Having a strong credit score unlocks major financial opportunities, while a low score can be very limiting. Fortunately, there are practical steps you can take to substantially improve your credit over time – even starting from a score as low as 300.

What is Credit and Why is Your Score So Important?

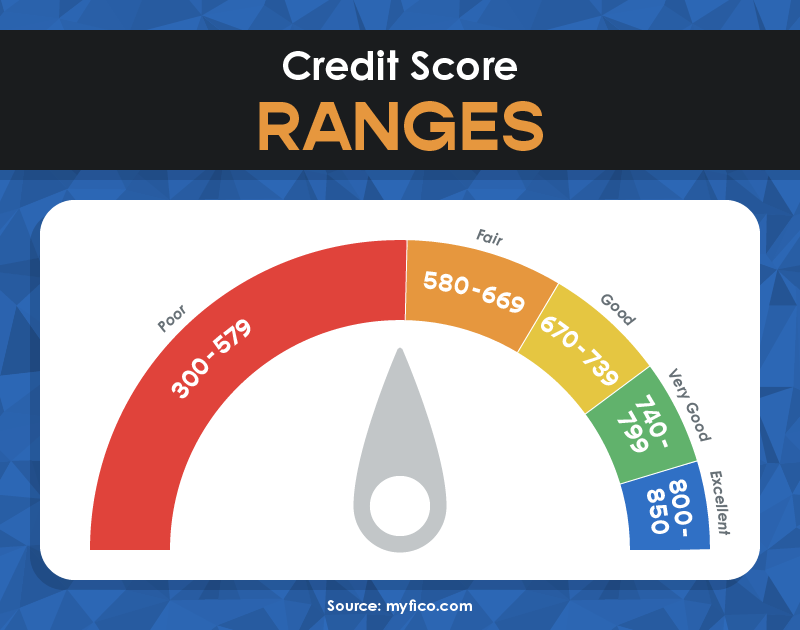

Your credit score is a three-digit number ranging from 300 to 850 that indicates your risk level to lenders. It is based on your history of paying bills and managing debt.

Higher scores represent lower risk and greater creditworthiness. This grants access to better loan terms, lower interest rates, and more desirable credit cards. Good credit saves you money and enables major purchases like cars, homes, and education.

On the other hand, very low scores around 300 mean you have a poor history with debt. This likely includes late payments, collections, bankruptcies, liens, and maxed out cards. As a high-risk borrower, you will face numerous restrictions and higher costs.

4 Impactful Ways to Raise Your Score from 300

Rebuilding from a very low starting point takes time and diligence. But with a sound long-term strategy, you can make significant strides. Here are some effective techniques:

1. Obtain Secured Credit Cards

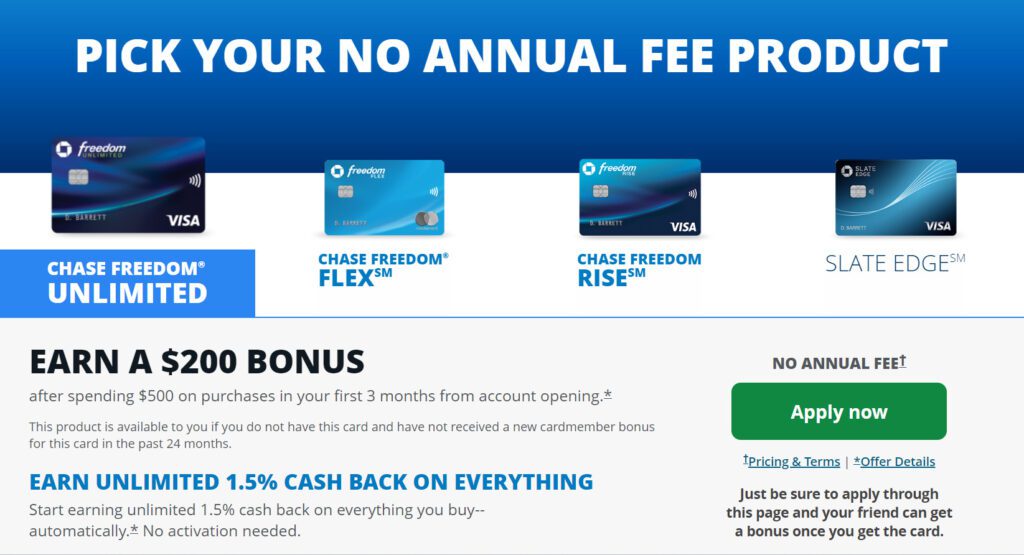

Since no lender will offer an unsecured card with bad credit, start with secured cards requiring a refundable deposit. Use them lightly and make on-time payments to establish positive history. After 6-12 months you can graduate to unsecured cards.

“A secured credit card is akin to a training ground for financial responsibility. It provides a safety net while allowing room for growth.” – The Complete Guide to Personal Finance

2. Pay Down Balances

High balances and maxed out cards severely hurt your score. Pay down cards to below 30% of the limit. Prioritize cards close to the limit first. Also make payment plans on collections, loans, and other negative marks to improve your report.

“The 30% rule is the fulcrum upon which credit scores pivot. It showcases prudence and restraint, painting a picture of responsible credit usage.” – Harnessing the Power of Higher Interest Rates

3. Become an Authorized User

Ask a friend or family member with a long positive history to add you as an authorized user. Their good standing will start being reflected on your report, giving your score a boost. Ensure they always make on-time payments.

4. Limit New Credit Applications

Each application causes a hard inquiry on your report, which can ding your score a bit. Avoid applying for multiple new accounts in a short period of time. Let your score build with your secured card and authorized user status first.

5. The Diligent Debt Slayer

While tending to my credit, I simultaneously waged war on my existing debts. Like a sculptor chiseling away at a block of marble, I steadily reduced my liabilities. Each payment was a step towards financial liberation. After a year of unwavering commitment, my credit score emerged from the shadows, standing tall at around 650.

“Debt is the anchor that weighs down credit scores. With each payment, you’re cutting the chains and setting your score free.” – The Complete Guide to Personal Finance

Prioritize high-interest debts first, as they’re the ones that can quickly spiral out of control. As each debt diminishes, redirect those funds towards the next in line. It’s a methodical approach that yields tangible results.

With consistency over 18-24 months, these five strategies can help raise your score by 100+ points or more. Be patient and focus on developing long-term positive habits.

Consequences of Very Low Credit Scores

A score around 300 will cause significant financial challenges including:

- Difficulty getting approved for credit cards and loans at reasonable rates – you may need to look for subprime lenders.

- Potential problems being approved for utilities, cell phone plans, and cable/internet without large deposits.

- Higher insurance premiums since you are deemed high risk.

- Difficulty finding landlords willing to rent to you without a co-signer.

- Paying extremely high interest rates on any loans over 20% APR.

- Inability to qualify for 0% financing deals on purchases.

- Being ineligible for top rewards credit cards and favorable loan terms.

The cumulative impact makes everything much more expensive and restrictive. A poor score should provide strong motivation to make positive changes.

“A low credit score is a financial straightjacket, limiting your options and squeezing your financial potential.” – The Power of Freezing Your Credit

My Experience: From 500 to Over 800

When I received my first credit card, I maxed it out in one day without knowing anything about credit. I was 18 years old and clueless. Needless to say, my father was furious when he found out! Once I realized that good credit is needed to make major purchases, I started the journey of building my credit score.

When I started, my credit score was around 500. Today, I can proudly say my score is over 800. The first thing I did was get a secured credit card, since no institution would give me an unsecured card with my low score. I used the secured card only for essential big-ticket purchases and paid off as much of the balance as I could each month. At the same time, I began incrementally paying down my outstanding debt.

After a couple of months, I noticed my credit score was not budging. I did more research and learned that you should only use 30% of your total available credit and pay off the whole balance each month if you can afford it. If you can’t pay it all off, you should pay more than the minimum payment. I started doing this, along with continuing to pay down debt.

After a year my credit score increased to around 650, and I was able to qualify for an unsecured credit card. From there, I finished paying off my debt entirely. I started using my credit cards more frequently while paying off the balances in full each month.

It took a couple of years to improve my credit score from 500 to over 800. But with my excellent credit now, I can purchase almost anything I want!

In Summary

A credit score of 300 can seem dire, but it does not have to define your financial life forever. With small positive steps compounded over time, you can build a strong credit history. Be patient, focus on long-term habits, and monitor your progress. Avoid shortcuts and quick fixes. With consistency, you can go from a score as low as 300 to over 800 in a few years. Rebuilding your credit unlocks major opportunities and savings that make the effort worthwhile.

For more insights on navigating the world of personal finance, explore our in-depth guides:

- Harnessing the Power of Higher Interest Rates: A Golden Opportunity

- The Complete Guide to Personal Finance: In-Depth Answers to Your Credit and Debt Questions

- The Power of Freezing Your Credit

Remember, your credit score is not just a number; it’s the key that unlocks the doors to your financial future. Embrace it, nurture it, and watch as it opens doors you never thought possible.

Here’s to the power of credit, and the limitless potential it holds!

Disclaimer: The information provided in this blog post is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor for personalized guidance tailored to your specific situation.