The world of finance is rapidly evolving. As we enter 2024, a wave of groundbreaking trends promises to shake up the status quo. From decentralized systems to AI insights, sustainability initiatives to subscription models, the financial landscape looks brighter than ever.

Get ready for innovation that expands access, insights, and opportunities. The future has never seemed more full of potential, if you know where to look. Here are 12 finance trends set to make a positive impact in 2024 and beyond. The forecast is sunny skies ahead!

DeFi Takes Center Stage

Forget the dusty reputations of traditional banks. Decentralized finance (DeFi) platforms are exploding onto the scene, offering blockchain-powered alternatives for lending, trading, and more. With incredible returns and minimal barriers to entry, it’s no wonder investors are diving into DeFi pools headfirst.

By the numbers:

| Total Value Locked in DeFi | 2021 | 2022 | 2023 (Predicted) |

|---|---|---|---|

| USD Billions | $100 | $210 | $475 |

In 2024, expect DeFi to captivate institutional investors as much as retail traders. Major players like Fidelity and BlackRock are already getting involved. As security and interoperability improves, DeFi will unlock financial access for millions more. The growth projections speak for themselves!

Green is the New Gold

Sustainability is transitioning from buzzword to financial priority. Impact-oriented products like green bonds and ESG funds are exploding in popularity. Corporates and investors alike are realizing environmental standards boost returns over the long term.

“88% of sustainable equity funds outperformed their non-ESG equivalents over 10 years.”

Morgan Stanley Institute for Sustainable Investing

With consumers and governments demanding more accountability, expect green finance to become the gold standard in 2024. Time to clean up your portfolio!

AI Whispers in Your Ear

AI is moving out of the back office and onto trading floors. Sophisticated algorithms can analyze alternate data sets, detect complex patterns, and generate insights beyond human capacity. Coupled with automation, AI is becoming a trusted advisor – and profit generator – for investors small and large.

The AI Equation:

$$Accuracy + Speed + Scalability = Returns$$

In 2024, look for AI penetrating further across the financial ecosystem. Portfolio managers, analysts, bankers, and traders alike will increasingly rely on machine learning to enhance decision making. Just imagine what investment outcomes are possible when AI’s predictive powers meet human creativity and ethics. A match made in heaven!

The Real Estate Revolution

Proptech innovations are disrupting property markets from the ground up. With blockchain tokenizing real estate assets and VR enabling virtual open houses, barriers to entry are vanishing. Meanwhile, fractional investment models are opening the doors to small-scale landlords and globetrotting real estate tycoons alike.

Unlocking Real Estate:

| Feature | Benefit |

|---|---|

| VR Tours | Enables remote visibility |

| Blockchain Tokens | Allows fractional ownership |

| Proptech Startups | Increase efficiency and sustainability |

As promising proptech startups secure more venture capital interest, expect 2024 to cement technology-driven disruption in real estate. With flexibility and accessibility for all, the property revolution has arrived!

Cybersecurity Fort Knox

Digital transactions are becoming ubiquitous across banking, investing, and financial services. But with digital acceleration comes increased vulnerability. A single breach can cripple foundations of trust and security critical for market stability.

That’s why cybersecurity is set to dominate boardroom agendas in 2024. Expect financial institutions to invest heavily in data protection infrastructure and cyber insurance hedge funds against digital threats. In an industry built on confidentiality, we’ll all sleep better knowing our financial Fort Knox stands guard.

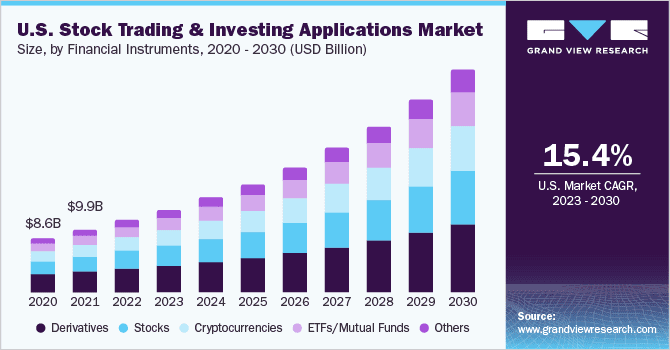

The Rise of the Retail Revolutionaries

Move over Wall Street – the retail traders are here to shake things up! Social media groups have enabled swarms of small-scale investors to move markets, while brokerage apps like Robinhood have democratized access. We’re witnessing an irreversible transfer of power to the people.

Trading in Your Pocket:

Data Source: Business of Apps

While the suits cling to antiquated notions that retail traders are reckless and volatile, the evidence contradicts those claims. In 2024 and beyond, the retail revolution promises to disrupt the old guard, bringing accessibility, creativity, and some much-needed millennial swagger to the table!

The Great Automation Showdown

Like it or not, robotics and intelligent automation are infiltrating finance. As AI and machine learning handle data-intensive tasks far faster than humans, redundancies seem inevitable. Repeatable manual processes in accounting, lending, claims management and more will be prime automation targets.

But while robots excel at rules-based execution, human strengths like strategy, creativity and emotional intelligence remain unmatched. Rather than a wholesale takeover, a collaboration between automated systems and human specialists is more likely. As processes transform, those who learn the most valuable complementary skills will stay ahead. The robots are coming – it’s time to decide where you stand!

The Data Deluge

Data is the lifeblood of finance. As customer analytics, market datasets and IoT sensors grow exponentially, so too do the opportunities to derive actionable insights. Already, AI and big data are combining to improve creditworthiness assessments, predict stock fluctuations, flag insurance fraud rings, and more.

With data as an indispensable asset, expect substantial investment across data science, analytics and business intelligence in 2024. Leaders will be distinguished by their ability to sift signal from overwhelming noise. Those who can smartly collect, interpret and activate data will have a competitive edge for years to come.

The Rise of Fintech Superpowers

The lines between financial sectors continue to blur. Fintech disruptors are rapidly moving beyond core offerings to build expansive ecosystems. The super-app dream promises banking, investment, insurance and advisory services in one seamless package.

While early efforts have focused on front-end convergence, backend integrations will ramp up to match ambitions. As open APIs and microservices enable specialization across groups, the most complete, client-centric experience will rule the roost. Customer retention and growth will hinge on simplicity through consolidation. Players not evolving into comprehensive fintech ecosystems risk extinction!

The Human-AI Tango

AI is transforming finance, but the most effective solutions put technology in service of users’ needs.. Rather than all-out automation, the ideal balance lies in collaborative intelligence – combining lightning-fast data processing with human judgment, ethics and emotional engagement.

The Best of Both:

| AI | Human |

|---|---|

| Data analysis | Strategy |

| Pattern recognition | Creativity |

| Tireless computation | Ethics |

| Predictive power | Empathy |

In 2024, look for tools that play to the strengths of both sides. Unique human skills will be augmented but not replaced. By putting people first, financial firms can deploy AI as a friendly partner in a mutually beneficial tango towards progress!

The Globalization Gamble

Economic interdependence across borders continues intensifying. For investors and institutions seeking portfolio diversification, emerging and frontier markets offer exciting potential returns boosted by young demographics and rising participation.

But cross-border complexity brings uniquely local risks too – from policy changes to transparency concerns. Those expanding globally must intimately understand specific regulatory standards, cultural nuances and due diligence requirements.

In 2024 regulatory bodies will demand more disclosures as watchdogs grow wary of threats to domestic stability from abroad. Global finance veterans able to skillfully navigate diversification opportunities without heightening exposure will be richly rewarded. But there are no guarantees – prepare for turbulence!

The Subscription Tsunami

The subscription model has disrupted media, software, transportation – and now it’s coming for finance. Products from crypto trading bots to financial planning advisors are shifting to flexible subscription packages. Pay-as-you-go convenience makes specialized services more accessible for clients.

But auto-renew functionality poses risks of “stacking” too many ongoing subscriptions absent continual optimization. And flexibility is a double-edged sword – the freedom to cancel any time obscures the critical importance of long-term financial planning.

In 2024 anticipating this tension, look for hybrid models with bundles that encourage retention savings and personalized advice anchoring users. Subscriptions may prove sticky for publishers, but financial health depends on consistency and commitment. Smart products will nurture those values while maintaining flexibility.

External Link

For more on future finance trends, check out the World Economic Forum Outlook.

Hope you enjoyed this optimistic outlook for the finance trends to watch in 2024! The winds of change promise accessibility, sustainability, and innovation for all. Here’s to a bright future ahead! What trend are you most excited by? Let me know in the comments.