When the Oracle of Omaha speaks through his actions, the investment world listens. Warren Buffett, renowned for his “buy and hold forever” philosophy, has recently undertaken a significant shift in his investment strategy that’s sending shockwaves through the financial markets. As a professional investor who has studied Buffett’s moves for years, I believe his current actions paint a concerning picture of what lies ahead.

Buffett’s Core Philosophy and the Surprising Deviation

Warren Buffett’s investment philosophy has always been crystal clear. As he famously stated, “The best thing to do is to buy stock that you never ever want to sell.” This buy-and-hold strategy has been the cornerstone of his spectacular success, helping him build Berkshire Hathaway into a $785 billion powerhouse.

“The only reason I would sell something would be if I lost confidence in the business or the management or if it became dramatically overpriced and that does not happen very often.” – Warren Buffett

Yet, recent months have witnessed a dramatic departure from this fundamental principle. [Check Berkshire Hathaway’s latest 13F filings] reveal substantial reductions in long-held positions across various sectors.

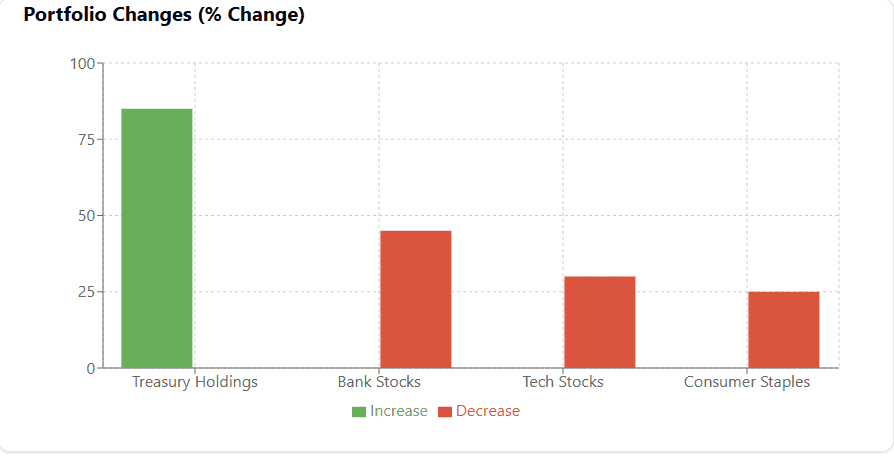

Understanding the Treasury Pivot

Perhaps the most telling aspect of Buffett’s recent strategy isn’t just what he’s selling – it’s where he’s redirecting the capital. The Oracle has been systematically moving billions into short-term Treasury bonds, a defensive position that speaks volumes about his market outlook.

Let’s examine the historical context of similar moves:

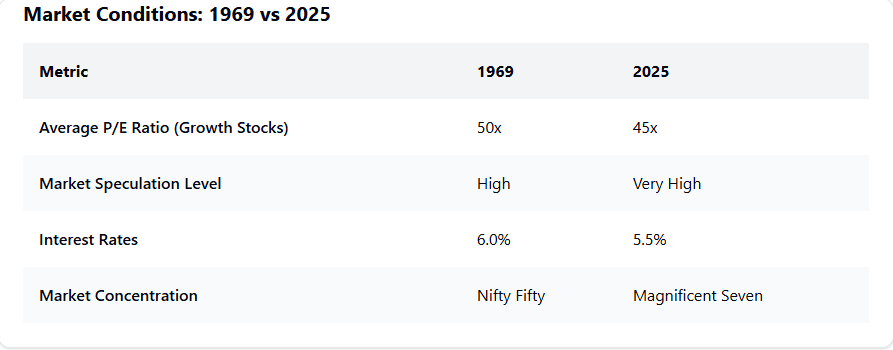

Historical Parallels: 1969 Redux

The year 1969 stands as a crucial reference point in understanding Buffett’s current strategy. That year, he made the unprecedented decision to close his investment partnership, citing:

- Excessive market speculation

- Unrealistic valuations of growth stocks

- The “Nifty Fifty” phenomenon

Today’s market bears striking similarities to that period:

Key Portfolio Changes and Their Implications

Buffett’s recent portfolio adjustments have been both substantial and strategic. Let’s analyze the most significant moves:

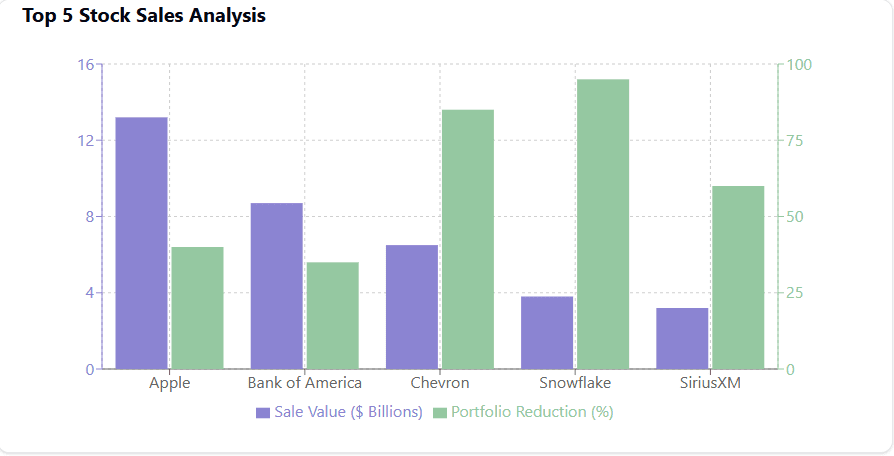

Analysis of Buffett’s Top 5 Strategic Exits

The magnitude and timing of Buffett’s recent stock sales provide crucial insights into his market outlook. Let’s examine the five most significant positions he has substantially reduced or eliminated:

Apple: A Strategic Reduction

The reduction in Berkshire’s Apple stake represents perhaps the most telling move. While maintaining Apple as the portfolio’s largest holding, Buffett has trimmed the position by approximately 40%, representing roughly $13.2 billion in sales. This measured reduction suggests not a loss of confidence in Apple’s business model, but rather a valuation concern. [Apple’s forward P/E ratio] has expanded significantly, potentially triggering Buffett’s “dramatically overpriced” criterion for selling.

Bank of America: Sector-Wide Concerns

The approximately 35% reduction in Bank of America holdings, valued at $8.7 billion, aligns with a broader pattern of reducing exposure to the banking sector. This move is particularly noteworthy given Buffett’s historical affinity for well-capitalized banks. The decision likely reflects concerns about:

- The impact of sustained higher interest rates on bank balance sheets

- Potential regulatory changes in the banking sector

- Commercial real estate exposure risks

Chevron: Energy Sector Exit

The dramatic 85% reduction in Chevron holdings, totaling approximately $6.5 billion, represents a significant shift in Berkshire’s energy sector exposure. This move is particularly interesting given:

“When we find a company we like, we prefer to buy all of it.” – Warren Buffett

The substantial exit from Chevron suggests Buffett may see structural changes in energy markets that could impact long-term profitability.

Snowflake: The Tech Rotation

The near-complete exit from Snowflake (95% reduction, approximately $3.8 billion) stands out as it represents one of Berkshire’s rare ventures into high-growth technology stocks. The sale likely reflects:

- Valuation concerns in the tech sector

- A return to Buffett’s traditional value investing principles

- Potential concerns about the sustainability of growth rates in the cloud computing sector

SiriusXM: Media Landscape Changes

The 60% reduction in SiriusXM holdings, valued at approximately $3.2 billion, reflects Buffett’s assessment of changing dynamics in the media and entertainment landscape. This sale suggests concerns about:

- Increasing competition in the audio entertainment space

- The impact of streaming services on traditional business models

- Potential technology disruption risks

Pattern Recognition: What These Sales Tell Us

When analyzed collectively, these five major sales reveal a clear pattern in Buffett’s current investment thinking:

- Valuation Discipline: Each sale involves companies trading at elevated multiples compared to historical averages

- Sector Rotation: A clear move away from technology, banking, and traditional energy sectors

- Risk Management: Reducing exposure to sectors facing potential structural changes or increased competition

This pattern aligns with Buffett’s historical tendency to reduce exposure when he sees market conditions deteriorating, similar to his actions in 1969.

The Treasury Strategy Decoded

Buffett’s shift toward Treasury bonds isn’t merely a defensive play – it’s a strategic positioning that suggests several key insights:

- Market Valuation Concerns: The move indicates that Buffett sees current market valuations as unsustainable.

- Liquidity Premium: Short-term Treasuries offering 5%+ yields provide both safety and flexibility.

- Dry Powder Strategy: Building a war chest for future opportunities when valuations become more attractive.

Three Critical Warning Signs

1. The Growth Stock Premium

Today’s market shows concerning parallels to the Nifty Fifty era. Just as investors in 1969 believed certain growth stocks deserved infinite premiums, today’s “Magnificent Seven” command extraordinary valuations based on similar assumptions.

“Price is what you pay. Value is what you get.” – Warren Buffett

2. Market Speculation Levels

The proliferation of retail trading, cryptocurrency speculation, and AI-driven investment hype bears striking similarities to the speculation Buffett observed in 1969. The key difference? Today’s speculation is amplified by technology and social media.

3. The Interest Rate Environment

The current interest rate environment creates a unique dynamic where:

- Treasury yields offer attractive risk-free returns

- Higher rates pressure growth stock valuations

- The cost of capital impacts corporate profitability

What This Means for Investors

Buffett’s actions suggest several key takeaways for investors:

- Valuation Discipline: The importance of maintaining strict valuation criteria

- Liquidity Value: The strategic advantage of maintaining dry powder

- Patience Premium: The benefit of waiting for better opportunities

Looking Ahead: The Buffett Playbook

Historical analysis suggests that when Buffett takes defensive positions of this magnitude, significant market opportunities often follow within 18-24 months. His current positioning might indicate he’s preparing for a similar scenario.

Strategic Considerations

For investors looking to align their strategy with Buffett’s current positioning, consider:

- Portfolio Review: Evaluate holdings against strict valuation criteria

- Cash Position: Consider increasing liquidity for future opportunities

- Risk Management: Implement appropriate hedging strategies

Conclusion

Warren Buffett’s recent portfolio actions represent more than just routine rebalancing – they signal a significant shift in market outlook from one of history’s most successful investors. While this doesn’t necessarily predict an immediate market correction, it suggests that maintaining valuation discipline and preparing for opportunities ahead may be prudent.

Remember Buffett’s wisdom: [Investment success] comes not from buying good things, but from buying things well. His current moves suggest he’s preparing to do exactly that – when the time is right.

Disclaimer: This analysis represents personal opinions and should not be considered financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.