The Fed: Not the Market Maestro You Think It Is

In the world of finance and economics, few institutions loom as large as the Federal Reserve, commonly known as the Fed. For decades, traders, investors, and financial pundits have hung on every word uttered by Fed officials, treating their pronouncements as gospel. But what if I told you that this reverence is largely misplaced? That the Fed’s power over markets and the economy is more illusion than reality?

Let’s dive into this controversial topic and challenge some long-held beliefs about the Fed’s role in our financial lives.

The Fed’s Limited Reach: Debunking the Rate-Setting Myth

One of the most pervasive myths about the Fed is that it has the power to set interest rates across the board. This couldn’t be further from the truth. In reality, the Fed’s direct influence is limited to a single rate: the Federal Funds Rate.

“The Fed only sets one interest rate which is called the Fed Funds Rate which does not affect consumers or businesses.” – Aswath Damodaran, Professor at Stern School of Business, NYU

But what exactly is the Federal Funds Rate? Let’s break it down:

| Term | Definition |

|---|---|

| Federal Funds Rate | An overnight intra-bank borrowing rate |

| Set by | Federal Open Market Committee (FOMC) |

| Meeting frequency | 8 times per year (or during emergencies) |

| Direct impact on | Banks’ overnight lending |

| Direct impact on consumers/businesses | None |

As you can see, this rate has no direct bearing on the interest rates that affect our daily lives. So why do we give it so much attention?

The Real Rate Setters: Market Forces and Institutions

If the Fed isn’t setting the rates that matter to us, who is? The answer lies in a combination of market forces and financial institutions. Let’s look at some examples:

- Bond yields: Set by the futures market (supply and demand)

- Credit card rates: Set by issuing banks

- Mortgage rates: Set by mortgage lenders

- Corporate bond rates: Determined by market participants

In essence, the rates that impact consumers and businesses are set either by market dynamics or by specific institutions – not by the Fed.

Correlation ≠ Causation: The Fed Funds Rate Misconception

Many people point to charts showing apparent correlations between the Fed Funds Rate and other interest rates as proof of the Fed’s influence. However, this is a classic case of confusing correlation with causation.

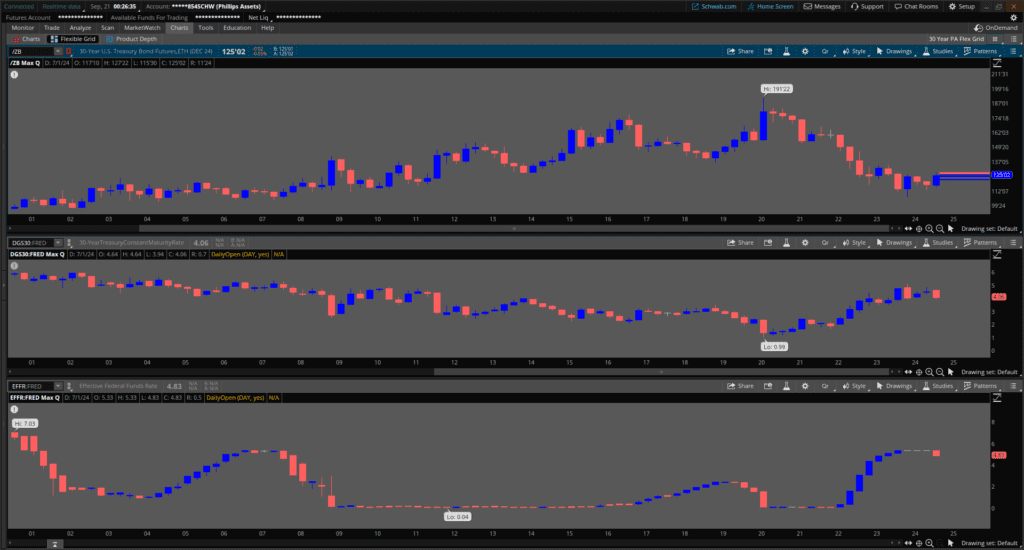

Let’s look at a comparison of the 30-year Bond futures, 30-year Treasury yield, and Fed Funds Rate over time:

As you can see, while there are periods of apparent correlation, there are also significant divergences. This suggests that other factors are at play in determining long-term interest rates.

The True Drivers of Interest Rates: Inflation and Economic Growth

If the Fed isn’t driving interest rates, what is? According to experts like Aswath Damodaran, the real culprits are inflation and economic growth. These macroeconomic factors have a far more significant impact on interest rates than any Fed decision.

Let’s consider how these factors influence rates:

- Inflation: Higher inflation expectations lead to higher interest rates as lenders seek to preserve the real value of their returns.

- Economic growth: Strong economic growth can lead to higher interest rates as demand for credit increases and lenders can command higher returns.

These factors operate independently of Fed actions, yet they have a profound impact on the interest rates that affect our daily lives.

The Fed as a Market Signaler: A Double-Edged Sword

Another commonly held belief is that the Fed acts as a market signaler, providing guidance on the direction of the economy. However, this role is far more ambiguous than many realize.

Consider a scenario where the Fed cuts interest rates by 50 basis points. How might different market participants interpret this action?

| Perspective | Interpretation |

|---|---|

| Optimistic | The Fed is proactively supporting economic growth |

| Pessimistic | The Fed sees trouble ahead and is trying to get ahead of it |

| Cynical | The Fed is reacting to political pressure rather than economic data |

As you can see, the same action can be interpreted in vastly different ways, rendering the Fed’s role as a market signaler far less clear-cut than many believe.

The Fed’s Limited Toolkit: Why It’s Not the Economic Panacea

Despite its outsized reputation, the Fed‘s actual tools for influencing the economy are quite limited. Let’s examine the primary tools at its disposal:

- Setting the Federal Funds Rate: As we’ve discussed, this has limited direct impact on consumers and businesses.

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Reserve Requirements: Adjusting the amount of money banks must hold in reserve.

- Forward Guidance: Communicating future policy intentions to influence market expectations.

While these tools can have some impact on the broader economy, they are far from the all-powerful levers many believe them to be. The Fed cannot directly control inflation, unemployment, or economic growth – it can only attempt to influence these factors indirectly.

The Danger of Overreliance on the Fed

Given the limitations of the Fed’s power, why do we continue to place so much emphasis on its actions? The answer lies in a combination of historical precedent, media narratives, and a desire for simple explanations in a complex economic landscape.

However, this overreliance on the Fed can be dangerous for several reasons:

- It can lead to misallocation of resources as investors react to Fed signals rather than underlying economic fundamentals.

- It can create moral hazard, encouraging excessive risk-taking based on the belief that the Fed will always step in to support markets.

- It can distract from more important economic factors and policy decisions that have a greater impact on long-term economic health.

A New Perspective: Looking Beyond the Fed

So, if the Fed isn’t the all-powerful market mover we’ve been led to believe, how should we approach economic and investment decisions? Here are some suggestions:

- Focus on fundamentals: Pay attention to underlying economic data, corporate earnings, and industry trends rather than Fed tea leaves.

- Understand market dynamics: Recognize that market prices are set by supply and demand, not by Fed decree.

- Consider multiple factors: Look at a broad range of economic indicators rather than fixating on Fed actions.

- Think long-term: Don’t let short-term Fed-induced market volatility distract from your long-term investment strategy.

By adopting this more nuanced view of the Fed’s role, investors and market participants can make more informed decisions based on a broader understanding of economic realities.

The Fed’s True Place in the Economic Landscape

As we’ve explored throughout this post, the Fed‘s influence on markets and the economy is far more limited than conventional wisdom suggests. While it remains an important institution, its power to set interest rates, signal market direction, and control economic outcomes is largely overstated.

By recognizing the Fed’s true place in the economic landscape – as one player among many rather than an all-powerful puppet master – we can develop a more accurate and nuanced understanding of how markets and economies truly function.

The next time you hear breathless news coverage about a Fed decision or see markets gyrating in response to a Fed statement, remember: the Fed is not the market mover most people think it is. The real drivers of economic outcomes are far more diverse and complex – and understanding this reality is key to making informed financial decisions in an ever-changing economic landscape.

External Resources:

For more information on the topics discussed in this post, check out these valuable resources:

- Aswath Damodaran’s Blog: Insights from the NYU professor quoted in this article.

- Federal Reserve Education: Official educational resources from the Federal Reserve.

- St. Louis Fed’s FRED Database: A treasure trove of economic data for those who want to dig deeper.

Also check out The Best Dollar Cost Averaging Opportunities to Seize in 2024.

Remember, while these resources are valuable, always approach economic information critically and form your own informed opinions.

Disclaimer: The opinions expressed in this blog post are those of the author and do not necessarily reflect the official policy or position of any financial institution, economic authority, or the Federal Reserve. This content is for informational purposes only and should not be considered financial, investment, or trading advice. The information provided is based on sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Readers are encouraged to conduct their own research and consult with qualified financial professionals before making any investment or economic decisions. Market conditions are subject to change, and past performance is not indicative of future results. The author and publisher are not responsible for any losses or damages resulting from the use of this information.