Having strong credit opens doors that would otherwise remain closed. It empowers you to reach new financial heights and pursue your biggest dreams – from buying a home to starting a business.

But for many people, credit seems confusing or intimidating. Where do you begin when you have little or no credit history? How do you go from creditworthiness to exemplary credit? This blog post breaks it down into simple, actionable steps.

Understanding Credit Scores and Reports

Before diving into building credit, it helps to understand precisely what a credit score and credit report measure.

What is a Credit Score?

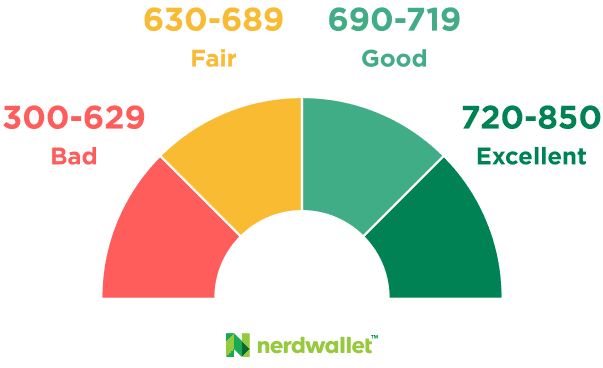

A credit score is a three-digit number ranging from 300-850 that indicates your “creditworthiness” or likelihood of repaying debts. Many lenders use credit scores to decide whether to approve financing for things like credit cards, auto loans, or mortgages.

In general, the higher your score, the better interest rates and loan terms lenders will extend. A “good” credit score typically starts in the mid-600s, while 750+ is considered excellent.

Credit score ranges via NerdWallet

What is in a Credit Report?

Your credit report provides the data used to calculate your score. Think of it as your financial report card spanning your history of borrowing money and paying debts.

Credit reports include several critical pieces of information:

- Identification details – Name, address, Social Security Number, birthdate.

- Credit history – All accounts where you borrowed money (credit cards, loans, etc.), credit limits, opening/closing dates, status (open/closed), payment history.

- Hard inquiries – Record of businesses that obtained your credit report to decide whether to extend financing.

- Public records – Bankruptcies, foreclosures, wage garnishments, etc.

The three major consumer credit bureaus – Experian, Equifax and Transunion – each maintain credit reports. While the data in your reports at each bureau should be nearly identical, small differences can result in varying credit scores.

Building Credit from Scratch in Easy Stages

If you have minimal credit history, the task of building your score can seem daunting. But have hope – with some diligence and responsible financial habits, you can establish strong credit in time.

Follow these steps to launch from no credit to 850:

Step 1: Apply for a Secured Credit Card

With no prior credit history, a secured credit card is often the easiest first card to qualify for. Secured cards require an upfront security deposit that acts as collateral if you default on payments later. As you demonstrate responsible usage over time, the card may graduate to an unsecured line of credit and refund your deposit.

Some top secured card options include:

“Taking the first step and opening my first secured card was scary. But within two years of diligent payment history I qualified for rates and rewards cards I never imagined possible early on.”

Step 2: Use Responsibly and Pay Balances in Full Each Month

Once approved for a starter card, using it responsibly is critical. Best practices include:

- Spend below 30% of your total limit – Using more leads issuers to see higher “credit utilization” indicating risk.

- Never miss payments – Payment history is the biggest factor influencing scores. Set up autopay to avoid issues.

- Pay statement balances in full – Balances carrying over month-to-month accrue interest charges and increase utilization.

Follow these habits with your first card for six months to start establishing positive history. Check your credit reports via AnnualCreditReport.com to ensure your details and history are being accurately reported.

Step 3: Expand to Additional Credit Lines

As your credit foundation strengthens, look to diversify your types of credit over the next six months. Applying for installment loans – like small personal loans from the likes of Upstart or Lightstream – or retail credit cards can continue enhancing your credit mix.

Be cautious not to overextend with too much available credit at once. Hard inquiries from a flurry of applications can temporarily ding scores as well. Consider spacing new account openings every three months or so.

Step 4: Open First Rewards Credit Card

Within your first year of responsible credit usage, you may qualify for your first rewards credit card – an exciting milestone! Consider products like the:

- Chase Freedom Flex – Earns 5% cashback or Ultimate Rewards points on rotating quarterly categories.

- Citi Double Cash – Straightforward 2% back on all purchases, 1% when you buy plus 1% when you pay.

- Bank of America Customized Cash Rewards – 3% category like gas or dining of your choice, intro 0% APR offer.

As your available credit and income rise while managing existing lines responsibly, more lucrative cards become within reach.

Step 5: Achieve Credit bliss

Within two to three years of diligent credit management, your score should exceed 700, considered “very good” credit. With this score range you become eligible for top-tier credit cards boasting lucrative travel rewards, statement credits, bonus categories, and perks like airport lounge access. Maintaining good financial habits makes excellent credit sustainable long-term.

Some aspirational credit card targets include:

- Chase Sapphire Reserve – Premium travel rewards like $300 annual travel credits and 50% point redemption bonuses.

- Citi Premier Card – 60,000 point welcome bonus worth $750 in travel.

- U.S Bank Altitude Reserve Visa Infinite – Up to $400 in annual travel statement credits and 50,000 welcome points.

Reaching this credit card echelon, you gain financial power to travel the world in style for less or finance milestone expenses. Enjoy your just rewards for long-term diligence!

While the foundation remains steady for financial habits over time, realizing excellent credit need not take endless years. Strategic first card applications, diligently keeping utilization and payments in check, and periodically expanding credit lines can help progress from credit-less to 850 within just a few years.

Tempted to learn more? Check out these popular blog posts:

- The Power of Credit: Your Passport to Financial Freedom

- Unleashing the Power of Credit: From Rock Bottom to Sky-High Success

Stay tuned for more tips and advice to master your money!

Note: This blog post is written by a professional trader and investor based on personal experiences and opinions. It is not intended as financial advice. Always conduct your own research and consult a financial advisor before making any financial decisions.