The entrepreneurial spirit is alive and well, and 2024 looks like a prime year to unleash your inner CEO. But before you dive headfirst into the world of LLCs, choosing the right state to house your business is crucial. It’s like picking the perfect superhero suit – you want something that grants you power, not weighs you down.

So, buckle up, business builders, because we’re about to embark on a whistle-stop tour of the best and worst states to form your LLC in 2024. Grab your notepads, legal eagles, because it’s time to get informed!

Top of the LLC Heap: The Best States to Unleash Your Inner Tycoon

North Dakota

This Midwestern marvel takes the crown for 2024. Think low costs, a supportive business climate, and a heart of gold for startups. It’s like that friendly gym buddy who cheers you on and spots you when you need it.

Some key reasons North Dakota shines:

- Low corporate income tax: More money in your pocket from day 1

- Low LLC formation costs: Usually under $200 to file

- Business-friendly legal climate: Loose regulations and no red tape headaches

- Booming economy: Oil and agriculture are driving growth

With wide open spaces, small business loans, and policies practically begging you to start an LLC, North Dakota rolls out the red carpet for entrepreneurs. Just be prepared for some chilly winters if you’re not used to the Great Plains!

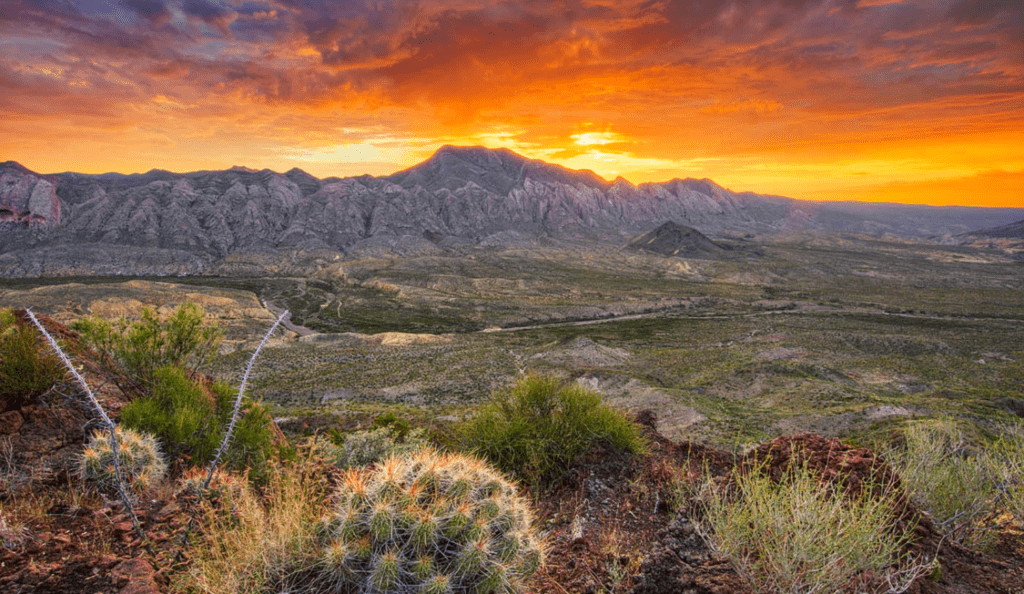

Wyoming

This cowboy country charmer boasts low taxes, minimal regulations, and stunning scenery that might inspire your next million-dollar idea. Just don’t get too distracted by the bison!

Saddle up and ride into business success with:

- No corporate income tax

- Low LLC filing fees (around $100)

- Minimal regulations to slow you down

- Protected assets thanks to strong LLC laws

With policies straight out of the Wild West, Wyoming makes it a breeze to get your LLC up and running. And entreps looking to protect personal assets will love Wyoming’s iron-clad LLC protections. Just be ready to embrace that rugged cowboy lifestyle!

Florida

Sunshine, beaches, and business-friendly policies? Sign us up! Florida’s got no corporate income tax and a streamlined LLC formation process, making it a haven for sun-kissed entrepreneurs.

Soak up these rays of startup sunshine:

- Low corporate income tax means more profits for you

- Rapid processing times to get your LLC off the ground

- No annual reports or fees to maintain your LLC

- Strong tourism economy primes the pump for small biz success

With warm weather and even warmer policies toward LLCs, Florida is practically begging you to make your entrepreneurial dreams come true. Just don’t spend so much time at the beach that you forget about your business!

Texas

Yeehaw! The Lone Star State’s got a can-do attitude when it comes to business. No corporate income tax, low regulations, and a booming economy make it a prime spot for bootstrapping your way to success. Just remember, don’t mess with Texas (or their business regulations).

If you’re fixin’ to start an LLC, mosey on down to Texas for:

- No corporate income tax

- Low LLC filing fees (usually around $300)

- Minimal regulations that won’t tie you down

- A red-hot economy across many sectors

Oil, tech, manufacturing, aerospace, tourism – Texas has it all when it comes to industries primed for entrepreneurial success. And with a low cost of living compared to other states, Texas gives your startup some breathing room to gain traction. But y’all better bring your entrepreneurial A-game. Because when it comes to business, Texas plays to win.

Utah

Mountains, tech hubs, and a love for all things entrepreneurial – that’s Utah in a nutshell. This state’s got low taxes, a supportive startup ecosystem, and access to some of the brightest minds in the biz. Just don’t get lost in the Salt Flats pondering your next big move.

In Mormon pioneer country, your business dreams can take flight thanks to:

- Low corporate taxes

- Business-friendly regulations

- Thriving tech industry and support

- Stunning natural landscapes to stir your creativity

Home to Silicon Slopes and a bustling startup scene, Utah has actively cultivated its entrepreneurial leanings. Low startup costs, made-for-business infrastructure, and venture capitalist connections prime the pipeline for small business success here. Just brace for the occasional tech bro over-enthusiasm along the way!

The LLC Danger Zone: Where Your Business Dreams Might Get Grounded

California

The Golden State may be glittering, but for LLCs, it’s more like the Tarnished Taxpayer Trap. High costs, complex regulations, and a seemingly endless love for paperwork can make even the most seasoned entrepreneur cry.

Despite the sunshine and beaches, expect rain on your LLC parade with:

- High taxes and operating costs

- Mountains of paperwork and compliance

- Strict regulations that restrict flexibility

- Saturated startup scene means cutthroat competition

With sky-high operating expenses, enough red tape to stretch from L.A. to San Francisco, and enough wannabe entrepreneurs to populate a small city, California can be a rough landscape to stake your first business claim. Make sure your LLC dreams come strapped with a serious business plan and budget before setting up shop here!

New York

The Big Apple might be tempting, but for LLCs, it’s more like the Big Bite of Bureaucracy. High taxes, mountains of red tape, and a cost of living that could make your accountant faint make New York a less-than-ideal launchpad.

You may wanna think twice before biting this forbidden LLC apple:

- High taxes will have you seeing less dollar signs

- Burdensome regulations that require serious legal know-how

- A cutthroat business climate where only the strong survive

- A high cost of living that strains already tight budgets

Between navigating tax codes equivalent to an Ivy League law degree, scoping out office space in a city where closets go for $1000/month, and facing off against some of the most savage entrepreneurs on the planet, trying to launch an LLC in New York is not for the faint of heart. While the sheer size of the market here is tempting, only those with industry connections and an iron-clad business plan need apply.

New Jersey

Don’t let the nickname “The Garden State” fool you – for LLCs, it’s more like the Thorny Tax Thicket. High taxes, a maze of regulations, and a general air of “leave us alone” can leave even the most persistent entrepreneur feeling lost.

While you were dreaming of ditching the corporate grind, New Jersey was busy planting roadblocks like:

- High taxes that chip away at margins

- Tangled regulatory framework requiring legal eagles

- Scrutiny of business practices and policies

- Slow processing times to get your LLC approved

If you think you’ll find open arms and eager support for your entrepreneurial dreams in New Jersey…think again. Draconian tax policies, watchful bureaucratic oversight, and generally tepid enthusiasm for small business makes this a complicated landscape to set up shop. Don’t step foot in the garden without a detailed business plan and decorated legal team!

Hawaii

Paradise may seem perfect, but for LLCs, it’s more like the Pricey Pineapple Pitstop. High costs, a remote location, and a laid-back island vibe (great for vacation, not so great for deadlines) can make Hawaii a challenging business environment.

Trade in your flowery shirts for a suit of serious business armor:

- Very high cost of living will strain budgets

- Remote location limits growth potential

- Good ole boy networks make launching tough

- Laxed pace of business may frustrate type A’s

Sure, kicking back with a Mai Tai while your LLC rakes in the profits sounds idyllic. But behind the sun, sand and serenity lies a state not always friendly to the entrepreneurial agenda. Tight business networks, steep upfront costs, limited access to capital and mainland partners can leave LLC dreams stranded on the shores of paradise. Book a vacay here before going all in on your island business empire.

Vermont

The Green Mountain State is beautiful, but for LLCs, it’s more like the Bureaucratic Blizzard. High taxes, complex regulations, and a general aversion to “big business” can make Vermont a tough nut to crack for entrepreneurs.

Brace for some stormy policy conditions:

- High income, property & corporate taxes

- Environmental regulations galore

- Resistance to corporatization

- Long winters limit growth seasons

What Vermont makes up for in quaint villages and stunning nature, it lacks in business-friendly conditions for LLC hopefuls. Stringent oversight on environmental issues coupled with high taxes and an ingrained suspicion of excessive profits and development make Vermont tricky terrain to traverse for startups. Make sure to nail down all regulatory compliance before breaking ground on your dream green business here!

Remember, Entrepreneurs:

This is just a starting point. The best state for your LLC depends on your specific industry, budget, and goals. Do your research, consult with professionals, and choose the state that gives your business the wings it needs to soar!

And hey, if you’re feeling overwhelmed, don’t forget to take a break, grab a coffee, and channel your inner Tony Stark. Building an LLC is an adventure, and with the right preparation and a dash of entrepreneurial spirit, you’ll be saying “Excelsior!” to success in no time.

Now go forth and conquer, business builders! The world (and your LLC) awaits!