Have you ever wanted to generate extra income from your investments without taking on excessive risk? As someone who’s been investing for over a decade, I’ve found that options strategies like covered calls and cash secured puts can be powerful tools for beginners looking to enhance their portfolio returns. Today, I’ll break down these concepts in plain English and share how they’ve worked for me.

The Basics: What Are Options Anyway?

Before diving into specific strategies, let’s establish what options are. Simply put, options are contracts that give you the right (but not the obligation) to buy or sell a stock at a predetermined price (the strike price) before a specific date (expiration date).

There are two main types:

- Call options: Give the holder the right to buy shares

- Put options: Give the holder the right to sell shares

Most beginners hear “options” and think “risky gambling,” but when used correctly, certain options strategies can actually reduce risk and generate consistent income.

Covered Calls: Getting Paid While Owning Stocks

What Is a Covered Call?

A covered call is when you:

- Own 100 shares of a stock

- Sell a call option against those shares

- Collect the premium (payment) for selling that option

Essentially, you’re giving someone else the right to buy your shares at a certain price, and they pay you for that right upfront.

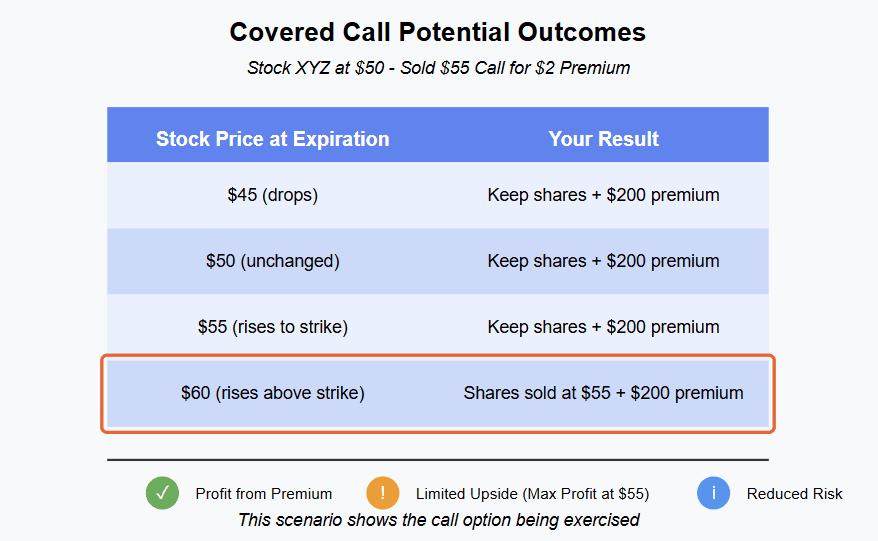

How It Works (With an Example)

Let’s say you own 100 shares of Company XYZ trading at $50 per share. You sell a call option with a $55 strike price expiring next month and receive a $2 premium per share ($200 total).

Two possible outcomes:

- Stock stays below $55: You keep your shares AND the $200 premium

- Stock rises above $55: Your shares get sold at $55, AND you keep the $200 premium

Either way, you make money!

My First Covered Call Experience

Yo, lemme tell you about my first time tryin’ this strategy. I was talkin’ with my friend Mervin about trying options trading. He was like, “Why don’t you write some covered calls? They have worked for me!” I ain’t gonna front—I was apprehensive at first. But I did my homework, sold a call option against my Apple shares for about 10% above the current price, and collected like $300 just like that! When that premium hit my account, I was hyped! Sure, the stock went up a bit, but not past my strike price, so I kept my shares AND that premium. That’s when I knew I was onto somethin’.

Cash Secured Puts: Getting Paid to Buy Stocks You Want

What Is a Cash Secured Put?

A cash secured put is when you:

- Set aside enough cash to buy 100 shares at your strike price

- Sell a put option at that strike price

- Collect the premium upfront

You’re essentially getting paid to promise to buy a stock at a specific price if it falls below that level.

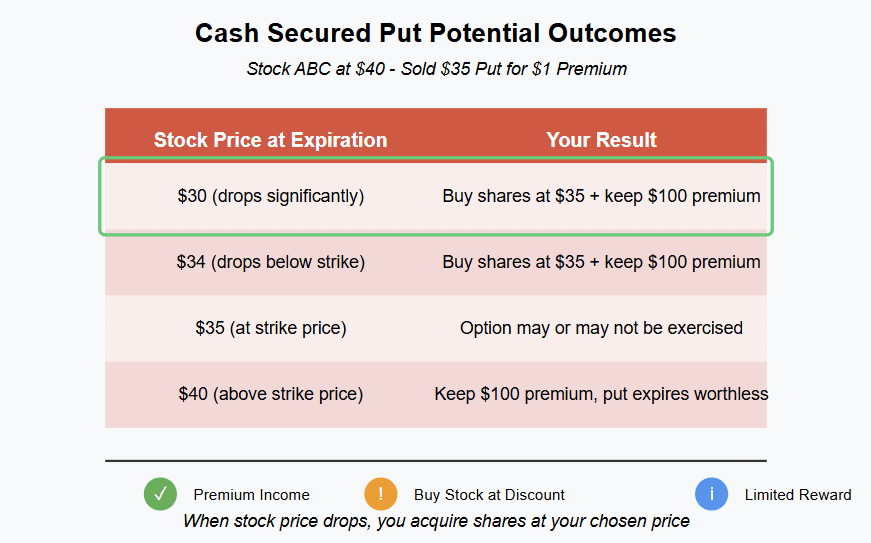

How It Works (With an Example)

Let’s say you want to buy Company ABC trading at $40 per share, but you think it’s a bit expensive and would prefer to buy at $35. You could:

- Set aside $3,500 (to potentially buy 100 shares at $35)

- Sell a put option with a $35 strike price

- Collect a $1 premium per share ($100 total)

Two possible outcomes:

- Stock stays above $35: You keep the $100 premium (and can repeat the strategy)

- Stock falls below $35: You buy 100 shares at $35 (which is what you wanted anyway) AND keep the $100 premium

Why I Love This Strategy

Listen, cash secured puts are a good deal when I’m feelin’ a stock but think it’s too pricey. Like last year, I had my eye on this tech stock that was blastin’ off, but man, the price was steep! Instead of chasin’ it, I wrote a cash secured put about 10% below the current price. Ended up collectin’ a nice premium, and the stock never dipped down to my strike price. Did this for like three months straight, makin’ bank each time. Finally, the market took a lil’ tumble, the stock dropped, and I got assigned the shares at exactly the discount I wanted. Plus, I had all them premiums to offset my cost basis. That’s what we call a win-win!

Comparing These Strategies

Both strategies can generate income, but they serve different purposes:

| Strategy | When to Use | Outlook | Risk Level | Key Benefit |

|---|---|---|---|---|

| Covered Call | When you own stock you’re willing to sell | Neutral to slightly bullish | Lower | Generate income from existing holdings |

| Cash Secured Put | When you want to buy a stock at a lower price | Neutral to slightly bearish | Medium | Get paid while waiting to buy |

The Wheel Strategy: Combining Both Approaches

Many investors, myself included, combine these strategies into what’s called “The Wheel”:

- Sell cash secured puts on a stock you want to own

- If assigned, you buy the stock

- Then sell covered calls on the stock you now own

- If called away, go back to step 1

This cycle can generate consistent income regardless of market direction.

Tips for Beginners

- Start with stocks you know and understand Focus on blue-chip companies with moderate volatility.

- Choose appropriate strike prices For covered calls: 5-10% above current price For cash secured puts: 5-10% below current price

- Mind your expiration dates 30-45 days typically offers the best balance of premium vs. time commitment.

- Always be aware of earnings dates Avoid selling options through earnings unless you’re comfortable with increased volatility.

- Keep position sizes reasonable Don’t commit more than 5% of your portfolio to any single options position.

If you want to learn more about these strategies, check out these resources:

- Options Playbook – Great for beginners

- TastyWorks Learn Center – Excellent free education

- Options Industry Council – Comprehensive educational site

Final Thoughts

Yo, let me keep it a hundred with you. These strategies ain’t get-rich-quick schemes. They’re about consistent income and smart risk management. When I started out, I was makin’ all kinds of rookie mistakes—sellin’ calls too close to the current price, not havin’ enough cash for my puts, you name it. But I stayed with it, kept learnin’, and now these strategies are payin’ my cable bill, my phone bill, and then some. Just start small, be patient, and trust the process. That’s real talk.

Remember, options can seem complex at first, but with practice, covered calls and cash secured puts can become valuable tools in your investment arsenal. They’ve certainly changed the game for me!

What options strategies have you tried? Drop a comment below and let me know your experiences.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always do your own research and consider consulting with a financial advisor before implementing new investment strategies.