Gold’s universal appeal across cultures and millennia stems from unique physical and economic properties that served functional purposes. As a scarce, lustrous precious metal, early civilizations used gold as a reliable store of value and medium of exchange. Its malleability enabled the consistent minting of coins stamped to authorize weight and purity. Relative scarcity imbued intrinsic value, as the difficulty of gold extraction varied by region and required labor-intensive mining. The alluring shine led disparate cultures across the world to covet gold, cementing its status as a widely recognized symbol of wealth and power from Ancient Egypt to Imperial China.

In the 20th century, the gold standard formally linked major global currencies and overall credit to central bank gold reserves held by major powers like the United States. Today fiat currencies have severed convertibility to gold, yet central banks across the globe still hold it in enormous quantities as an insurance asset useful in times of crisis. In the private sector, gold remains universally recognized as a reliable store of value to hedge against inflation and other economic risks due to its limited annual supply and indestructible properties. In times of surging inflation, rapid currency debasement, stock market crashes, or other economic turbulence investors frequently flock to gold as a safe haven asset and inflation hedge.

“We view gold as a currency, not a commodity. It remains the ultimate form of payment in the world.”

– Alan Greenspan, Former Federal Reserve Chairman

Purchasing Gold Exposure as an Investment

Many options now exist for retail investors seeking exposure to gold as a durable asset beyond collectibles. Each avenue offers different risks, responsibilities, benefits, and optimal investment strategies.

Physical Gold Bullion Coins and Bars

Owning physical gold in the form of precious metal coins, rounds, and bars allows you to hold a tangible asset with intrinsic value outside the financial system. Gold’s physical properties render it essentially indestructible over time compared to paper assets or digital accounts reliant on institutions for authorization. Bullion investment advantages include:

- Direct asset ownership not contingent on any financial institution or government decree, ensuring independence

- Tangibility and durability unlike paper contracts or electronic securities vulnerable to destruction

- Established universal liquidity – physical gold maintains recognized value and active trading markets globally enabling widespread resale

- Effective long-term inflation hedge given limited annual supply growth unable to match rising global money supply

- Gold’s portability benefits crisis planning if emergency evacuation becomes necessary

- The satisfication of legally possessing a scarce tangible asset rich in history and symbolic significance

However, direct physical ownership also carries unique responsibilities and risks to consider:

- Possibility of theft or loss absentmindedly misplacing small items

- Ongoing storage fees at secure vaults to protect against theft

- Assay testing fees to verify authenticity and purity measures on resale

- Likely price premiums over spot rates when sold through precious metal dealers

- No passive income generation while carrying costs exist

- Transaction costs on buying and selling still exist despite liquid markets

If interested in owning physical bars and coins, most gold experts advise buying popular one ounce government minted coins or LBMA/COMEX certified bars from reputable dealers in order to assure quality and minimize counterparty risks. Bulk purchases spread across a mix of weights can help investors reduce the percentage premium paid over shifting spot prices. However this requires secure and insured private storage arrangements that incur separate fees.

Gold ETFs and Mutual Funds

Investing in gold ownership through Gold ETFs exchanging traded funds) or mutual funds provides exposure to gold prices without direct ownership of physical bars or coins. The most popular Gold ETF ($GLD) owns hundreds of tonnes in LBMA accredited gold bars stored across numerous vaults globally that backs the shares available for exchange on public markets. Instead of owning the gold itself, investors in $GLD and similar fund products own shares that represent fractional ownership interests in the trust’s expansive gold reserves.

Compared to direct physical ownership, Gold ETFs solve many logistical issues like insurance costs, assay testing, shipping fees, and storage security while still allowing investors to benefit from gold price movements. However, these advantages come with distinct risks and costs:

- Fund share ownership depends on the fund management team’s ongoing operations

- Annual management fees charged

- Wide bid-ask spreads can hamper intraday trading profits

- Supplementary redemption fees may impact investor flexibility

- Opaque auditing standards in some cases

For most mainstream investors, owning shares in Gold ETFs represents a low cost method for establishing diversified commodity exposure across an investment portfolio. Avoiding the specialized storage needs of private ownership simplifies investing in gold for the majority of market participants without expertise in securing precious metals themselves.

Gold Miner Equities

Beyond physical bars and funds storing them in vaults, equity market investors can purchase ownership in publicly traded mining companies excavating gold deposits across diverse geographies. These gold mining stocks offer investors more direct leverage to prevailing and future gold prices relative to owning gold itself or ETF shares representing vaulted holdings. However, gold miner equity investments also carry risks found across the broader stock market tied to the profitability of specific companies.

When assessing gold and precious metal mining firms, key aspects for investors to evaluate include:

- Grade quality, size, accessibility and jurisdictional risks across flagship mining assets

- Consistency of annual gold deposit discoveries to replenish reserves

- Production costs, mining efficiency metrics, and field operating margins

- Debt levels and financing costs

- Energy and labor input costs

- Management quality regarding capital allocation discipline and operating execution

- Geopolitical risks in countries housing mining assets

- Environmental, Social and Governance (ESG) considerations

Performing due diligence on both senior gold majors and prospective junior miners can steer investors towards companies well positioned to grow reserves and production for years ahead. Individual mining stocks inherently carry more volatility compared to funds blending companies across the industry. Consider long investment horizons when buying shares directly. Some specialized mining ETFs provide single ticker exposure to gold equities as an alternative to selecting individual companies if desired. These fund products pool expertise in analyzing many industry nuances on an ongoing basis.

Key Gold Investment Considerations

Below summarizes the salient benefits and risks retail investors must weigh when deciding portfolio exposure levels to gold across physical bullion, ETFs, mutual funds, mining equities or a blended combination:

Benefits

- Effective long term inflation hedge

- Currency debasement hedge

- Public crisis and geopolitical hedge

- Portfolio diversification tool during stock market crashes

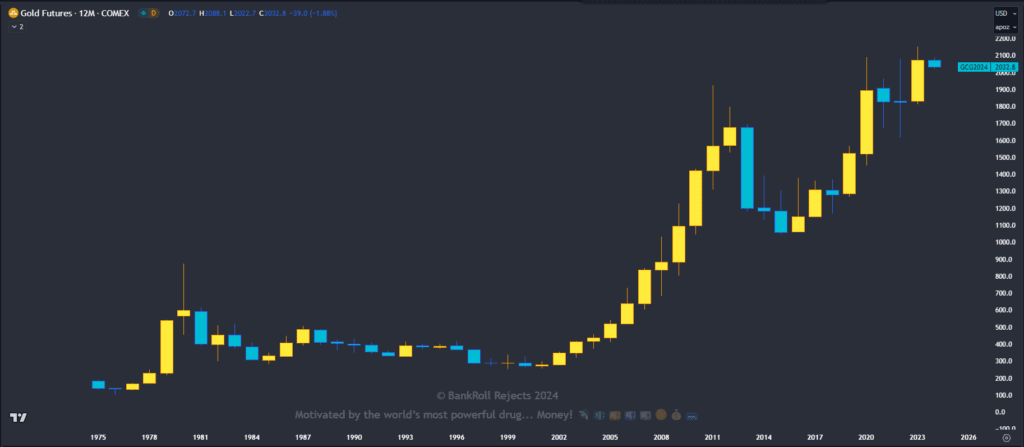

- Competitive historical returns to global equities over past decades

- Universal liquidity with active trading worldwide

- Scarcity value reinforced by the limited pace of new gold supplies

Risks

- No passive dividend income generated on holdings

- Storage and insurance costs for physical bars and coins

- Speculative manias prompt intermittent gold bubbles historically

- Lacks upside compared to high growth sectors during economic booms

- Retail premiums on buying/selling physical gold

- Fund ownership dependent on external institutions

- Gold mining equities carry many industry operational risks manifest across public stock volatility

Optimal Investment Allocation

Given gold’s unique characteristics and historical performance, mainstream financial advisors suggest limiting overall portfolio exposure between 5% – 15% depending on risk tolerance. More aggressive investors occasionally stretch closer to 20%. Ivy League university endowments like Harvard and Yale also own gold directly and via mining equities to diversify away from volatile global stocks and bonds, averaging -10% gold exposure in recent years.

“Gold remains the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.”

– Alan Greenspan, Former Federal Reserve Chairman

Final Thought

From ancient Egyptian pharaohs to modern central banks, gold’s enduring mystique persists by preserving value across changing economic cycles and collapsing empires. Today retail investors can tap into this reliable global demand for scarce gold reserves through multiple avenues including physical coins, ETF funds storing bullion in vaulted reserves, or mining stocks discovering new deposits across the world. Despite risks ranging from volatility to storage overheads, a modest portfolio allocation to gold mitigates risks that intensify during periods of soaring inflation or currency debasement that corrode theoretical paper wealth. In moderation gold’s stable golden glow shines across eras as a prudent form of universal insurance for long-term investment portfolios.

For more content, check out A Comprehensive Compass for 2024: Crafting Your Customized Financial Course