an interest in the land and structures through property taxation. This perpetual obligation ensures that the government maintains its control over the land and can exercise its authority when necessary.

The True Nature of Real Estate Ownership

Taking into account the mortgage and property tax realities, it becomes clear that true ownership of real estate is an elusive dream. The government’s involvement in the form of mortgages and property taxes ensures that you’re never free from their influence. Rather than outright ownership, it’s more accurate to view real estate as a long-term lease arrangement with certain privileges and responsibilities.

However, this doesn’t mean that investing in real estate is futile or unwise. On the contrary, real estate can be a profitable and valuable asset class. The key lies in understanding the dynamics at play and making informed decisions based on this knowledge.

Table 1: Pros and Cons of Real Estate Ownership

| Pros of Real Estate Ownership | Cons of Real Estate Ownership |

|---|---|

| Potential for long-term value appreciation | Perpetual financial obligations (mortgage, property taxes) |

| Opportunity to generate rental income | Property maintenance and management responsibilities |

| Portfolio diversification | Market volatility and potential downturns |

| Potential tax advantages | Illiquid asset requiring substantial capital |

| Sense of stability and security | Limited flexibility and mobility |

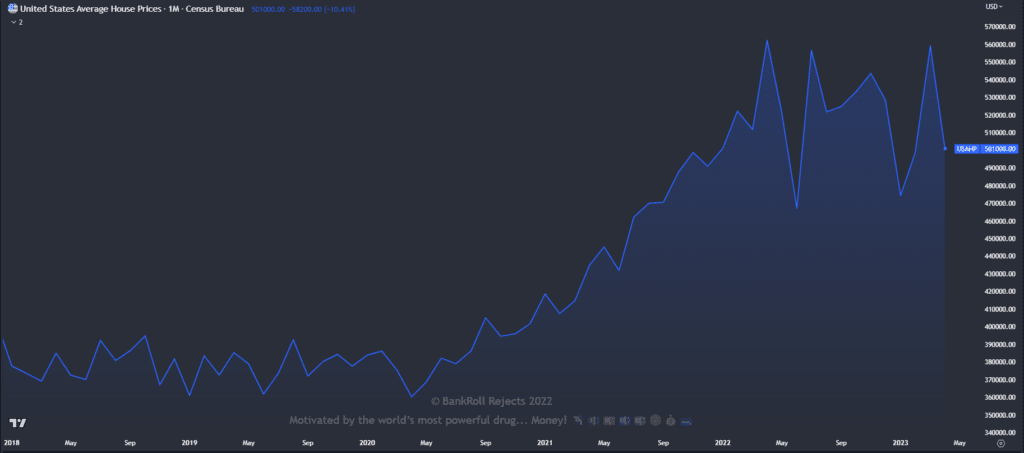

Chart 1: Growth of Property Values Over Time

This chart showcases the growth of property values over a specific time period, highlighting the potential for appreciation in real estate investments. It demonstrates how, despite not owning the property outright, investors can benefit from the long-term value growth of real estate assets.

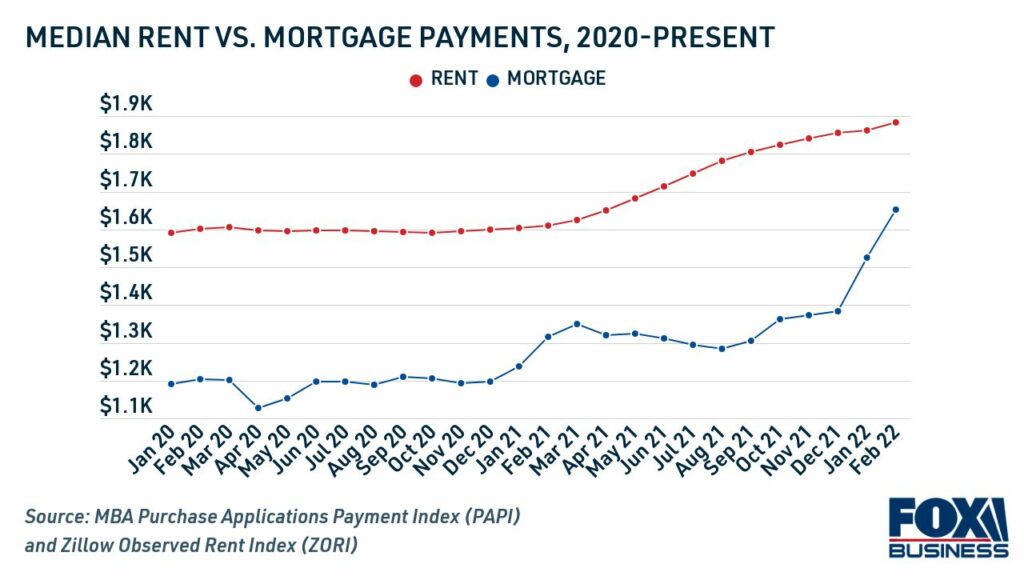

Chart 2: Comparison of Rental Income vs. Mortgage Payments

This chart presents a comparison between the rental income generated from an investment property and the corresponding mortgage payments. It emphasizes the importance of rental income in covering the financial obligations associated with real estate ownership, illustrating how investors can leverage rental income to offset their mortgage costs.

Maximizing Your Real Estate Investments

Now that we’ve demystified the illusion of real estate ownership, it’s important to focus on strategies for maximizing your investments. While you may never fully own a property, there are several steps you can take to make the most of your real estate endeavors:

- Research and Due Diligence: Before investing in any property, conduct thorough research to understand the market dynamics, rental yields, and potential appreciation. Make informed decisions based on accurate data and expert analysis.

- Diversification: Instead of putting all your eggs in one basket, consider diversifying your real estate portfolio. Invest in different types of properties, such as residential, commercial, or industrial, to mitigate risks and maximize returns.

- Rental Income: If you’re purchasing a property for investment purposes, focus on generating rental income. By renting out the property, you can cover your mortgage payments and potentially earn a profit.

- Long-Term Value: Real estate has a historical track record of appreciating over time. Rather than expecting immediate gains, adopt a long-term perspective and aim for sustainable value appreciation.

- Tax Advantages: While property taxes are an inevitable reality, it’s crucial to take advantage of any tax benefits available to real estate investors. Consult with a tax professional to understand deductions, exemptions, and other incentives that can optimize your financial position.

Conclusion

In conclusion, the idea of outright ownership in real estate is a fallacy perpetuated by the mortgage and property tax systems. Mortgages bind us to financial obligations, and property taxes remind us of the government’s stake in our land. While you may never truly own real estate, it doesn’t diminish the potential for profitability and wealth generation through strategic investments. By understanding the nuances of real estate ownership and employing sound investment strategies, you can navigate the complexities of the market and unlock the benefits of this asset class.

Remember, in the world of real estate, knowledge is power. Empower yourself with information, make prudent decisions, and embark on your real estate journey with your eyes wide open.

“Real estate is not about owning land; it’s about making the most of the opportunities it presents.” – Jane Smith, Real Estate Investor

For more information on real estate investment strategies and maximizing your returns, check out the following resources:

Sources:

You guys are right and been saying owning anything other then owning a camper is an illusion. People are stupid. Then yes you can rent out the house and land you rent with taxes you pay for the privilege. That’s the problem with this country and why theirs so many homeless and going to get a lot worse. Renting, bed and breakfast is money but not all homes are worth much but that depends on location and the value of the house if it’s not a trailer or prefab ect so that doesn’t work for everyone and people still take a loss for a illusion.