In an era of increasing natural disasters and economic uncertainty, the stability of home insurance companies has never been more crucial. Yet, many homeowners remain unaware of the devastating consequences that could unfold if these financial safeguards were to collapse. This comprehensive analysis explores the potential domino effect of insurance company insolvency and what it means for millions of homeowners across the nation.

Understanding Insurance Company Insolvency

Insurance company insolvency occurs when an insurer lacks sufficient funds to meet their financial obligations to policyholders. Unlike traditional bankruptcies, insurance insolvency presents unique challenges due to the nature of insurance as a promise of future protection.

“Insurance is the backbone of modern risk management. When insurance companies fail, they don’t just impact their immediate customers – they create ripples throughout the entire economic system.” – Dr. Sarah Matthews, Financial Risk Analysis Expert

Key Factors Leading to Insurance Insolvency

Several critical factors can contribute to insurance company cash shortages:

- Natural Disaster Clusters

- Economic Downturns

- Poor Risk Management

- Investment Portfolio Failures

- Regulatory Changes

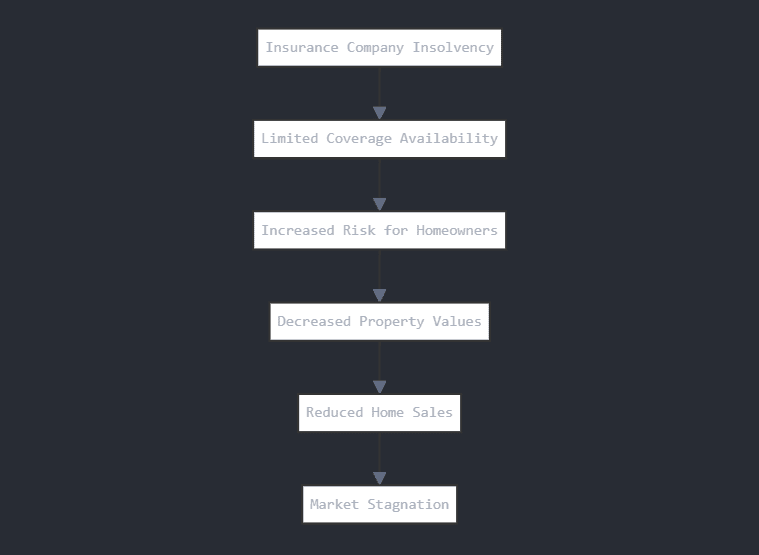

The Immediate Impact of Insurance Insolvency

When insurance companies face cash shortages, the effects cascade through multiple layers of society. Let’s examine the immediate consequences:

Claims Processing Disruption

The most immediate impact of insurance insolvency affects pending claims. Homeowners with active claims might find themselves in a particularly vulnerable position:

| Claim Status | Likely Outcome | Recovery Timeline |

|---|---|---|

| Pending | Frozen/Delayed | 6-12 months |

| In Process | Partial Payment | 3-6 months |

| New Claims | No Coverage | Immediate |

Property Value Implications

The relationship between insurance availability and property values is intricate and significant:

Long-term Consequences for Homeowners

Financial Security Erosion

The long-term implications of insurance insolvency extend far beyond immediate claim issues. Homeowners face multiple challenges:

- Mortgage Compliance Issues

- Most mortgages require continuous insurance coverage

- Default risks increase

- Limited refinancing options

- Property Maintenance Challenges

- Reduced ability to address repairs

- Increased vulnerability to future damage

- Growing maintenance backlogs

Market Availability Crisis

When major insurers face cash shortages, the entire market experiences disruption:

- Reduced competition

- Higher premiums

- Stricter underwriting requirements

- Coverage gaps

The Ripple Effect Through the Economy

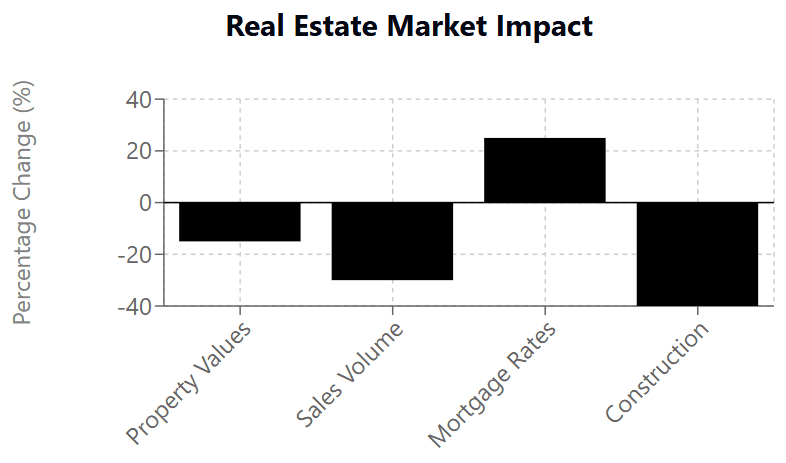

Real Estate Market Impact

The real estate market would face significant challenges:

Banking Sector Stress

The banking sector’s exposure to real estate makes it particularly vulnerable to insurance industry problems:

- Increased mortgage defaults

- Higher lending risks

- Stricter lending requirements

- Reduced property investment

Protective Measures and Solutions

Government Intervention

State and federal governments typically maintain safety nets for insurance failures:

- State Guaranty Associations

- Coverage limits

- Claim prioritization

- Fund management

- Federal Oversight

- Regulatory reform

- Market stabilization measures

- Consumer protection

Consumer Protection Strategies

Homeowners can take several steps to protect themselves:

“Diversification isn’t just for investments – it’s crucial for insurance protection as well. Understanding your coverage options and maintaining emergency funds are essential safeguards.” – Michael Chen, Consumer Protection Advocate

Alternative Insurance Models

Emerging Solutions

The industry is exploring innovative alternatives:

- Peer-to-peer insurance networks

- Parametric insurance products

- Hybrid coverage models

- Community insurance pools

Technology’s Role

Modern technology offers new approaches to risk management:

Regulatory Reform and Market Stability

Strengthening the System

Recent events have prompted calls for regulatory reform:

- Enhanced Capital Requirements

- Higher reserves

- Stress testing

- Regular audits

- Market Transparency

- Public reporting

- Risk disclosures

- Performance metrics

Global Perspectives and Lessons

International Case Studies

Looking at international examples provides valuable insights:

| Country | Crisis Year | Recovery Method | Timeline |

|---|---|---|---|

| Japan | 2011 | Government Intervention | 3 years |

| Australia | 2001 | Market Consolidation | 2 years |

| UK | 2008 | Regulatory Reform | 5 years |

Preparing for the Future

Individual Action Plans

Homeowners should consider several protective measures:

- Documentation

- Regular property assessments

- Detailed inventory records

- Maintenance logs

- Financial Planning

- Emergency funds

- Coverage reviews

- Alternative protection methods

Research and Expert Opinions

Academic Perspectives

Recent studies highlight concerning trends:

“The frequency of extreme weather events, combined with economic volatility, creates unprecedented challenges for the insurance industry. Traditional models may need complete reconstruction.” – Prof. James Wilson, Insurance Economics Department, Stanford University

Industry Expert Insights

Leading professionals suggest various solutions:

- Market Reforms

- Risk-sharing mechanisms

- International reinsurance

- Technology integration

- Consumer Education

- Understanding coverage

- Risk management

- Financial planning

Bottom Line

The potential collapse of home insurance companies represents a serious threat to financial stability and homeowner security. While the scenario may seem unlikely, understanding the risks and preparing for possibilities is crucial. Through proper planning, regulatory oversight, and market innovation, we can work toward a more resilient insurance system.

Additional Resources

For more information, consider these valuable resources:

- [National Association of Insurance Commissioners]

- [Federal Insurance Office]

- [Consumer Financial Protection Bureau]

- [Insurance Information Institute]

For more content, check out the following reads:

- Why the 30/30/3 Home Buying Rule is a Game-Changer for Smart Home Buyers in Today’s Market

- The Hidden Pitfalls of Homeownership: Why Homeowners Are Struggling to Afford Monthly Expenses

About the Author: This comprehensive analysis was prepared using data from multiple sources, including government reports, academic studies, and industry experts. For the most current information, please consult with insurance professionals and financial advisors.