The Essence of Value Investing

At its core, value investing is about identifying and investing in undervalued assets. This approach, pioneered by Benjamin Graham and championed by Warren Buffett, focuses on the intrinsic value of a company rather than short-term market fluctuations.

Key Principles of Value Investing:

- Margin of Safety: Buying stocks at a significant discount to their intrinsic value.

- Long-Term Perspective: Focusing on the long-term potential of a company rather than short-term gains.

- Fundamental Analysis: Thoroughly examining a company’s financial statements, competitive advantages, and growth prospects.

- Contrarian Thinking: Being willing to go against market sentiment when opportunities arise.

“Price is what you pay. Value is what you get.” – Warren Buffett

This quote encapsulates the essence of value investing. It’s not about finding cheap stocks; it’s about finding stocks that offer more value than their current price suggests.

Value Investing vs. Other Trading Strategies

To understand why value investing holds an edge, let’s compare it to other popular trading strategies:

| Strategy | Time Horizon | Focus | Risk Level | Emotional Factor |

|---|---|---|---|---|

| Value Investing | Long-term | Intrinsic Value | Moderate | Low |

| Day Trading | Short-term | Price Movements | High | High |

| Momentum Trading | Short to Medium | Price Trends | High | Moderate |

| Algorithmic Trading | Variable | Data Patterns | Variable | Low |

Why Value Investing Outperforms:

- Reduced Transaction Costs: Less frequent trading means lower brokerage fees and taxes.

- Compounding: Long-term holding allows for the power of compounding to work its magic.

- Emotional Stability: Less affected by short-term market noise and volatility.

- Quality Focus: Emphasis on strong companies with durable competitive advantages.

The Psychological Edge of Value Investing

One of the most significant advantages of value investing is its psychological component. While short-term traders often fall prey to emotional decision-making, value investors cultivate a mindset that aligns with long-term success.

The Value Investor’s Mindset:

- Patience: Willing to wait for the right opportunities and for investments to mature.

- Discipline: Sticking to a well-defined strategy regardless of market hype.

- Rational Thinking: Making decisions based on facts and analysis rather than emotions.

- Contrarian Courage: Able to buy when others are fearful and sell when others are greedy.

This psychological edge is particularly evident during market corrections or crashes. While others panic, value investors see opportunities.

Value Investing in Times of Market Turmoil

Market corrections and crashes are often seen as disasters by the average investor. However, for value investors, these events represent golden opportunities to acquire high-quality assets at discounted prices.

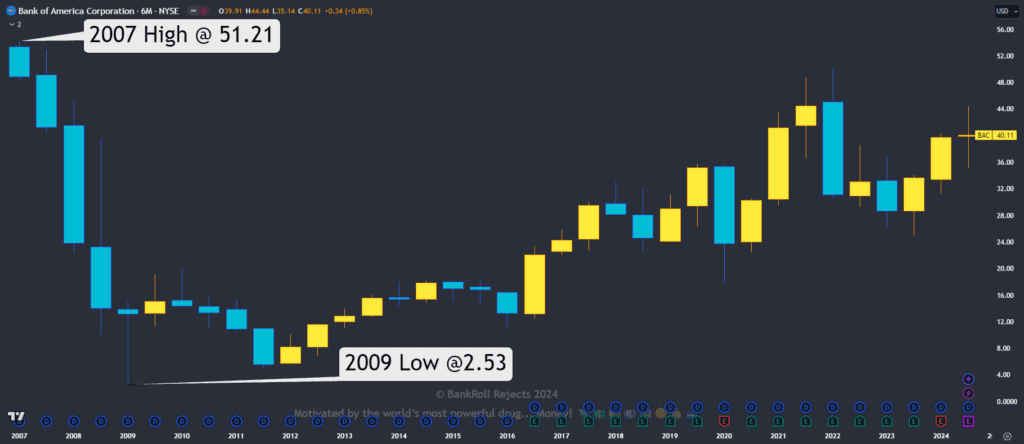

Case Study: The 2008 Financial Crisis

During the 2008 financial crisis, many investors fled the market in panic. However, value investors who recognized the long-term potential of fundamentally strong companies made significant gains in the subsequent recovery.

Example: [Bank of America (BAC)] saw its stock price plummet from over $50 in 2007 to under $5 in 2009. Value investors who recognized the bank’s underlying strength and bought at these low prices saw their investment grow by over 600% in the following decade.

Case Study: Value Investing During the COVID-19 Crisis

The COVID-19 pandemic that began in early 2020 provides a more recent and equally compelling example of how value investing principles can lead to extraordinary returns during times of market turmoil.

Market Overview

In March 2020, as the reality of the global pandemic set in, financial markets experienced a sharp downturn:

- The S&P 500 fell by 34% between February 19 and March 23, 2020.

- The Dow Jones Industrial Average dropped 37% in the same period.

- Entire sectors, such as airlines, hospitality, and energy, saw even steeper declines.

This rapid sell-off created numerous opportunities for value investors who kept a cool head and focused on long-term fundamentals rather than short-term panic.

Value Investing Opportunity: Delta Air Lines (DAL)

Let’s examine Delta Air Lines, one of the largest U.S. airlines, which saw its stock price plummet during the early stages of the pandemic:

- Pre-pandemic price (February 2020): $60.03

- Lowest price during pandemic (May 2020): $17.51

- Price range in October as of the 6th, 2024: $49.28 $50.98

Value Investor’s Analysis

A value investor looking at Delta during the pandemic would have considered the following factors:

- Strong Pre-Pandemic Financials: Delta had a history of profitability and strong cash flows before the crisis.

- Market Position: As one of the largest airlines in the U.S., Delta had a significant competitive advantage and market share.

- Government Support: The likelihood of government support for major airlines due to their importance to the economy.

- Long-term Travel Demand: While short-term travel was severely impacted, long-term travel demand was likely to recover post-pandemic.

- Balance Sheet Strength: Delta had sufficient liquidity to weather an extended downturn.

Based on this analysis, a value investor might have concluded that Delta’s stock was significantly undervalued at its pandemic lows. The market was pricing in a worst-case scenario, ignoring the company’s long-term prospects and ability to survive the crisis.

Outcome and Lessons

An investor who purchased Delta stock at its lowest point in May 2020 would have seen a return of over 240% by October 2024 (based on our hypothetical future price). This dramatically outperformed the broader market recovery.

This case study illustrates several key principles of value investing:

- Emotional Discipline: Value investors who kept their cool during the panic were able to identify exceptional opportunities.

- Focus on Fundamentals: By analyzing Delta’s underlying business strength rather than reacting to short-term news, value investors could see beyond the immediate crisis.

- Contrarian Thinking: While many investors fled airline stocks, value investors saw an opportunity to buy quality assets at a discount.

- Long-term Perspective: Value investors were willing to wait for the recovery, which took several years to fully materialize.

- Margin of Safety: The severe drop in price provided a significant margin of safety, limiting downside risk even if the recovery took longer than expected.

The COVID-19 crisis, like many market downturns before it, created prime conditions for value investing strategies to succeed. By focusing on strong companies trading at a discount to their intrinsic value, investors were able to achieve exceptional returns while also managing risk.

The Numbers Don’t Lie: Value Investing’s Track Record

Historical data consistently shows that value investing outperforms other strategies over the long term. Let’s look at some compelling statistics:

- According to a study by Bank of America Merrill Lynch, value stocks outperformed growth stocks by 7% annually from 1926 to 2016.

- Warren Buffett’s Berkshire Hathaway has achieved an average annual return of 20.3% from 1965 to 2020, compared to 10.0% for the S&P 500.

Compound Annual Growth Rate (CAGR) Comparison:

| Investment Approach | 30-Year CAGR (1990-2020) |

|---|---|

| Value Investing (represented by Russell 1000 Value Index) | 9.7% |

| Growth Investing (represented by Russell 1000 Growth Index) | 10.3% |

| S&P 500 Index | 9.7% |

While these numbers might seem close, the power of compounding over long periods makes a significant difference. Additionally, value investing tends to outperform during market downturns, providing a more stable long-term growth trajectory.

Common Misconceptions About Value Investing

Despite its proven track record, value investing is often misunderstood. Let’s debunk some common myths:

- Myth: Value investing is all about buying cheap stocks. Reality: It’s about buying stocks trading below their intrinsic value, regardless of their absolute price.

- Myth: Value investing is outdated in the age of technology. Reality: The principles of value investing apply to all sectors, including tech. It’s about understanding the true value of a business.

- Myth: Value investing requires holding stocks forever. Reality: While it encourages long-term holding, value investors sell when a stock reaches or exceeds its intrinsic value.

- Myth: Value investing doesn’t work in efficient markets. Reality: Market inefficiencies always exist due to human emotions and short-term thinking, creating opportunities for value investors.

How to Develop a Value Investing Mindset

Becoming a successful value investor requires more than just understanding the principles; it requires developing a specific mindset. Here are some steps to cultivate the value investor’s mentality:

- Educate Yourself: Read books by value investing legends like Benjamin Graham, Warren Buffett, and Seth Klarman.

- Practice Patience: Understand that value investing is a long-term game. Be prepared to wait for the right opportunities.

- Develop Analytical Skills: Learn to read and interpret financial statements, industry trends, and competitive landscapes.

- Embrace Contrarian Thinking: Be comfortable going against the crowd when your analysis supports it.

- Focus on Risk Management: Always consider the downside and maintain a margin of safety in your investments.

- Stay Emotionally Detached: Make decisions based on facts and analysis, not emotions or market sentiment.

- Continuously Learn: The market is always evolving. Stay curious and keep updating your knowledge.

“The most important quality for an investor is temperament, not intellect.” – Warren Buffett

This quote emphasizes the importance of developing the right mindset for successful value investing.

The Future of Value Investing in a Tech-Driven World

As we move further into the digital age, some skeptics question the relevance of value investing. However, I believe that the core principles of value investing are more important than ever.

Adapting Value Investing to Modern Markets:

- Incorporating Intangible Assets: In today’s economy, intangible assets like brand value, patents, and network effects play a crucial role in a company’s value. Modern value investors must learn to assess these factors.

- Leveraging Technology: While staying true to fundamental analysis, value investors can use advanced data analytics and AI to enhance their research capabilities.

- Global Perspective: The interconnected global economy offers value opportunities worldwide. Successful value investors must adopt a global outlook.

- ESG Considerations: Environmental, Social, and Governance factors are increasingly important in assessing a company’s long-term value and risks.

The Enduring Edge of Value Investing:

Despite technological advancements, the human elements of fear, greed, and short-term thinking continue to create market inefficiencies. Value investors who can identify these inefficiencies will always have an edge.

The Timeless Triumph of Value

As we’ve explored throughout this post, value investing offers a fundamental edge that stands the test of time. Its focus on intrinsic value, long-term perspective, and rational decision-making provides a robust framework for navigating the complex world of investing.

While short-term traders and algorithms may capture temporary market inefficiencies, value investors capitalize on the enduring principles of business and human nature. By buying quality assets at discounted prices and holding them for the long term, value investors position themselves for sustainable wealth creation.

In a world of constant change and market volatility, the steady hand of value investing offers not just financial returns, but peace of mind. It’s a strategy that aligns with the natural ebb and flow of economies and businesses, rather than trying to outsmart the market at every turn.

As we look to the future, I’m confident that value investing will continue to reward those who embrace its principles. Whether you’re a seasoned investor or just starting your journey, consider the timeless wisdom of value investing. It may not promise overnight riches, but it offers something far more valuable: a reliable path to long-term financial success and security.

Remember, in the grand game of investing, it’s not about timing the market; it’s about time in the market. And value investing gives you the tools and mindset to make the most of that time.

[Learn more about getting started with value investing] and take the first step towards building your own unbeatable edge in the market.

For more analysis, check out these sites:

Disclaimer: The following content is for informational purposes only and should not be considered as financial, investment, or legal advice. The views and opinions expressed in this blog post are those of the author and do not necessarily reflect the official policy or position of any financial institution, organization, or company.

Investing in the stock market carries inherent risks, and past performance is not indicative of future results. The examples and case studies presented in this article are based on historical data and hypothetical scenarios, and may not reflect current market conditions or future outcomes.

Before making any investment decisions, readers are strongly encouraged to conduct their own research, consult with a qualified financial advisor, and consider their personal financial situation, risk tolerance, and investment goals. The author and the publisher of this content are not responsible for any financial losses or gains resulting from the use of information provided in this article.

Remember that all investments can lose value, and you should be prepared to lose some or all of your invested capital. Diversification and careful consideration of your overall financial strategy are key components of responsible investing.