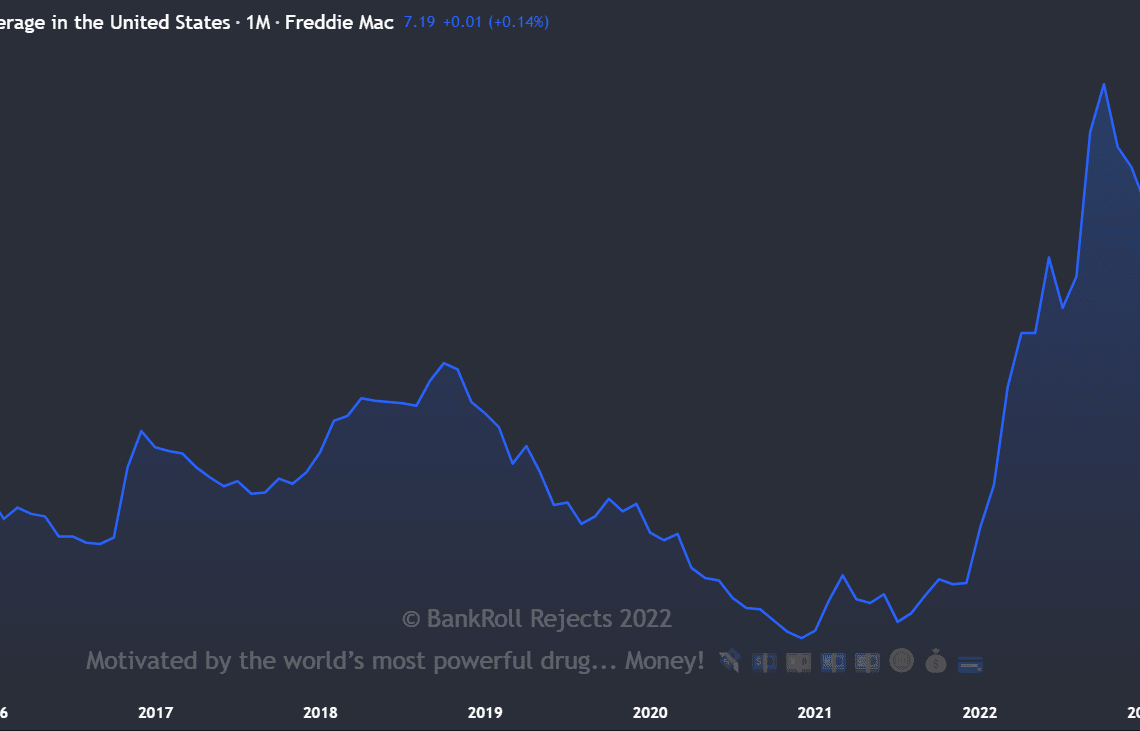

The Federal Reserve has been aggressively raising interest rates in 2022 to fight inflation. After keeping rates near zero for years during the pandemic, the Fed has hiked rates multiple times this year, causing mortgage rates to spike to their highest levels since 2008.

This seismic shift in interest rate policy is already starting to reverberate through the real estate market. As mortgage rates rise, they dampen demand among homebuyers and investors. Meanwhile, with the cost of borrowing increasing, real estate financing is getting pricier.

Together, these forces will reshape the housing market in the months and years ahead. In this blog post, we’ll analyze the major ways that rising interest rates are impacting different real estate sectors.

Home Sales Are Slowing as Affordability Declines

Rising interest rates are having a significant impact on the real estate market in 2023. As mortgage rates increase, it becomes more expensive to buy a home, which is leading to a slowdown in demand.

Here are some of the specific ways that rising rates are affecting home sales:

- Plunging existing home sales: According to the National Association of Realtors, home sales fell 15.1% in July 2023 from the previous month, and are down 20.2% from a year ago. This is the largest monthly decline in home sales since 2008.

- New home sales slump: New home sales fell 12.6% in July 2023, reaching the lowest sales pace since early 2016. Supply chain issues and high construction costs continue hampering builders.

- Affordability squeeze: With mortgage rates rising faster than incomes and home prices, monthly payments have become increasingly unaffordable for buyers. According to Redfin, around 40% of potential homebuyers are now priced out of the market.

- Larger down payments: To offset higher rates, many buyers are making larger down payments. According to the Mortgage Bankers Association, the average down payment on a home purchase in July 2023 was 22%, up from 20% a year ago.

This slowdown in home sales shows how rising rates reduce buyers’ purchasing power. But the market remains relatively healthy, with low unemployment and strong demand for housing.

Home Price Growth Moderating

While home prices are still up overall from a year ago, the rapid pace of appreciation is slowing down:

- Smaller price gains: The median home price in July 2023 was $413,800, up 10.8% from a year ago. However, this is the smallest annual gain since February 2020, showing growth decelerating.

- Regional disparities emerging: Some pandemic boom cities like Phoenix and Tampa are seeing steeper slowdowns, while prices remain resilient in undersupplied markets like San Francisco and Miami. This marks a reversal from the nationwide frenzy of 2021.

- Affordability ceiling: With mortgage payments skyrocketing, buyers have limited wiggle room on prices. This “affordability ceiling” will likely cap excessive price growth in coming months. According to Realtor.com, 65% of listed homes have cut prices in the past four weeks.

Moderating home price appreciation reflects easing demand. While rates remain elevated, buyers will regain negotiating power. But a full-on housing crash still appears unlikely given the supply shortages.

Inventory Relief Coming, But Will Take Time

The ultra-lean housing inventory has exacerbated imbalances between buyers and sellers. But rising rates could gradually improve the supply picture:

- Investor pullback: With lower returns, real estate investors may sell off speculative properties. Redfin notes that investors bought just 28% of homes in July 2022, down from a peak of 33% earlier this year.

- More existing homeowners selling: An August 2022 Realtor.com survey found that around 60% of homeowners plan to list their home within 18 months if rates keep rising. This “rate shock” response could unlock fresh supply.

- Price growth moderation: As bidding wars fade, more homeowners may opt to list before appreciation stalls further. But prices need to show sustained declines to really get sellers off the fence.

- New construction still slow: While permits and starts have fallen this year, new supply remains constrained by construction delays, labor shortages, and high costs. Existing inventory will still lead any near-term improvement.

Inventory relief would help restore balance between buyers and sellers. But after years of underbuilding, analysts caution it will take sustained patience for the housing shortage to fully correct.

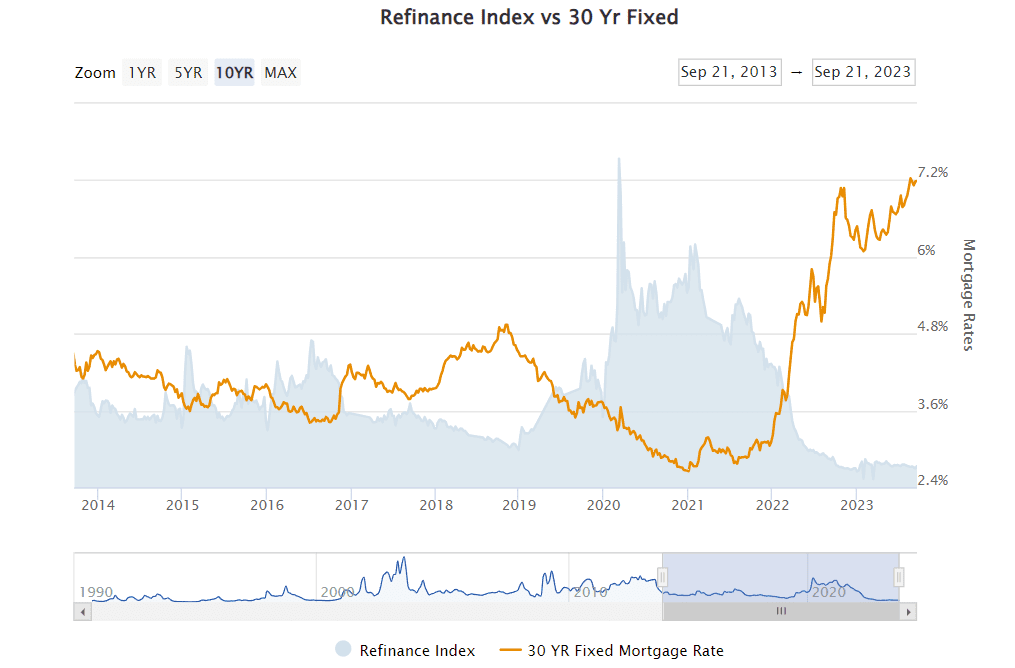

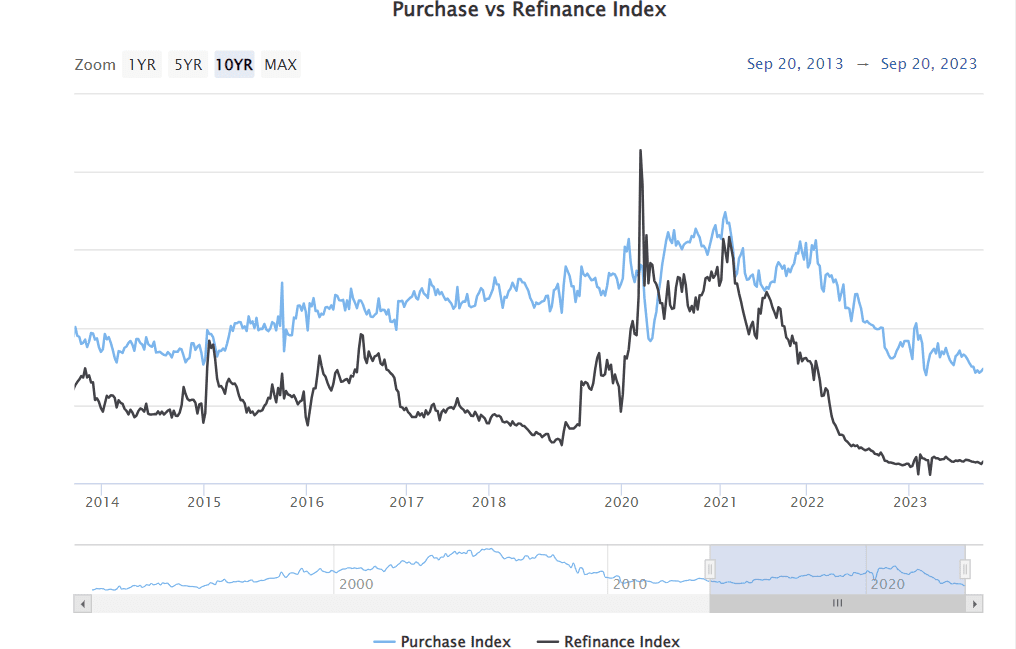

The Refinancing Wave Recedes

With rates plunging last year, refinancing surged to record levels as homeowners rushed to cut rates and tap equity. But rising rates have now shut off this lending spigot:

- Refi activity plunges: As the two charts above shows, refi applications were down 82% year-over-year in August 2022. With rates above 6%, only a fraction of homeowners can still benefit from refinancing.

- Tappable equity shrinks: Many homeowners are now locked out of cash-out refis. According to Black Knight, the number of mortgage holders with at least 20% tappable equity fell by over 40% from 2021 to 2022 as rates rose.

- Consumer spending impacted: In 2021, there were over $5 trillion in refi originations providing excess household cash. But Fannie Mae expects this number to plunge to just $870 billion in 2022 as the tide turns.

With fewer homeowners able to tap equity, this is one less tailwind for the housing sector. But the refi wave was always destined to fade at some point as rates normalized.

Commercial Real Estate Market Faces Choppy Waters

Rising rates are also causing turmoil in commercial real estate markets. Here are some of the key impacts:

- Lower property valuations: As cap rates rise with higher buyer borrowing costs, commercial valuations are declining. According to JLL, national cap rates could rise 25-75 basis points in 2023.

- Shift to shorter leases: To offset inflation, landlords are utilizing shorter 3-5 year leases rather than traditional 10 year terms. This increases volatility and cash flow uncertainty.

- Ongoing remote work headwinds: Depressed office and retail demand continues as remote work and e-commerce keep occupancies low. Per Kastle Systems, office utilization in major metros remains around just 50% of pre-pandemic levels.

- Transaction volume slowing: With higher financing costs and growing economic uncertainty, commercial real estate sales activity is declining. Through August 2022, sales volume was down 18% from the same period in 2021, per Real Capital Analytics.

While the commercial sector faces hurdles, some property types like multifamily and industrial remain resilient. But the days of easy credit and soaring asset values appear to be over.

Key Takeaways for Real Estate Market Participants

For both residential and commercial real estate, the market winds have decisively shifted as the era of historically low rates comes to a close. Here are some tips for navigating this rising rate environment:

For buyers: Be ready to make a larger down payment while shopping aggressively for the best mortgage terms. Maintain patience and be selective – don’t feel rushed into overpaying.

For sellers: Price accurately from the start by comparing recent comps. Don’t turn down reasonable offers while waiting for the “perfect” deal.

For investors: Prioritize defensive asset classes and markets with strong population and job growth. Scale back on speculative plays and high-leverage strategies.

For homeowners: If eligible to refinance, do so now before rates move higher. Or consider a cash-out refi to tap equity while still possible.

While the housing market is cooling from its feverish pandemic pace, discipline and savvy navigation can still pay off for many participants. By understanding the market impacts of rising rates, individuals can make smart moves even during uncertainty.

For a comprehensive tool to aid in your real estate ventures, consider leveraging BirdDogBot, the search engine tailored for discerning real estate investors.

For further insights into the dynamic world of real estate, explore our previous articles:

- The Power of Real Estate: Unlocking Cashflow Investment Opportunities

- The Illusion of Real Estate Ownership: Why You’ll Never Truly Own Property

- The Power and Pitfalls of Real Estate: Unveiling the Enigma of Quitclaim Deeds

Invest wisely, and let the currents of rising interest rates propel you towards prosperity.

Disclaimer: This blog post is intended for informational purposes only and does not constitute financial advice. Consult with a certified financial advisor before making any investment decisions.