In the vast landscape of financial investments, few vehicles have captured the imagination, stirred controversy, and generated wealth quite like hedge funds. These sophisticated investment structures have evolved from humble beginnings to become titans of the financial world, wielding enormous influence over global markets and economies. This comprehensive exploration will delve into the fascinating history of hedge funds, their strategies, key players, and the ongoing debate about their role in modern finance.

The Birth and Evolution of Hedge Funds

The Genesis of Hedge Funds: A Revolutionary Idea

The story of hedge funds begins in 1949 with a visionary sociologist turned investor named Alfred Winslow Jones. Dissatisfied with traditional investment approaches, Jones conceived a revolutionary strategy that would forever change the landscape of finance. His innovative “hedged fund” combined two powerful techniques:

- Long-short equity strategy: Buying undervalued stocks while simultaneously short-selling overvalued ones.

- Leverage: Borrowing money to amplify potential returns.

This approach aimed to generate positive returns regardless of overall market direction, effectively “hedging” against market risk – hence the term “hedge fund.”

“I had the theory that you could make more money by avoiding losses than by targeting big profits.” – Alfred Winslow Jones

Jones’s fund outperformed traditional mutual funds by significant margins, attracting attention from Wall Street and beyond. His success laid the groundwork for what would become a multi-trillion dollar industry.

The Early Pioneers: Hedge Funds in the 1960s and 1970s

Following Jones’s breakthrough, the 1960s saw a proliferation of hedge funds. Key figures during this era included:

- George Soros: Founded the Quantum Fund in 1969, which would become one of the most successful hedge funds in history.

- Michael Steinhardt: Launched Steinhardt Partners in 1967, pioneering the use of short-term trading strategies.

The 1970s brought both challenges and innovations to the hedge fund world:

- Market volatility: The oil crisis and stagflation tested hedge fund strategies.

- Diversification: Funds began expanding beyond equities into bonds, commodities, and currencies.

- Regulatory scrutiny: The SEC began paying closer attention to these largely unregulated investment vehicles.

The Hedge Fund Mentality: Risk, Reward, and Sophistication

As hedge funds evolved, a distinct mentality emerged among managers and investors:

- Absolute returns: Unlike traditional funds benchmarked against market indices, hedge funds aimed for positive returns in all market conditions.

- Aggressive risk management: Sophisticated techniques to measure and control risk became paramount.

- Exclusivity: High minimum investments and limited transparency created an aura of exclusivity.

- Performance-driven compensation: The “2 and 20” fee structure (2% management fee and 20% performance fee) aligned manager and investor interests.

This mentality attracted both praise for its innovation and criticism for its perceived elitism and opacity.

The Rise of Quantitative Strategies

The late 1980s and 1990s saw the emergence of quantitative hedge funds, leveraging computer models and complex algorithms to identify market inefficiencies. Notable pioneers included:

- James Simons: Founded Renaissance Technologies in 1982, becoming one of the most successful quant funds in history.

- David Shaw: Launched D.E. Shaw & Co. in 1988, applying computational finance to trading strategies.

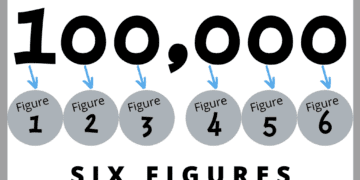

This table illustrates the growth of hedge fund assets under management (AUM) during key periods:

| Year | Estimated Global Hedge Fund AUM |

| 1990 | $39 billion |

| 2000 | $491 billion |

| 2010 | $1.92 trillion |

| 2020 | $3.87 trillion |

The explosive growth in AUM reflects the increasing acceptance of hedge funds as a crucial component of institutional and high-net-worth portfolios.

The Golden Age of Hedge Funds

Unprecedented Growth and Influence

The period from the late 1990s through the mid-2000s is often referred to as the “Golden Age” of hedge funds. During this time, the industry experienced explosive growth, both in terms of assets under management and influence on global financial markets.

Key factors contributing to this golden era included:

- Bull market conditions: Strong equity markets provided ample opportunities for long-short strategies.

- Increased institutional investment: Pension funds, endowments, and sovereign wealth funds began allocating significant capital to hedge funds.

- Globalization: Hedge funds expanded their reach into emerging markets and alternative asset classes.

- Technological advancements: Improved trading and risk management systems enabled more sophisticated strategies.

The Rise of Mega Funds

This period saw the emergence of “mega funds” with billions of dollars under management. Notable examples include:

- Bridgewater Associates: Founded by Ray Dalio, it became the world’s largest hedge fund.

- Citadel: Ken Griffin’s fund grew to become a multi-strategy powerhouse.

- SAC Capital: Steve Cohen’s fund was known for its aggressive trading strategies and exceptional returns.

“The biggest mistake that people make is to believe that what happened in the recent past is likely to persist.” – Ray Dalio

The 2008 Financial Crisis: A Turning Point

The 2008 global financial crisis marked a significant turning point for the hedge fund industry:

- Performance challenges: Many funds suffered substantial losses, challenging the notion of “absolute returns.”

- Liquidity issues: Some funds implemented gates and side pockets to manage redemptions.

- Regulatory scrutiny: The crisis led to increased regulation, including the Dodd-Frank Act in the US.

- Reputational damage: High-profile frauds, such as the Bernie Madoff scandal, tarnished the industry’s image.

The Modern Era: Challenges and Adaptations

Post-Crisis Landscape

In the aftermath of the 2008 crisis, hedge funds faced a new set of challenges:

- Low interest rates: Quantitative easing policies made certain strategies less profitable.

- Increased competition: The proliferation of funds led to crowded trades and reduced alpha.

- Fee pressure: Investors began demanding more favorable fee structures.

- Passive investing: The rise of low-cost index funds and ETFs challenged the value proposition of active management.

Adaptation and Innovation

To remain relevant, hedge funds have adapted in several ways:

- Diversification of strategies: Funds expanded into areas like private equity, real estate, and cryptocurrencies.

- Improved transparency: Many funds now offer more detailed reporting and risk disclosures.

- Technology integration: Advanced AI and machine learning techniques have become integral to many strategies.

- ESG focus: Increasing emphasis on environmental, social, and governance factors in investment decisions.

The Rise of Quants and Algorithmic Trading

Quantitative and algorithmic trading have become increasingly dominant in the hedge fund space:

- High-frequency trading (HFT): Firms like Virtu Financial have leveraged technology to execute trades in microseconds.

- Big data analysis: Funds are using alternative data sources to gain a competitive edge.

- AI and machine learning: These technologies are being used to identify patterns and make trading decisions.

Here’s a chart showing the growth of quantitative hedge fund strategies:

Assets Under Management ($ Billions)

^

|

1000 | ****

900 | *****

800 | *****

700 | ****

600 | ****

500 | ****

400 | ****

300 | ****

200 | ****

100 | ****

0 +-----+-----+-----+-----+-----+-----+-----+-----+---->

2010 2012 2014 2016 2018 2020 2022 2024 YearNotable Hedge Fund Managers and Their Legacies

Jim Cramer’s Hedge Fund Experience

Before becoming a prominent financial television personality, Jim Cramer co-founded the hedge fund Cramer Berkowitz in 1987.

- Strategy: Cramer employed a long-short equity strategy, often taking concentrated positions.

- Performance: The fund reportedly achieved average annual returns of 24% during its operation.

- Legacy: Cramer’s experience managing a hedge fund significantly influenced his later career as a financial commentator and host of CNBC’s “Mad Money“.

Warren Buffett’s Hedge Fund Roots

While Warren Buffett is best known for his leadership of Berkshire Hathaway, his early career included running what was essentially a hedge fund:

- Buffett Partnership, Ltd.: Established in 1956, this fund operated until 1969.

- Strategy: Value investing, focusing on undervalued securities.

- Performance: The partnership achieved a compound annual return of 29.5% before fees.

- Legacy: Buffett’s success with this partnership laid the groundwork for his later achievements and cemented his reputation as one of the greatest investors of all time.

Steve Cohen’s SAC Capital

Steve Cohen founded SAC Capital Advisors in 1992, which became one of the most successful and controversial hedge funds:

- Strategy: Employed a multi-strategy approach with a focus on aggressive trading.

- Performance: Reportedly achieved annual returns of about 30% over two decades.

- Controversy: In 2013, SAC pleaded guilty to insider trading charges and paid a $1.8 billion fine.

- Legacy: Despite the controversy, Cohen’s fund was known for its exceptional returns and influence on Wall Street trading culture.

Ken Griffin’s Citadel

Ken Griffin founded Citadel in 1990, which has grown into one of the largest and most successful hedge funds:

- Strategy: Multi-strategy approach, including quantitative trading, commodities, and fixed income.

- Performance: Citadel has consistently outperformed many of its peers, including during market downturns.

- Innovation: Known for its heavy investment in technology and quantitative strategies.

- Legacy: Griffin has become one of the wealthiest and most influential figures in finance, with Citadel playing a significant role in modern market structure.

The Hedge Fund Advantage: Why Investors Still Flock to These Vehicles

Despite challenges and controversies, hedge funds continue to attract significant capital. Here’s why many investors still see value in these sophisticated investment vehicles:

1. Potential for Alpha Generation

Hedge funds aim to generate alpha, or returns above what the market provides, through various strategies:

- Market-neutral strategies: Attempting to profit regardless of overall market direction.

- Event-driven investing: Capitalizing on corporate events like mergers or bankruptcies.

- Global macro: Taking positions based on macroeconomic trends.

2. Portfolio Diversification

Hedge funds can offer exposure to strategies and asset classes that are not easily accessible through traditional investments:

- Alternative assets: Including commodities, real estate, and private equity.

- Exotic derivatives: Complex financial instruments not available to retail investors.

- Emerging markets: Opportunities in developing economies.

3. Risk Management

Sophisticated risk management techniques are a hallmark of hedge funds:

- Hedging strategies: Protecting against downside risk.

- Dynamic asset allocation: Adjusting portfolios based on market conditions.

- Tail risk protection: Guarding against extreme market events.

4. Access to Top Talent

Hedge funds often attract some of the brightest minds in finance:

- Experienced portfolio managers: Many with proven track records.

- Quants and data scientists: Leveraging advanced analytics and AI.

- Industry specialists: Providing deep expertise in specific sectors.

5. Potential for Uncorrelated Returns

Hedge fund returns may have low correlation with traditional asset classes:

- Market-neutral strategies: Aiming for consistent returns regardless of market direction.

- Long-short equity: Potentially profiting in both bull and bear markets.

- Arbitrage strategies: Exploiting price discrepancies across markets.

This table illustrates the potential diversification benefits of hedge funds:

| Asset Class | Correlation with S&P) 500 |

| US Bonds | -0.3 |

| International Stocks | 0.8 |

| Hedge Funds | 0.5 |

| Real Estate | 0.6 |

| Commodities | 0.3 |

“The goal of a hedge fund is to maximize investor returns and eliminate risk. That’s not how the real world works.” – Daniel Loeb, founder of Third Point LLC

Criticisms and Controversies

Despite their potential benefits, hedge funds have faced significant criticism and controversy:

1. High Fees

The traditional “2 and 20” fee structure has been a major point of contention:

- 2% management fee: Charged annually on assets under management.

- 20% performance fee: Applied to profits above a certain threshold.

Critics argue these fees are excessive, especially when funds underperform.

2. Lack of Transparency

Many hedge funds operate with limited disclosure:

- Black box strategies: Proprietary algorithms and trading methods kept secret.

- Limited reporting: Less frequent and detailed than mutual funds.

- Valuation concerns: Difficulty in accurately pricing illiquid assets.

3. Regulatory Issues

Hedge funds have faced increased scrutiny from regulators:

- Insider trading: High-profile cases have tarnished the industry’s reputation.

- Systemic risk: Concerns about the impact of large hedge funds on market stability.

- Dodd-Frank Act: Increased reporting requirements and restrictions on bank investments in hedge funds.

4. Performance Concerns

Critics argue that many hedge funds fail to deliver on their promises:

- Underperformance: Some studies suggest the average hedge fund underperforms market indices.

- Survivorship bias: Failed funds are often excluded from industry performance data.

- Capacity constraints: As funds grow larger, it becomes harder to generate outsized returns.

5. Social and Economic Impact

Some critics argue hedge funds have negative societal impacts:

- Short-selling controversies: Accusations of manipulating markets or targeting vulnerable companies.

- Activist investing: Debates over whether activist hedge funds create long-term value or focus on short-term gains.

- Wealth inequality: Concerns that hedge funds primarily benefit the ultra-wealthy.

The Future of Hedge Funds

As the financial landscape continues to evolve, hedge funds are adapting to new challenges and opportunities:

1. Technological Innovation

- AI and Machine Learning: Increasingly sophisticated algorithms for trading and risk management.

- Big Data Analysis: Leveraging alternative data sources for investment insights.

- Blockchain and Cryptocurrencies: Exploring new asset classes and trading platforms.

2. Evolving Fee Structures

- Performance-aligned fees: More funds adopting hurdle rates and clawback provisions.

- Customized arrangements: Tailored fee structures for large institutional investors.

- Lower overall fees: Pressure to reduce fees in response to competition from passive investments.

3. Increased Regulation and Transparency

- Enhanced reporting: Greater disclosure to both investors and regulators.

- Operational due diligence: Increased focus on fund governance and risk management processes.

- ESG integration: Growing emphasis on environmental, social, and governance factors in investment decisions.

4. Democratization of Hedge Fund Strategies

- Liquid alternatives: Mutual funds and ETFs offering hedge fund-like strategies to retail investors.

- Digital platforms: Fintech solutions providing access to alternative investments.

- Hedge fund replication: Products aiming to mimic hedge fund returns at lower costs.

5. Global Expansion

- Emerging markets: Increasing focus on opportunities in developing economies.

- New financial centers: Growth of hedge fund hubs beyond traditional locations like New York and London.

- Cross-border strategies: Exploiting global market inefficiencies and regulatory arbitrage.

“The hedge fund industry will be here for a long time, but it will continue to evolve and adapt. The successful managers will be those who can innovate and deliver true alpha.” – David Swensen, former Chief Investment Officer of Yale University

Bottom Line

The hedge fund industry has come a long way since Alfred Winslow Jones’s innovative “hedged fund” in 1949. Through bull markets and bear markets, booms and busts, hedge funds have remained a controversial yet influential force in the global financial landscape.

While challenges persist – from fee pressures and regulatory scrutiny to performance concerns and technological disruption – the industry continues to attract significant capital and top talent. The future of hedge funds will likely be shaped by their ability to adapt to changing market conditions, leverage new technologies, and deliver value to investors in an increasingly competitive environment.

For investors considering hedge funds, careful due diligence and a clear understanding of both the potential benefits and risks are essential. As with any investment, hedge funds should be evaluated in the context of one’s overall financial goals, risk tolerance, and investment horizon.

As we look to the future, one thing is certain: the hedge fund industry will continue to evolve, innovate, and play a significant role in shaping global financial markets.

For more information on the current state and future trends of the hedge fund industry, visit the Alternative Investment Management Association (AIMA) website.

For more content, check out The Power of Hedge Funds: Unveiling the Top Managers and their Winning Strategies.

Disclaimer: The information provided in this blog post is for general informational and educational purposes only. It should not be construed as professional financial advice, investment recommendations, or a solicitation to buy, sell, or hold any securities or investments.

Important Points:

- Not Financial Advice: The content of this article does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

- Past Performance: Past performance of any investment, including hedge funds, is not indicative of future results. Investment returns and principal value will fluctuate, and investments may be worth more or less than the original invested amount when redeemed.

- Risk Warning: Hedge funds and alternative investments can be highly speculative and carry a high degree of risk. They are not suitable for all investors and may result in substantial or complete loss of invested capital.

- Accuracy of Information: While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained in this blog post.

- Third-Party Content: Any reference to third-party products, services, or websites is for informational purposes only and does not constitute an endorsement or recommendation.

- Regulatory Considerations: Hedge funds are subject to complex regulations that may vary by jurisdiction. Investors should be aware of the regulatory environment in their respective locations.

- Tax Implications: Investing in hedge funds may have significant tax implications. Readers are advised to consult with a tax professional regarding their individual circumstances.

- Updates and Changes: The hedge fund industry is dynamic and subject to rapid changes. Information presented here may become outdated quickly.

By reading this blog post, you acknowledge that you have read, understood, and agree to be bound by this disclaimer. If you do not agree with any part of this disclaimer, please refrain from using the information provided in this blog post for any purpose.

Your blog is a true gem in the world of online content. I’m continually impressed by the depth of your research and the clarity of your writing. Thank you for sharing your wisdom with us.