Building a diversified investment portfolio is key to growing your wealth over time. Many investors turn to mutual funds to help achieve diversification through a single investment. But are mutual funds a good choice for your hard-earned money?

In this comprehensive guide, we’ll explain exactly what mutual funds are, how they work, their pros and cons, and whether they may be a powerful addition to your investment strategy.

What Are Mutual Funds and How Do They Work?

A mutual fund is an investment vehicle made up of a pool of money collected from many investors for the purpose of investing in stocks, bonds, and other securities. The fund is overseen by a professional investment management firm.

Mutual funds allow you to invest your money alongside other investors to participate in a wider variety of investments than you could likely access individually.

Key Characteristics of Mutual Funds

- Mutual funds are operated by investment management companies like Vanguard, Fidelity, and American Funds. They research, select, and manage investment assets on behalf of the fund’s investors.

- When you invest in a mutual fund, you purchase shares that represent ownership in the fund and its underlying holdings. Each share is priced based on the fund’s per share net asset value (NAV).

- Mutual funds have a wide variety of investment objectives and strategies, such as growth stocks, dividends, bonds, etc. Review a fund’s prospectus to understand its approach.

- The major benefit mutual funds provide is instant diversification. Rather than purchasing individual assets yourself, mutual funds allow you to gain exposure to potentially thousands of securities through a single fund investment.

- Most mutual funds are actively managed, meaning managers actively research and select assets to buy and sell based on the fund’s strategy. Passively managed index funds track market indexes like the S&P 500.

- Mutual funds are generally more accessible to retail investors than other investments, requiring smaller minimum investments to get started. Many funds have initial minimum investments between $500-$3,000.

- Mutual funds pool together smaller investments from many contributors to purchase assets. This provides economy of scale benefits compared to individual investors buying assets directly.

While mutual funds provide diversification and professional management, those benefits come at a cost. Mutual funds charge investors various fees that serve to compensate the fund manager and third parties that support the operations of the fund.

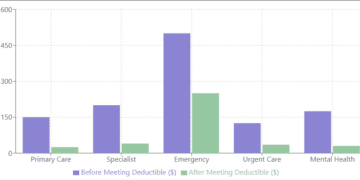

Mutual Fund Fees: Expense Ratios, Loads, and Transaction Fees

Understanding the fees charged by mutual funds is critical, as those fees directly impact your net investment returns over time. Let’s take a closer look at the common fees mutual fund investors pay:

Expense Ratios

This annual fee is charged as a percentage of your assets in the fund. Expense ratios typically range anywhere from 0.5% for passive index funds up to over 1.5% for actively managed funds.

The expense ratio serves to cover the fund’s operating costs, including:

- Portfolio manager and research team compensation

- Administrative costs for recordkeeping, accounting, and communicating with investors

- Marketing, distribution, and advertising costs

- Technology costs

- Regulatory compliance costs

- Custodian fees for holding the fund’s assets

- Accounting and auditing fees

- Legal fees

- Board of directors compensation

- Other overhead costs of operating the fund

The total expense ratio is deducted from the fund’s assets annually before performance is reported to shareholders. So these fees directly reduce your net gains. Expenses also get passed on in the form of lower dividends.

For example, if a fund has a 1% expense ratio and gains 10% for the year, after fees you would earn just 9%. Pay close attention to expense ratios when selecting funds, as high fees can seriously hinder long-term performance.

Sales Loads

Many mutual funds charge sales loads, which are commissions paid to brokers who sell fund shares. Sales loads serve as compensation to advisor networks like Morgan Stanley, Edward Jones, and other firms for distributing the fund’s shares.

Not all funds charge sales loads. No-load mutual funds do not charge commissions.

Funds that do assess sales loads will charge either a front-end load when you first purchase shares, or a back-end load if you sell shares within a certain time frame, such as 5-7 years.

Front-end loads typically range from 1% to 5% of your investment amount.

Back-end loads are charged if you sell shares before the minimum holding period, usually around 5% if shares are sold within the first year. These loads discourage short-term “timing” of mutual funds which increase transaction costs.

When considering a mutual fund investment, pay close attention to whether the fund charges front or back-end sales loads, as they can significantly impact your investment value.

Transaction Fees

Some mutual funds charge fees when you buy into or sell out of the fund to cover trading costs. These fees are traditionally smaller than sales loads, such as $10 – $15 per transaction.

Transaction fees serve to compensate the fund manager for costs to buy/sell securities as investors move money in and out of the fund. This helps offset expenses related to trading large fund positions.

Redemption Fees

These fees are charged specifically when an investor sells mutual fund shares prior to a minimum required holding period, such as 30-90 days.

Redemption fees are typically 1% to 2% and serve to discourage market timing activities which may increase the fund’s transaction costs and disrupt the managers’ investment strategies.

By understanding the various fees mutual funds charge, you can better evaluate the impact on your potential returns when selecting investments. Actively managed funds tend to have higher expense ratios, while index funds offer lower costs.

The Pros and Cons of Mutual Fund Investing

Now that you understand what mutual funds are and their fee structures, let’s examine some of the notable pros and cons of mutual fund investing:

Key Advantages of Mutual Funds

- Diversification – Mutual funds provide diversification across a broad group of individual stocks, bonds, and other securities. This helps reduce portfolio risk compared to owning just a handful of assets.

- Professional Management – Mutual fund managers and analysts actively manage fund assets. This can benefit hands-off investors who lack time for security analysis.

- Affordability – Investors can get started in mutual funds with relatively low minimum investments, often between $500-$3,000 initially. This allows even small investors to access professional management.

- Liquidity – It’s easy to buy into or sell out of mutual fund positions. No secondary market is required as with individual securities. Most trades settle in 1-3 days.

- Variety – Thousands of mutual funds exist covering various geographies, market caps, sectors, asset classes, and investment strategies to match any investor’s needs.

- Automation – Mutual fund investors can set up automatic recurring investments and reinvestment of dividends for hands-off discipline.

Potential Drawbacks of Mutual Funds

- Fees – As discussed earlier, mutual funds come with annual expense ratios, sales loads, transaction fees, and other expenses that eat into investor returns.

- Taxes – Mutual funds generate taxable capital gains when managers buy/sell positions. This can increase investors’ tax bills versus holding individual securities directly.

- No Control – You don’t have input on specific investment choices within a mutual fund. If you want control, investing in individual stocks/bonds may be preferable.

- Manager Risk – A fund’s success heavily depends on the skill and discipline of its investment team. Poor management can lead to underperformance.

- Minimums – Some funds require large initial investments of $50,000 or more. Others only allow institutional investors. This bars many individuals.

- Account Minimums – Mutual funds often require you to maintain a minimum account balance or make minimum periodic investments to avoid fees.

As you evaluate whether to invest in mutual funds, weigh the diversification and management advantages against the costs, tax implications, and lack of control. Their merits depend on your specific investing needs and preferences.

Key Differences Between Mutual Funds vs. ETFs

Exchange-traded funds (ETFs) have surged in popularity in recent years as an alternative to traditional mutual funds. If you’re considering mutual funds, it pays to understand the key differences between mutual funds vs. ETFs:

Pricing

- ETFs trade on exchanges throughout the day like stocks. Their share prices fluctuate in real-time according to supply/demand.

- Mutual funds price just once per day after markets close based on net asset value.

Trading

- ETFs can be traded any time of day during exchange hours. Mutual funds only trade after close of markets.

Fees

- ETFs offer significantly lower costs with no sales loads or redemption fees. Average ETF expense ratio is 0.44% vs. 0.79% for managed mutual funds.

Tax Treatment

- ETFs are more tax efficient as they rarely distribute capital gains to investors. Mutual funds generate more taxable gains when trading positions.

Transparency

- ETFs reveal their full holdings daily. Mutual funds only report holdings a few months in arrears.

Investment Minimums

- ETFs can be purchased as a single share. Mutual funds often require minimums of $1,000 or more.

Liquidity

- ETFs trade instantaneously like stocks. Mutual funds only trade once per day after close.

So in summary, ETFs offer better liquidity, lower costs, and superior tax efficiency compared to traditional mutual funds. However, mutual funds allow small recurring investments unlike ETFs. Both provide easy diversification for passive investors.

Should You Invest in Mutual Funds?

Mutual funds offer an accessible way for novice investors to gain instant diversification across many assets and markets through a single fund investment.

Their advantages including built-in diversification, professional management, liquidity, affordability, and convenience make them appealing to many investors.

However, their layered fees, tax inefficiency, lack of transparency, and lack of control over holdings work against investors in the long run.

Overall, mutual funds deserve consideration as part of a balanced portfolio, especially for new investors. But their limitations make them less ideal as an entire portfolio solution.

Constructing a portfolio with passive index funds, individual stocks, ETFs, and selective actively managed mutual funds tends to provide better long-term results for more experienced investors.

As with any investment, mutual funds require thorough upfront research and an understanding of how their costs may impact your returns.

But for many portfolios, dedicating a percentage to mutual funds for their diversification and professional oversight can prove a powerful way to pursue your financial goals over time.

In the words of Warren Buffett, “The stock market is designed to transfer money from the Active to the Patient.”

For more insights on optimizing your investment strategy, be sure to check out our article on Building Wealth Through Smart Investing. Happy investing!

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.