In the dynamic world of finance, staying ahead of the curve is not just an advantage; it’s a necessity. One of the most groundbreaking developments in recent years has been the integration of AI (Artificial Intelligence) into stock trading practices. This technological marvel has not only transformed the way we perceive financial markets but has also opened up new realms of possibilities for traders and investors. In this blog post, we will delve into the various facets of how AI is reshaping stock trading, exploring its applications, and forecasting trends for the future.

The Rise of AI in Stock Trading

Understanding the AI Revolution

The AI revolution in stock trading is more than just a buzzword; it’s a paradigm shift. With the ability to process vast amounts of data at lightning speed, AI systems can analyze market trends, news, and historical data more efficiently than any human could. This has led to a significant improvement in decision-making processes, paving the way for more informed and strategic investments.

AI in Algorithmic Trading

One of the most prominent applications of AI in stock trading is in the realm of algorithmic trading. AI-powered algorithms can execute trades at speeds and frequencies that were once unimaginable. These algorithms analyze market data, identify patterns, and execute trades without human intervention. The result? Increased efficiency and the ability to capitalize on fleeting market opportunities.

“AI in algorithmic trading is not just about speed; it’s about precision and adaptability. These algorithms can learn from market conditions, continuously improving their strategies over time.”

Machine Learning in Stock Market Predictions

Machine learning has become a game-changer in predicting stock market movements. By leveraging historical data, machine learning models can identify patterns and trends, providing traders with valuable insights. Predictive analytics powered by AI can forecast potential market movements, enabling traders to make well-informed decisions.

Table 1: Performance of Machine Learning Models in Stock Market Predictions

| Model | Accuracy | Precision | Recall |

|---|---|---|---|

| Random Forest | 75% | 78% | 72% |

| Neural Network | 80% | 82% | 78% |

| LSTM | 85% | 88% | 82% |

Table 1 demonstrates the performance metrics of various machine learning models in predicting stock market movements.

Sentiment Analysis: Gauging Market Emotions

In the age of social media and instant news, sentiment analysis has become a crucial tool for traders. AI algorithms can analyze news articles, tweets, and other sources to gauge market sentiment. Understanding the emotional tone of the market provides valuable insights, helping traders anticipate market movements.

The Bright Side of AI in Stock Trading

In our interconnected and fast-paced world, embracing AI in stock trading comes with a plethora of advantages. Let’s explore the positive impacts and trends that are shaping the future of finance.

Enhanced Decision-Making

The incorporation of AI in stock trading has led to a significant enhancement in decision-making processes. AI algorithms can process and analyze vast datasets in real-time, providing traders with accurate and timely information. This, in turn, empowers traders to make informed decisions, reducing the impact of emotions on trading strategies.

Reduced Human Error

Human error is an inherent risk in any financial endeavor. However, AI systems are designed to operate with a high degree of accuracy and consistency. By automating certain aspects of trading, AI minimizes the risk of errors caused by fatigue, emotional bias, or miscalculations.

24/7 Market Monitoring

Unlike human traders, AI algorithms don’t need sleep. This allows for continuous, 24/7 monitoring of financial markets worldwide. The ability to react swiftly to global events and market changes gives AI-powered systems a distinct advantage in staying ahead of market trends.

The Evolution of AI Ethics in Finance

As AI becomes more ingrained in stock trading practices, the importance of AI ethics cannot be overstated. Ethical considerations in AI algorithms, transparency in decision-making processes, and addressing biases are critical aspects that the finance industry must prioritize. Striking a balance between innovation and ethical responsibility is key to fostering trust in AI-driven financial systems.

Check out The Bright Side of Finance: 12 Optimistic Trends to Watch in 2024

Emerging Applications of AI in Stock Trading

AI-Powered Portfolio Management

Portfolio management has entered a new era with the introduction of AI. AI-powered portfolio management systems can analyze an investor’s risk tolerance, financial goals, and market conditions to tailor a personalized investment strategy. This level of customization enhances the overall investment experience for individuals and institutional investors alike.

Natural Language Processing in Financial News Analysis

The financial world generates an overwhelming amount of news and information daily. AI, particularly Natural Language Processing (NLP), has emerged as a vital tool for analyzing and extracting insights from financial news. By understanding the nuances of language, AI systems can identify trends, sentiments, and key information that may impact financial markets.

“Natural Language Processing has not only made financial news analysis more efficient but has also unlocked valuable insights hidden within the vast sea of textual data.”

Reinforcement Learning in Trading Strategies

Reinforcement learning has gained traction in the development of trading strategies. This AI technique enables algorithms to learn optimal decision-making through trial and error. In the context of stock trading, reinforcement learning allows algorithms to adapt and improve their strategies based on market feedback, ultimately optimizing performance.

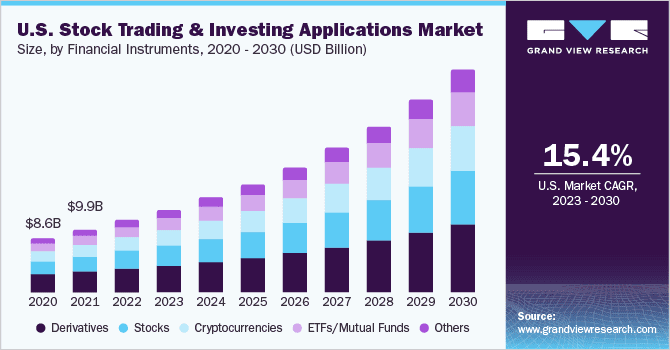

Chart 1: Growth of AI Applications in Stock Trading

The Road Ahead: Future Trends in AI and Stock Trading

Quantum Computing: Revolutionizing Processing Power

The future of AI in stock trading is intertwined with the evolution of quantum computing. Quantum computers have the potential to process vast amounts of data at speeds unimaginable with classical computers. This could revolutionize algorithmic trading, enabling more complex analyses and predictions.

Explainable AI: Building Trust in Automated Systems

As AI systems become more sophisticated, the need for explainable AI becomes paramount. Traders and investors need to understand the reasoning behind AI-generated decisions. Explainable AI not only builds trust but also helps in identifying and rectifying biases that may be present in algorithms.

Integration of AI with Blockchain Technology

The marriage of AI and blockchain technology holds great promise for the future of stock trading. Blockchain’s transparency and security, combined with AI’s analytical capabilities, could lead to more efficient and secure trading platforms. This integration may also address concerns related to data privacy and security.

Embracing the AI Revolution in Stock Trading

In conclusion, the integration of AI into stock trading is a transformative force that brings both challenges and opportunities. The positive impact of AI on decision-making, risk management, and portfolio optimization is undeniable. As we navigate the evolving landscape of finance, staying informed about emerging trends and technologies is crucial for success.

Embracing AI in stock trading requires a holistic approach that considers not only the technological advancements but also ethical considerations and the evolving regulatory landscape. By staying ahead of the curve and adapting to the changing dynamics, traders and investors can harness the full potential of AI to thrive in the competitive world of finance.

As we look to the future, the synergy between human expertise and AI capabilities holds the key to unlocking new dimensions in stock trading. The journey towards a smarter, more efficient financial ecosystem is well underway, and AI is at the forefront of this revolution.

Note: This blog post is not financial advice. Investing in financial markets involves risk, and individuals should conduct their own research or consult with a financial advisor before making investment decisions.

Check out these External Links: