Understanding the Emergency Fund Crisis

In today’s volatile economic landscape, the stark reality is that 64% of Americans are living paycheck to paycheck. This troubling statistic underscores the critical importance of maintaining an emergency fund. Yet, traditional approaches to building these safety nets often fall short in our digital age.

“The best time to start an emergency fund was yesterday. The second best time is today.” – Financial Planning Institute

The Digital Emergency Fund Advantage

Modern technology has revolutionized how we can approach emergency fund building. By leveraging digital tools and automation, we can transform this crucial financial safety net from a daunting challenge into an achievable goal.

Key Benefits of Digital Emergency Funds

- Automated Savings

- Real-time Tracking

- Smart Goal Setting

- Intelligent Fund Allocation

- Enhanced Security Features

Emergency Fund Statistics: A Reality Check

Let’s examine current emergency fund statistics across America:

| Emergency Fund Coverage | Percentage of Population |

|---|---|

| 0-1 Month Expenses | 25% |

| 1-3 Months Expenses | 35% |

| 3-6 Months Expenses | 24% |

| 6+ Months Expenses | 16% |

Essential Digital Tools for Emergency Fund Building

1. Smart Banking Applications

Modern banking apps have evolved beyond simple balance checking. Ally Bank and SoFi offer specialized emergency fund features including:

- Automated round-up savings

- Goal-based savings buckets

- AI-powered spending analysis

- Real-time fund optimization

2. Dedicated Emergency Fund Apps

Several applications focus specifically on emergency fund building:

Digit analyzes your spending patterns and automatically saves appropriate amounts, while Qapital allows you to set specific rules for emergency fund contributions.

Strategic Implementation of Digital Emergency Funds

Setting Up Your Digital Foundation

- Choose a High-Yield Savings Account

- Look for FDIC insurance

- Compare APY rates

- Check for automatic transfer capabilities

- Review minimum balance requirements

- Configure Automation Settings

- Determine optimal transfer frequency

- Set up direct deposit splits

- Enable round-up features

- Configure alert thresholds

Optimizing Your Emergency Fund

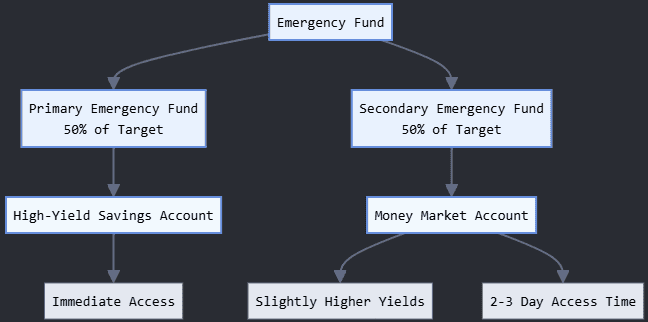

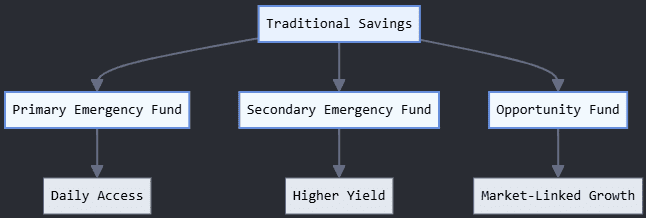

Smart Allocation Strategies

Modern digital tools enable sophisticated allocation strategies:

Leveraging Technology for Fund Growth

Automated Micro-Savings Features

Digital platforms offer various micro-savings capabilities:

- Round-Up Automation

- Every purchase rounded to nearest dollar

- Difference automatically transferred to emergency fund

- Average monthly contribution: $50-$150

- Income Skimming

- Automatic percentage-based transfers

- Customizable thresholds

- Real-time adjustment capabilities

Smart Monitoring and Alerts

Modern emergency fund management includes sophisticated monitoring:

- Balance threshold notifications

- Spending pattern alerts

- Goal progress tracking

- Market rate updates

Emergency Fund Calculator Integration

Empower and similar platforms offer emergency fund calculators that consider:

- Monthly expenses

- Income stability

- Dependent requirements

- Regional cost of living

- Industry volatility

Advanced Digital Emergency Fund Strategies

AI-Powered Optimization

Modern fintech platforms utilize artificial intelligence to:

- Predict optimal saving amounts

- Identify potential savings opportunities

- Adjust for seasonal spending variations

- Recommend reallocation strategies

Emergency Fund Protection Mechanisms

Digital Security Features

Modern emergency fund accounts include:

- Two-factor authentication

- Biometric verification

- Encryption protocols

- Fraud detection systems

Insurance and Backing

Ensure your digital emergency fund is protected by:

- FDIC insurance

- Bank guarantees

- Platform security measures

- Third-party auditing

Common Digital Emergency Fund Mistakes

Technology-Related Pitfalls

- Over-automation without monitoring

- Ignoring security updates

- Not backing up access credentials

- Failing to diversify digital platforms

Future of Digital Emergency Funds

Emerging Technologies

The future of emergency fund management will likely include:

- Blockchain integration

- Smart contract automation

- Predictive AI allocation

- Cross-platform synchronization

Implementation Timeline

30-Day Digital Emergency Fund Setup

Week 1:

- Research and select digital platforms

- Set up primary accounts

- Configure basic automation

Week 2:

- Implement security measures

- Connect multiple accounts

- Set up monitoring systems

Week 3:

- Fine-tune automation rules

- Establish backup procedures

- Test emergency access protocols

Week 4:

- Review and adjust settings

- Set up regular maintenance schedule

- Document access procedures

Measuring Success

Key Performance Indicators

Track these metrics using your digital platform:

- Monthly contribution consistency

- Growth rate versus targets

- Emergency fund adequacy ratio

- Liquidity maintenance levels

Educational Resources and Support

Digital Learning Platforms

Enhance your emergency fund knowledge through:

Coursera – Financial planning courses Khan Academy – Basic financial education Udemy – Specialized financial technology courses

Bottom Line

The digital revolution has transformed emergency fund building from a manual, often forgotten task into an automated, optimized process. By leveraging these digital tools and strategies, you can build and maintain a robust emergency fund that provides genuine financial security.

Remember, the key to success lies in:

- Choosing the right digital tools

- Setting up proper automation

- Maintaining regular oversight

- Adapting to changing circumstances

“Technology is not just a tool. It can give learners a voice that they may not have had before.” – George Couros

Start your digital emergency fund journey today and secure your financial future with the power of modern technology.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and should not be construed as financial advice. Every individual’s financial situation is unique, and decisions about emergency funds should be made in consultation with qualified financial professionals. The digital tools and strategies mentioned may change over time, and their effectiveness can vary based on personal circumstances, market conditions, and geographical location. Always conduct thorough research and due diligence before making any financial decisions or implementing automated savings strategies.