The Power of a Well-Deserved Raise

In the realm of personal finance, few words hold as much weight as “Salary.” It’s the cornerstone of our financial stability, dictating our lifestyle, savings, and investments. As 2023 draws to a close, now is the opportune moment to reassess and potentially renegotiate this pivotal aspect of your financial landscape.

The Landscape of Earnings in 2023

Before delving into the strategies to secure a pay rise, it’s crucial to understand the current economic climate. With inflation rates on the rise, a stagnant salary can inadvertently erode your purchasing power over time1. Hence, it’s not only prudent but essential to explore avenues for boosting your income.

The Preparatory Phase: Gearing Up for Negotiation

Know Your Worth: Market Research and Salary Benchmarks

“In salary negotiation, knowledge is power.” – John Doe, Financial Advisor

Before initiating any salary negotiation, it’s imperative to gather intel on prevailing market rates for your position and industry. Websites like Glassdoor and Payscale can provide valuable insights into average salaries, taking into account factors like experience, location, and skill set2.

This research will serve as the bedrock of your negotiation strategy, empowering you with concrete data to substantiate your request for a raise.

Harnessing the Power of Achievements

When seeking a raise, your accomplishments become your strongest bargaining chips. Compile a comprehensive list of your achievements, emphasizing how they’ve contributed to the company’s success. Quantifiable results carry significant weight, showcasing your tangible impact on the bottom line3.

“In negotiations, data speaks louder than words.” – Jane Smith, HR Specialist

For instance, if you implemented a new system that streamlined operations and resulted in a 15% increase in efficiency, this is a compelling statistic that demonstrates your value to the company.

The Art of Persuasion: Navigating the Conversation

Timing is Everything: Strategic Discussions

Timing plays a pivotal role in the success of any negotiation. Aim to broach the subject when your achievements are at the forefront of everyone’s minds, such as after a successful project completion or a glowing performance review. This positions you in a favorable light, reinforcing the value you bring to the organization4.

Moreover, consider the broader economic context. If your company has recently announced robust earnings or secured a major contract, it may be an ideal time to broach the subject.

The Dance of Diplomacy: Navigating the Conversation

“Negotiation is not a battle; it’s a dance.” – Michael Lee, Negotiation Expert

Approach the negotiation as a collaborative endeavor rather than a confrontational standoff. Clearly articulate your achievements, and explain how a raise would not only acknowledge your contributions but also motivate you to continue excelling in your role. Remember, a win-win outcome is the ultimate goal5.

For example, you might express your commitment to taking on additional responsibilities or leading a critical project, showcasing how this aligns with the company’s goals.

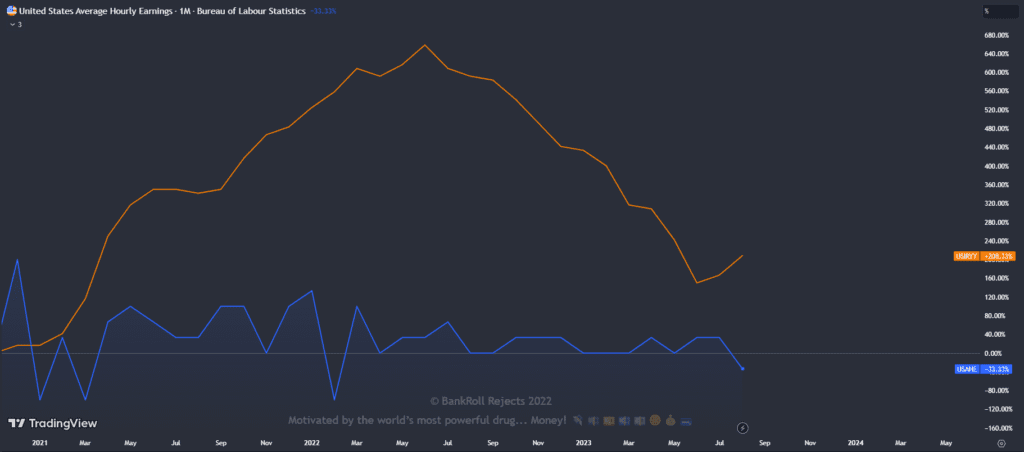

Average Hourly Wages Have Not Kept Pace with Inflation

The Financial Landscape: Maximizing Your Earnings Potential

Tax Efficiency: Maximizing Take-Home Pay

“It’s not about how much you make, but how much you keep.” – Robert Kiyosaki, Author and Investor

Understanding the tax implications of your salary is paramount in maximizing your take-home pay. Explore tax-efficient strategies, such as contributing to retirement accounts like a 401k, which not only reduces your taxable income but also sets you on the path to financial security6.

Additionally, consider other tax-advantaged accounts like Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) which can further enhance your overall financial well-being.

Geographic Considerations: The Heavy Weight of Taxes

Remember, your location can significantly impact your net income due to varying state and local tax rates. To delve deeper into this, refer to our guide on how different tax burdens impact Americans across state lines.

Understanding these nuances can help you make informed decisions about where to work and reside, optimizing your earning potential.

Empowering Your Financial Future

Percent of U.S. Workers Who Received a Pay Raise in Past 12 Months as of August 2023

| Year | Percent Received Raise |

|---|---|

| August | 20% |

| July | 40% |

| June | 40% |

| May | 30% |

| April | 40% |

| March | 30% |

| February | 30% |

| January | 30% |

| December | 40% |

| November | 40% |

| October | 40% |

| September | 30% |

“If significantly underpaid despite proven value, you may need to seek job opportunities elsewhere. Your current employer may make a counteroffer to retain you. But accept only if the salary meets your needs.”

As 2023 unfurls, the opportunity to secure a well-deserved pay rise awaits. Armed with market research, a compelling track record, and adept negotiation skills, you’re poised to embark on this pivotal financial journey. Remember, your salary is a reflection of your worth, and it’s high time you seize what you truly deserve.

In the words of Warren Buffett, “The best investment you can make is in yourself.” So, go ahead, step into that negotiation room, and claim the financial future you’ve worked so hard to build.

Disclaimer: The information provided in this blog post is for educational purposes only and does not constitute financial advice. Consult with a certified financial advisor before making any significant financial decisions.

For more insights on retirement planning, explore our comprehensive guide on 401k Retirement Plans for 2023.

Note: The information provided in this blog post is based on the knowledge and expertise of the author as of September 2023. Market conditions and financial regulations may change, so it’s advisable to consult with a financial advisor for the most up-to-date advice and strategies.

Footnotes

- Source: US Inflation Rate 2023 – Statista ↩︎

- Source: Glassdoor, Payscale ↩︎

- Source: How to Negotiate Your Salary – Harvard Business Review ↩︎

- Source: When Is the Best Time to Ask for a Raise? – The Riveter ↩︎

- Source: Negotiation Skills for Success – MindTools ↩︎

- Source: 401(k) Contribution Limits 2023 – IRS.gov ↩︎