Greetings readers! As a professional trader and investor, I’m excited to share some insights on one of the best retirement savings vehicles available – the Roth IRA. With its unique tax-free growth potential, Roth IRAs can be an incredibly powerful tool for building long-term wealth. However, they may not be right for everyone. In this post we’ll explore what exactly Roth IRAs are, why they can be beneficial, and who may want to avoid them. Let’s dive in!

What is a Roth IRA?

A Roth IRA is a specific type of individual retirement account that offers some unique tax benefits compared to traditional IRAs. Here’s a comprehensive look at how Roth IRAs work:

- Contributions are made with after-tax dollars – Unlike traditional IRAs where contributions are often tax-deductible, you don’t get a tax break for Roth contributions. Your contributions come from money you’ve already paid taxes on.

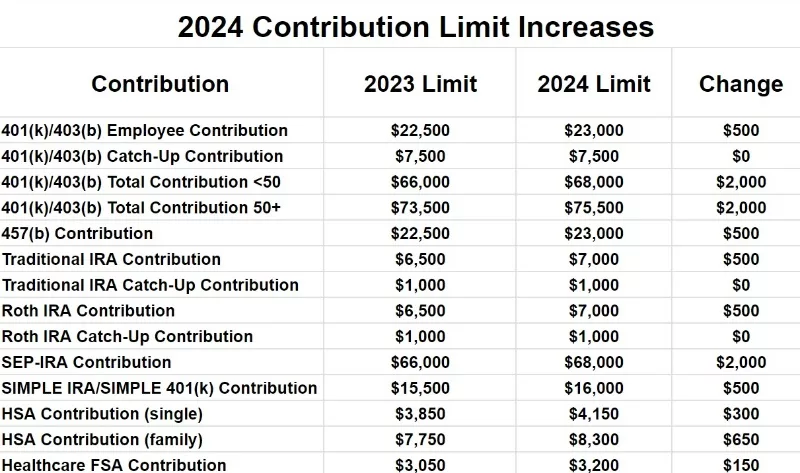

- Annual contribution limits – For 2024, you can contribute up to $7,000 to a Roth IRA, or $8,000 if you are 50 or older. Total contributions cannot exceed your earned income.

- Income limits for eligibility – Your eligibility to contribute begins phasing out at $146,000 – $161,000 for single filers and $218,000 – $228,000 for joint filers in 2024.

- Tax-free growth – The investments within a Roth IRA grow tax-free. No taxes on dividends, interest, capital gains, or reinvested returns.

- Tax-free withdrawals – Qualified Roth withdrawals in retirement are completely tax-free. This includes both your contributions and any investment gains.

- Early withdrawal rules – You can withdraw contributions tax and penalty-free anytime. But investment earnings are subject to taxes and penalties if withdrawn before age 59.5.

- Required minimum distributions – Unlike traditional IRAs, there are no required minimum distributions from a Roth IRA during your lifetime.

This combination of tax-free growth and withdrawals can be incredibly advantageous for retirement savings. While you don’t get an upfront tax break on contributions, the compounded, tax-free growth over decades can far outweigh the initial tax deduction from traditional IRAs.

Why Can Roth IRAs Be Beneficial?

There are a few key reasons why Roth IRAs tend to be excellent retirement savings tools:

Tax-Free Growth and Compounding

As mentioned above, the tax-free growth and compounding within a Roth IRA can significantly increase your investment returns over time compared to taxable accounts. For example, if you are 25 years old and invest $7,000 annually with a 7% return for 37 years (62 years old), here is the difference:

| Account Type | Growth after 30 years |

|---|---|

| Taxable account | $805.823 |

| Roth IRA | $1,202,531 |

That’s over $400,000 of additional savings simply by avoiding taxes on dividends, interest, and capital gains along the way. This shows the immense power of compounded, tax-free investment growth over decades.

Flexibility of Tax-Free Withdrawals

Qualified Roth withdrawals are completely tax-free, giving you tremendous flexibility in retirement. You can withdraw as much or as little as you need each year without worrying about taxes. This allows Roth savers to optimize distributions to manage taxes on Social Security, pensions, and other income sources.

“A Roth IRA acts like a financial greenhouse, fostering the growth of your investments without the burden of constant pruning in the form of taxes.”

Never Pay Taxes on Gains

With a Roth IRA, you’ll never pay a penny of taxes on any investment gains, as long as withdrawals are qualified. By contrast, all gains in a traditional IRA are taxed as ordinary income upon withdrawal. Paying no taxes on profits can supercharge your savings.

Tax Diversification

Having a mix of pre-tax (traditional IRA) and post-tax (Roth IRA) savings provides valuable flexibility in retirement. If tax rates increase in the future, your Roth withdrawals will remain tax-free. This tax diversification across accounts types reduces risk.

No Required Minimum Distributions

Roth IRAs never force you to take required minimum distributions, allowing your savings to compound tax-free as long as you wish. You can even pass your account down to heirs for continued tax-free growth.

Emergency Fund Alternative

A Roth IRA can serve as a unique emergency fund alternative. Because contributions (but not earnings) can be withdrawn penalty-free at any time, it can act as a safety net for unexpected expenses. However, it’s crucial to remember that while you can withdraw contributions penalty-free, you should aim to keep the account primarily earmarked for retirement.

“A Roth IRA offers financial security not just in retirement, but also in the face of unexpected financial challenges.”

Estate Planning Benefits

For those looking to leave a legacy, a Roth IRA offers significant advantages. Inherited Roth IRAs maintain their tax-free status, providing a valuable asset for beneficiaries. This can be a powerful tool for passing on wealth to future generations.

Roth IRAs Never Expire

A Roth IRA has no mandatory distribution age, so it never expires. You can accumulate savings for as long as you live, and leave remaining assets to beneficiaries after you pass away. This tax-free compounding can continue indefinitely.

Who Should NOT Use a Roth IRA?

While Roth IRAs can provide immense tax-free growth benefits, they aren’t ideal for 100% of retirement savers. Here are a few specific cases where a Roth IRA may not be advantageous:

- If you expect your tax rate to be much lower in retirement, traditional pre-tax savings will result in lower lifetime taxes.

- If most of your savings are already pre-tax (401k, traditional IRA, etc), more Roth contributions may imbalance your tax diversification.

- If you have high-interest debt, it may be smarter to pay down debts first before locking up savings in a Roth IRA.

- If you need to tap retirement funds in the next 5 years, a Roth IRA’s withdrawal restrictions could be problematic.

- If you do not expect your income to exceed the Roth eligibility limits now or in coming years, traditional pre-tax may provide more benefit.

Determining the right savings split between Roth and traditional accounts takes analysis based on your full financial picture. Consult a financial advisor to map out a tax-efficient strategy.

How to Get Started with a Roth IRA

Getting started with a Roth IRA is a straightforward process. Here are the steps you need to take:

- Open a Roth IRA Account: You can open a Roth IRA account through a variety of financial institutions, including banks, brokerage firms, and robo-advisors. Choose an institution that aligns with your investment preferences and long-term goals.

- Choose Your Investments: Once your account is set up, you’ll need to decide how to invest your contributions. Many Roth IRA providers offer a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider your risk tolerance and time horizon when making investment choices.

- Make Regular Contributions: To maximize the benefits of a Roth IRA, aim to contribute the maximum allowable amount each year. As of 2024, the annual contribution limit is $7,000 for individuals under 50 and $8,000 for those 50 and older (including catch-up contributions).

- Monitor and Adjust Your Portfolio: Regularly review your investments to ensure they align with your financial goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

- Stay Informed: Keep yourself updated on any changes in tax laws or regulations that may affect your Roth IRA. Consult with a financial advisor if you have specific questions or need personalized guidance.

Conclusion

A Roth IRA can be a game-changing retirement savings tool, thanks to decades of tax-free growth and flexibility of tax-free withdrawals. However, Roth accounts are not ideal for everyone. It’s critical to diversify your savings across pre-tax, post-tax, and taxable accounts based on your individual situation. As always, I highly recommend meeting with a qualified financial advisor to create a customized strategy.

What do you think about Roth IRAs? Do you use one as part of your retirement planning? Share your thoughts and questions in the comments below! And be sure to check out my other posts on 401(k) plans and investing strategies.

Remember, the road to financial freedom is paved with informed decisions and strategic investments.

Disclaimer: The information provided in this blog post is for educational purposes only and should not be considered as financial advice. Consult with a qualified financial advisor before making any investment decisions.