The 2025 tax filing season is approaching rapidly, bringing significant changes that could impact your financial future. As someone passionate about personal finance and tax education, I’m excited to share essential insights to help you navigate these changes effectively. While I’m not a licensed financial advisor, I’ve thoroughly researched official IRS guidelines to bring you accurate, actionable information.

Disclaimer: This blog post is for educational purposes only and does not constitute professional financial or tax advice. Please consult with qualified tax professionals or financial advisors for advice specific to your situation.

Understanding the Revolutionary Digital Tax Landscape

The tax landscape is evolving dramatically, particularly in the digital realm. The IRS has expanded its digital capabilities to make filing easier and more secure than ever before. Here’s what you need to know about these transformative changes:

Digital Account Management: Your Gateway to Seamless Tax Filing

The IRS’s online portal has become increasingly robust. Create your IRS Online Account to access these powerful features:

| Feature | Benefit |

|---|---|

| Tax Return Access | View key details from recent returns |

| Identity Protection | Request IP PIN for enhanced security |

| Account Transcripts | Access wage and income records |

| Payment Management | View, make, and cancel payments |

| Notice Access | View over 200 IRS electronic notices |

| Language Preferences | Customize communication preferences |

Digital Asset Reporting: The New Frontier

Cryptocurrency and digital assets have become a central focus for the IRS. Let’s break down the key reporting requirements:

What Qualifies as a Digital Asset?

- Convertible virtual currencies

- Cryptocurrencies

- Stablecoins

- Non-fungible tokens (NFTs)

You must report digital asset transactions if you:

- Received assets as payment or rewards

- Sold or exchanged digital assets

- Had any financial interest in digital assets

Pro Tip: Keep detailed records of all digital asset transactions, including purchase prices, sale prices, and dates. This documentation is crucial for accurate tax reporting.

Smart Payment Strategies for Tax Season 2025

Estimated Tax Payments: The Secret to Avoiding Penalties

For those with non-traditional income sources, understanding estimated tax payments is crucial. Key dates and considerations:

| Quarter | Due Date | Income Types to Consider |

|---|---|---|

| Q4 2024 | Jan 15, 2025 | Self-employment |

| Unemployment benefits | ||

| Digital asset earnings | ||

| Annuity payments |

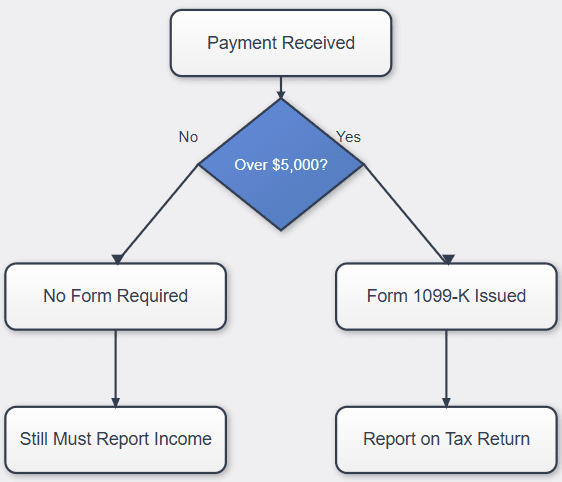

The Game-Changing 1099-K Reporting Update

A significant change for 2024 is the new $5,000 threshold for Form 1099-K. This affects:

- Online marketplace sellers

- Payment app users

- Gig economy workers

- Small business owners

Revolutionary Refund Optimization Strategies

Direct Deposit: The Fast Track to Your Refund

To maximize refund efficiency:

- Set up direct deposit with accurate banking information

- Options for those without traditional bank accounts:

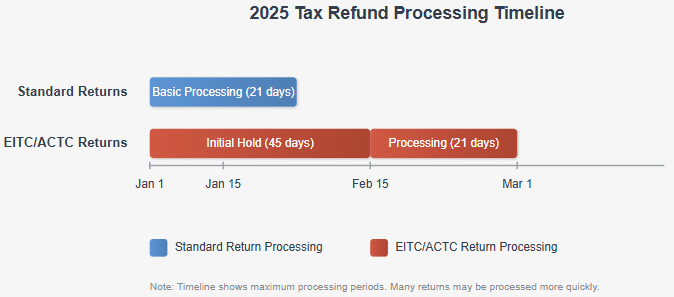

Understanding Refund Timing

Important factors affecting refund processing:

Smart Documentation Strategies for Success

Essential Document Checklist

Create a comprehensive filing system for:

| Document Type | Purpose | Deadline |

|---|---|---|

| W-2 Forms | Employment income | January 31 |

| 1099-MISC | Miscellaneous income | January 31 |

| 1099-K | Payment card transactions | January 31 |

| 1099-INT | Interest income | January 31 |

| Digital Asset Records | Cryptocurrency transactions | Ongoing |

Free Filing Resources: Maximizing Value

Take advantage of these cost-effective filing options:

- IRS Free File

- Available for 70% of taxpayers

- Brand-name tax software

- Completely free federal filing

- Direct File Program

- New IRS initiative

- Simple returns eligible

- State-specific availability

- VITA/TCE Programs

- Free preparation by IRS-trained volunteers

- Available for:

- Low-income taxpayers

- Elderly individuals

- Military personnel

Innovative Security Measures for 2025

Identity Protection PIN System

The IRS has introduced a game-changing security feature for 2025: The Identity Protection PIN (IP PIN). This six-digit number provides crucial protection against tax-related identity theft.

Breaking Update: Starting in 2025, the IRS will accept returns with duplicate dependent claims if the second return includes a valid IP PIN, potentially accelerating refund processing.

Digital Security Best Practices

Protect your tax information with these essential security measures:

- Regular password updates

- Multi-factor authentication

- Secure document storage

- Regular credit monitoring

- Prompt response to IRS notices

Strategic Planning for Special Situations

Digital Asset Transactions

For cryptocurrency and digital asset holders:

- Track all transactions meticulously

- Record fair market values in USD

- Document mining activities

- Monitor staking rewards

- Report NFT transactions

Gig Economy and Self-Employment

Special considerations for independent contractors:

- Track all income sources

- Document business expenses

- Maintain mileage logs

- Record home office expenses

- Track healthcare costs

Looking Ahead: Future-Proofing Your Tax Strategy

Emerging Trends in Tax Technology

The tax landscape continues to evolve with:

- Increased digital integration

- Enhanced security measures

- Simplified filing processes

- Improved taxpayer services

- Greater transparency

Building Long-Term Tax Efficiency

Consider these strategic approaches:

- Regular tax planning reviews

- Quarterly estimated payments

- Strategic timing of income/expenses

- Documentation system updates

- Professional consultation when needed

Your Action Plan for 2025

Success in the 2025 tax season requires proactive planning and attention to detail. Key takeaways include:

- Embrace digital tools and security measures

- Maintain comprehensive records

- Understand new reporting requirements

- Utilize available free resources

- Stay informed about changes and updates

Remember, while this guide provides valuable information, complex tax situations often benefit from professional guidance. Stay proactive, organized, and informed to navigate the 2025 tax season successfully.

What tax preparation steps are you taking for 2025? Share your thoughts and experiences in the comments below!

Remember to subscribe to our newsletter for more financial insights and tax preparation tips.